Israeli FinTech Association – FinTech-Aviv: The Financial Aspects of the Metaverse

Popularized by gaming, the metaverse has grown in popularity. So much so that other industries are seriously starting to consider investing in it.

The economic aspects of the metaverse are beginning to turn heads in the financial industry. With the NFT market size expected to grow by $147.24 billion from 2021 to 2026, and the metaverse’s global market currently estimated to be worth $100 billion, it can no longer be ignored.

Nir Netzer is a fintech innovation strategist, founder of Equitech Group and chairman of the board i The Israeli FinTech Association. With a strict focus on serving the needs of the Israeli fintech ecosystem and with over 30,000 members, The Israeli FinTech Association’s community is growing rapidly through a collective passion for meeting, networking and sharing knowledge to build its products.

One product of these products in question is the metaverse. Talking to The Fintech Times on its financial aspects, Netzer breaks down the market and looks at the future of the metaverse:

A new frontier is on the horizon, a virtual space filled with unknown territories, the metaverse has grown at an unprecedented pace in recent years. We delved into exactly what the metaverse entails and how it continues to influence the future of the digital marketing landscape. We’ve mapped the hottest trends and are here to share the most interesting numbers to explore ways to adapt and adapt financial elements in this new space.

What is the metaverse?

Over the past couple of years, you’ve probably heard the term metaverse thrown around with a very loose definition, because to each individual it represents something different.

Broadly speaking, it represents an ever-expanding virtual space used to socialize, work and create, share and sell digital content. Brands have been developing their own metaverses localized to their products, but are now trying to enable the seamless movement of products from one metaverse to the next, creating an evolving interconnected singular world, the metaverse.

With an already massive global market size of $100 billion, its seemingly limitless scalability and interoperability across all types of hardware has made it a key driver behind many companies looking to the future of marketing and finance.

The currency of the metaverse

A major contributor to the future of the metaverse that has gained a lot of attention over the pandemic is the rise of NFTs (non-fungible tokens). By allowing ordinary people to own a piece of online media that cannot be reproduced or stolen, users can hold their tokens in a metaverse wallet, like digital, that can also store cryptocurrencies.

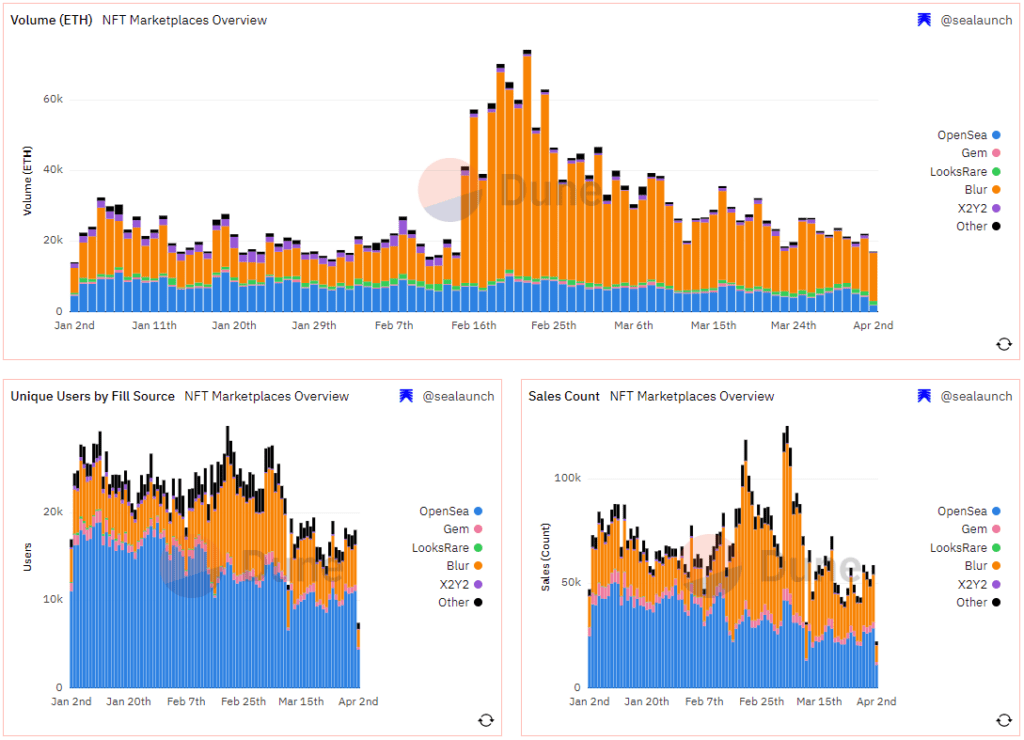

These wallets are the next step in online personal finance and continue to evolve and optimize for the growing market. Users must have secure online storage while being able to showcase their collections. These collectors have already sent over $37 billion to NFT marketplaces in 2022 as of May. The size of the NFT market is expected to grow by $147.24 billion from 2021 to 2026 according to Technavio Reportwhich shows that this is not just a passing fad.

