These cryptocurrencies are being hit the hardest during the SEC crackdown

[gpt3]rewrite

They range from the idea of a winner of computer science’s most prestigious prize to a crypto token that supports the largest blockchain-based video game. But they all have one thing in common, according to the US Securities and Exchange Commission: They are all securities.

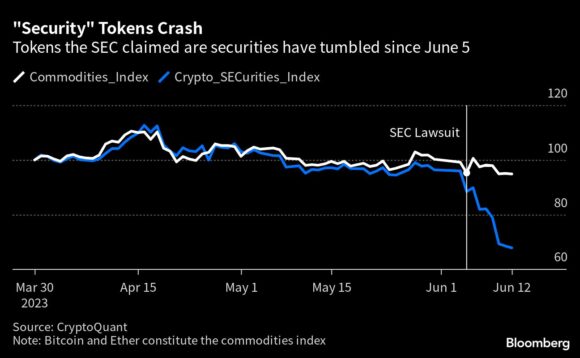

This designation of 19 tokens, laid out in an SEC lawsuit against crypto exchanges Binance and Coinbase Global Inc. last week, was perceived as so potentially harmful that it caused a sharp selloff. Their combined market capitalization has fallen by about $23 billion since just before the SEC’s lawsuit against Binance was filed on June 5. Robinhood Markets Inc. removed three of the coins from its crypto trading platform and eToro stopped allowing US customers to open positions in some of them.

Below is an overview of the 19 tokens, who is behind them, which blockchains they operate on, and how their prices have been affected by the SEC labeling them securities.

ADA:

ADA, the original token of the Cardano blockchain, has fallen 20% since it was mentioned in the SEC’s Binance lawsuit. Cardano, created by Charles Hoskinson in 2015, is built on a proof-of-stake consensus protocol called Ouroboros. ADA has been traded on the global Binance.com platform since November 2017.

ALGO:

Cited in the Binance complaint, ALGO is down 21% since, according to CoinMarketCap. ALGO is the initial token of the Algorand blockchain, a protocol founded by Silvio Micali, a professor at the Massachusetts Institute of Technology and recipient of the Turing Award in Computer Science. The blockchain was launched in 2019, and is used by some decentralized finance apps that allow trading and lending of coins.

ATOM:

The token is down about 13% since it was listed in the Binance complaint, according to CoinGecko data. ATOM is the native token of the Cosmos Hub, a blockchain creation platform that underlies a number of high-profile blockchains. While Cosmos is not as well known as other blockchains such as Ethereum or Solana, a number of popular projects were built on their system – including the Terra blockchain, which collapsed last year. Cosmos was introduced in 2016 by Jae Kwon and Ethan Buchman, and an initial coin offering for ATOM was conducted in April 2017.

AXS:

Axie Infinity’s AXS token was cited in both the Coinbase and Binance suits. It has fallen by around 27%, reducing its market cap to $562 million. The token is used as a governance token in Axie Infinity, a “play-to-earn” game launched in 2018 by Vietnam-based Sky Mavis Inc. that took off during the Covid-19 pandemic in countries such as the Philippines and became the world’s largest blockchain-based video games.\

BNB:

BNB is the original token of the Binance exchange as well as the BNB Chain, a blockchain that Binance started. It has fallen around 17 percent. BNB’s $15 million initial coin offering took place in 2017, and it has become one of the largest tokens by market capitalization, as it is widely used in the Binance ecosystem. For example, the decentralized lending platform Venus accepts BNB as collateral for lending other cryptocurrencies.

BUSD:

BinanceUSD, or BUSD, is a stablecoin operated by New York-based Paxos Trust Co. under Binance’s brand, leading the SEC to include the token in the lawsuit. Relying on a store of cash and cash-equivalent collateral to maintain a one-to-one value with the dollar, BUSD is the third largest stablecoin with a circulation of $4.6 billion. That’s down from a peak of more than $23 billion last November, with its market value collapsing after Paxos was ordered by New York’s financial regulator to wind down the product in February.

