This ratio on the chain shows that Bitcoin can go lower before the final capitulation

One of the most commonly used on-chain metrics to determine Bitcoin’s performance is the behavior of long-term owners. Defined as addresses that have not moved any BTC in six to twelve months, long-term holders often indicate market tops and bottoms.

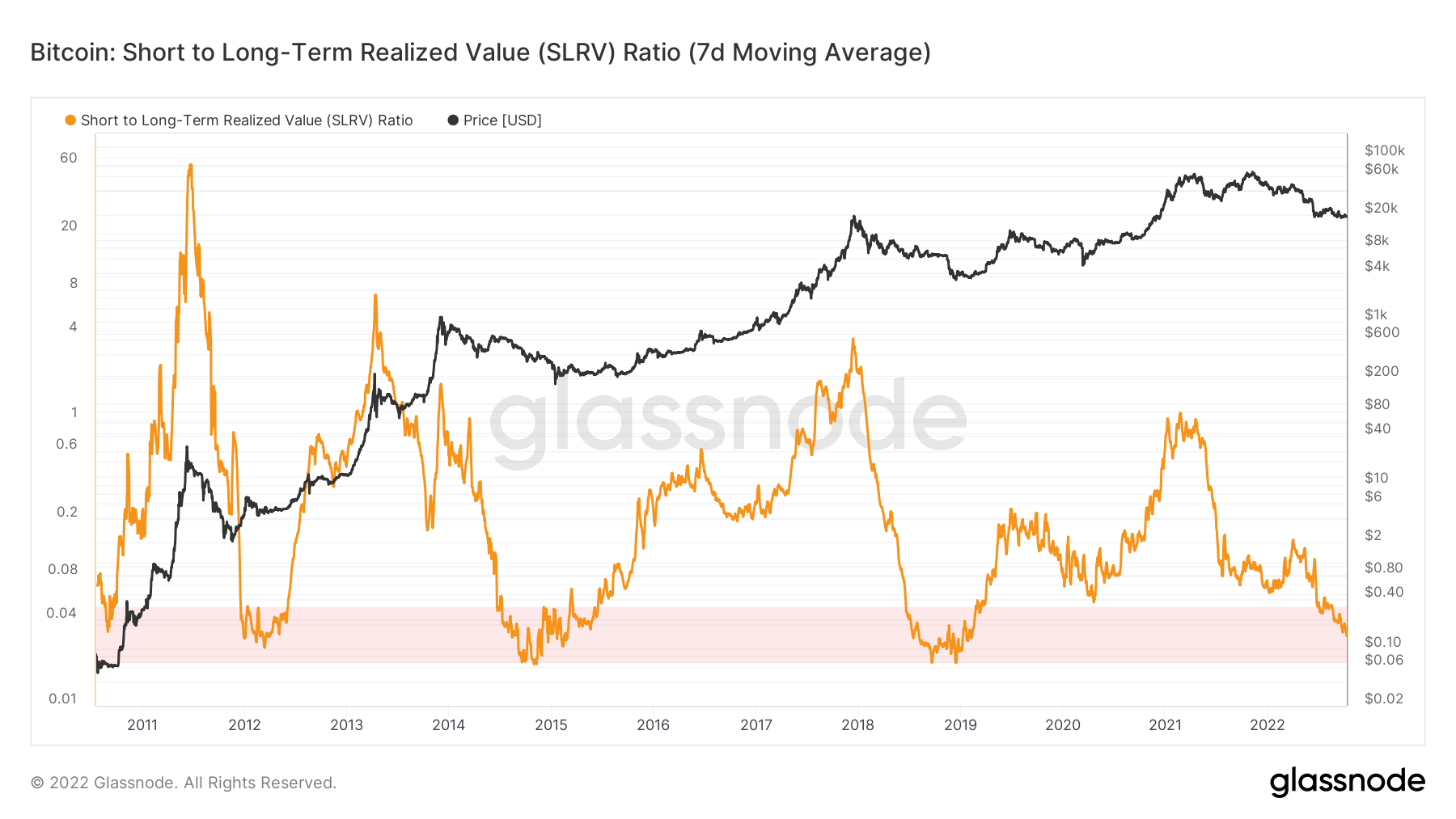

The short-to-long-term realized value (SLRV) ratio looks at the behavioral differences between short- and long-term owners to detect bear markets. The SLRV ratio shows the percentage of Bitcoin’s supply that was last moved within 24 hours divided by the percentage that was last moved between six and twelve months ago.

A high SLRV ratio shows that short-term holders are more active on the network and can often indicate a hype cycle or that a market top is near. A low SLRV ratio indicates little activity from short-term holders or that the basis for long-term holders has increased significantly.

The ratio was created by Capriole Investments, a cryptocurrency investment fund, to identify market transitions between risk-on and risk-off allocations to Bitcoin.

According to the SLRV ratio, Bitcoin is currently in the pink zone, where it has been since June of this year, when it entered a local low of $17,600. The pink zone shows an SLRV ratio below 0.04 and has historically coincided with the accumulation zone of previous bear markets.

In all previous bear markets, Bitcoin set a firm bottom in the pink zone, marking the final price capitulation before a rebound. However, data from Glassnode shows that BTC has still not reached the bottom of the pink zone. This suggests that it could see a further decline from the $19,600 level before the final capitulation.