The greatest players we should all know

There are currently five billion internet users worldwide (92.4 percent are on mobile), and Gardener estimated that by 2026, a quarter of these users will spend at least an hour each day in the metaverse for anything from work, education, social interaction or entertainment. The largest part of this population is young teenagers. Virtual worlds like Roblox (210 million monthly active users), Fortnite (80 million), and Minecraft (160 million) have an average user age of 12-13 years and make up about a quarter of the metaverse.

It’s no surprise, then, that the biggest contributors to the metaverse’s growth are gaming companies, which are currently a $180 billion global industry that derives 75 percent of its revenue from virtual objects—almost a fourfold increase in market share for this business model over the last the decade.

Fortune Business Insights shows that they make up more than 40 percent of the global metaverse market share, with the second largest sector being social media, which takes up nearly a quarter. Near the bottom, we see that online shopping only accounts for 10 percent.

Reality is what you make it

From being a contender in the gaming industry, VR and AR technologies have branched out and established themselves as the main gateway to the metaverse. The latest Gartner report predicted that global spending on VR/AR could rise from $12 billion in 2020 to $72.8 billion in 2024.

While many companies are moving towards creating more affordable VR devices, AR devices remain cheaper, more accessible and generally safer than VR, making it the more popular choice with an estimated 1.7 billion mobile AR users by 2024. In fact, combined gaming and AR/VR experiences in the metaverse look set to be a $390 billion industry by 2025, deriving almost all of its revenue from virtual objects.

Make the move

After seeing the success that the gaming industry has achieved through digital exclusives alone, many other industries are looking to claim their share of the metaverse.

The greatest champion of this new era is none other than Meta (previously Facebook) who recently put $50 million into non-profit funding groups to help the metaverse grow responsibly, in addition to $10 billion Meta Reality Labs have already invested. It is also looking to create 10,000 new jobs in Europe alone over the next five years.

McKinsey & Co research details the growing number of fashion and entertainment companies managing marketing costs and skills to tap into the metaverse market could lead to customer demand exceeding $55 billion by 2030. One such example is Balenciaga thought to merge the fashion and digital worlds after their successful collaboration with Fortnite, while Hyundai has created Mobility Adventure, a Roblox metaverse showcasing Hyundai Motor merchandise and future mobility solutions.

Many companies jump to the corner of the market on these new technologies as soon as possible. Nike has already filed four patent and trademark applications for downloadable virtual goods that operate in the metaverse.

Even the media titan Disney is looking at developing an entirely online theme park, going as far as applying for a patent on a virtual-world simulator. Ally Bank has even gone as far as creating a game called Fintropolis, which aims to help players understand various financial concepts such as budgeting, taxation, investing, stock trading and even buying real estate.

The newest land grabber

The virtual real estate market is also currently booming. These digital lands allow gamers and brands a space to create digital experiences that they can populate with user-generated content, effectively online real estate groups Sandbox and Decentralized country has seen a huge price increase of 700 percent from January 2021 to December 2021.

No wonder that the Alexander brothers, a huge name in the property market with clients such as Kanye West and Tommy Hilfiger, became the first luxury brokers in the metaverse, investing $4.3 million for 2,500 digital packages on the Sandbox. These figures show the roaring success of the digital real estate market, and make it clear that there are no limits to what is within the reach of the metaverse.

Just the beginning

The metaverse is growing faster and faster every day, and many companies are having trouble keeping up or in some cases struggling to understand it, but it’s becoming clearer that this is the newest frontier of our digital age that needs to be explored.

It is ripe for financial institutions to step in and help shape the way people interact and trade in the metaverse. Fortune Business Insights estimated that the metaverse market size could reach $426.9 billion by 2027 at a compound annual growth rate (CAGR) of 47.2 percent. Being well-versed and well-accumulated to operate in the Metaverse is essential to a company’s longevity, something almost every industry leader turns out to claim for fear of being left behind.

Francis Bignell

Francis Bignell

![Breakout or retracement? Where does Bitcoin come from [BTC] head next Breakout or retracement? Where does Bitcoin come from [BTC] head next](https://www.cryptoproductivity.org/wp-content/uploads/2023/04/bitcoin-break-120x120.png)