CHZ:

CHZ has fallen 28% since being included in the SEC’s case against Coinbase. It is the native token of the Chiliz blockchain, although it runs on Ethereum. CHZ operates Socios, a sports fan engagement platform based in Malta that operates so-called “fan tokens” on behalf of major sports teams such as FC Barcelona and Manchester City and Formula 1 team Aston Martin. Owners of CHZ can use it to purchase fan tokens from Socios, which in turn allow them to vote in polls that can influence team decisions. Chiliz raised approximately $66 million in a 2018 offering of CHZ tokens.

COTI:

The original token of the Coti blockchain has fallen by more than 25% since it was mentioned in the lawsuit against Binance. Coti, a company co-founded by former HSBC Israel chief David Assaraf, aims to create a digital infrastructure for payments and corporate tokens, according to its website. COTI, which began trading in 2019, has a market capitalization of $55 million.

DASH:

Named in the SEC lawsuit against crypto exchange Bittrex in April, DASH has fallen by about 50% since then. The token is one of the most popular so-called “privacy coins”, whose technology makes it easier for users to hide transactions. Unlike most of the tokens listed by the agency, DASH is a fork of Bitcoin, but not a proof-of-stake token. It was created in January 2014 and was originally called Xcoin.

FILE:

Named in the Coinbase lawsuit, FIL is down about 19% since then. It is the original cryptocurrency of the Filecoin blockchain, which allows users to store files on a distributed network of computers. The token was created by San Francisco-based Protocol Labs Inc. — part of a YCombinator program and led by Stanford alum Juan Benet — and launched in fall 2020.

FLOW:

The cryptocurrency is down nearly 26% since it was mentioned in the Coinbase complaint. The token is linked to the Flow blockchain, launched in 2020 by Canada-based game developer Dapper Labs, which is known for titles such as CryptoKitties and non-fungible tokens NBA Top Shot. FLOW was specially developed to run games and NFT apps cost-effectively.

ICP:

The original symbol of Internet Computer Protocol has fallen by more than 13% since it was mentioned in the Coinbase color. The protocol was founded by Swiss startup DFINITY Foundation in 2016 and has raised funding from investors including a16z, Polychain Capital and Multicoin Capital. The goal is to offer a decentralized alternative to cloud providers. The token has a market cap of $1.6 billion.

MANA:

Decentraland’s MANA has fallen by more than 25% since the Binance action was mentioned. Decentraland is a browser-based virtual reality platform, launched in 2020 through an entity called Metaverse Holdings. MANA tokens can be used to purchase parcels of “land” in Decentraland and currently have a total market capitalization of $617 million.

MATIC:

Mentioned in the Binance complaint, MATIC is down nearly 22% since then. MATIC is the original token of the Polygon blockchain created by Jaynti Kanani, Sandeep Nailwal and Anurag Arjun, and it was launched in 2017. Polygon was originally called the Matic Network, but was renamed in 2021. The Polygon network is an Ethereum-based scaling platform designed to allow developers to build decentralized applications with low transaction fees, according to the website.

NEAR:

The cryptocurrency is down around 20% since the lawsuits. It is the initial token of NEAR, a decentralized blockchain platform that supports a variety of applications such as peer-to-peer lending projects. The NEAR platform was launched by the Switzerland-based non-profit organization NEAR Foundation and was officially published in April 2020.

NEXO:

NEXO is the native token of European crypto exchange, lending and payment firm Nexo Inc., and it hasn’t moved much since it was mentioned in the SEC’s complaint against Coinbase. Nexo settled with the SEC and several US states in January over its crypto lending activities. The initial offering of NEXO raised $52.5 million in 2018. Nexo pays its users varying interest rates based on how much NEXO they own and invest on the platform.

SANDY:

Named in both the Coinbase and Binance complaints, SAND is down around 30%. SAND is based on Ethereum and is used in The Sandbox, a blockchain-based metaverse where players can create avatars and own virtual land. Pixowl Inc, a startup founded by Arthur Madrid and Sebastien Borget, created The Sandbox and was acquired by blockchain gaming conglomerate Animoca Brands in 2018. Animoca co-founder Yat Siu told Bloomberg in October that The Sandbox had more than 200,000 monthly active users.

Copyright 2023 Bloomberg.

[gpt3]