Diving deeper into the SLRV ratio reveals that Bitcoin set a lower high with each bull run. This could mean Bitcoin could see less severe bull and bear market declines in the future, with less volatility in between. Apart from providing relief to long-term investors, a less volatile market can also increase institutional adoption.

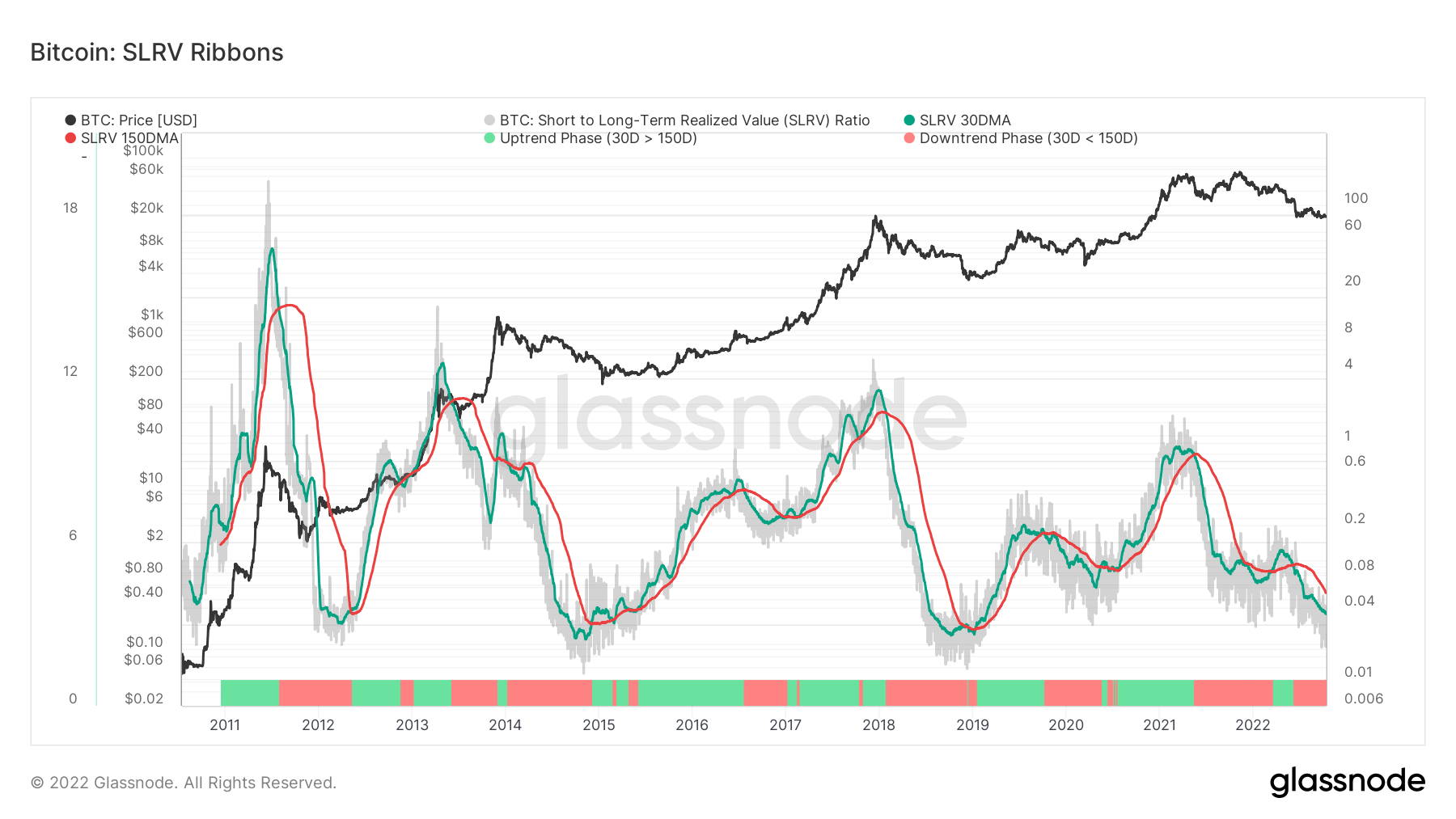

To address some of the problems with the SLRV ratio, Capriole Investments created SLRV bonds. SLRV Ribbons is an investment strategy that uses a short-term and a long-term moving average of the SLRV ratio to mark the transition from a risk-on to a risk-off market.

SLRV bands consist of a 30-day moving average and a 150-day moving average. The 30-day MA exceeding the 150-day MA suggests that the market is exiting a period dominated by long-term holder activity.

Periods where long-term owners show the most activity are often associated with accumulation zones – price troughs LTHs use to increase their BTC holdings. Short-term holder activity tends to increase in the later stages of these accumulation zones, indicating the beginning of a new adoption cycle and the beginning of a market pullback.

The SLRV bands show that the market has been in a predominantly risk-off state since China’s Bitcoin mining ban in May 2021. The downward path of the SLRV 150-day MA has been briefly broken by a short-lived bear market rally in early 2022, but for now shows no signs of reversal.

A lack of trend reversal in sight further reinforces the data presented by the SLRV ratio – Bitcoin may have further down to go before bottoming out.