The solution to Argentina’s inflation crisis?

Argentina’s economic woes have been compounded by record inflation and a rapidly falling peso. Citizens have struggled to cope with the effects of excessive currency creation and the impact of the conflict between Russia and Ukraine. Could Bitcoin be the solution?

In this context, Michael Saylor, CEO of MicroStrategy and avid Bitcoin advocate, recently suggested that Argentina buy Bitcoin as a potential hedge against inflation.

Argentina’s Economic Troubles and the Bitcoin Solution

Argentina’s economy is in turmoil, with soaring inflation and public unrest. Excessive currency creation and macroeconomic factors have exacerbated the situation, leaving the citizens in serious financial trouble. Michael Saylor suggests Bitcoin as a potential hedge against inflation amid these challenges. While cryptocurrencies offer security and decentralization, it is crucial to examine potential pitfalls before embracing them as a panacea.

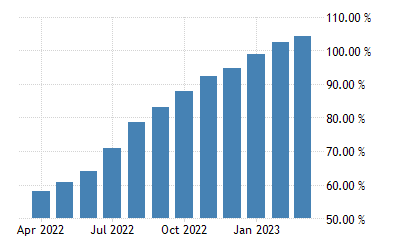

Hyperinflation has plagued Argentina, with the inflation rate reaching 118% at one point. This astronomical figure has eroded the purchasing power of the Argentine peso, causing immense hardship to its citizens. The central bank’s excessive currency creation and fallout from the Russia-Ukraine conflict have only exacerbated the crisis. As people search for solutions, Bitcoin is emerging as a possible answer.

A key factor contributing to Argentina’s economic struggles is the government’s reliance on printing money to finance public spending. This has led to a rapid increase in the money supply, devaluing the peso and driving up prices. In addition, the conflict between Russia and Ukraine has caused disruptions in global trade, leading to commodity price increases that greatly affect Argentina’s import-dependent economy.

The Allure of Bitcoin: Security and Decentralization

Cryptocurrencies such as Bitcoin offer certain advantages over traditional financial systems. They are decentralized, meaning no single entity controls them, reducing the risk of manipulation. In addition, cryptocurrencies can provide security and privacy, making them an attractive option for individuals in countries with unstable economies or struggling currencies. These features could make Bitcoin appealing to Argentines seeking relief from their financial woes.

For Argentines, adopting Bitcoin can provide a degree of financial autonomy. In this way, they can bypass capital controls and preserve their wealth. Bitcoin’s decentralized nature also means it is less susceptible to government interference, providing stability in an otherwise unstable economic landscape.

Potential Drawbacks of Embracing Bitcoin

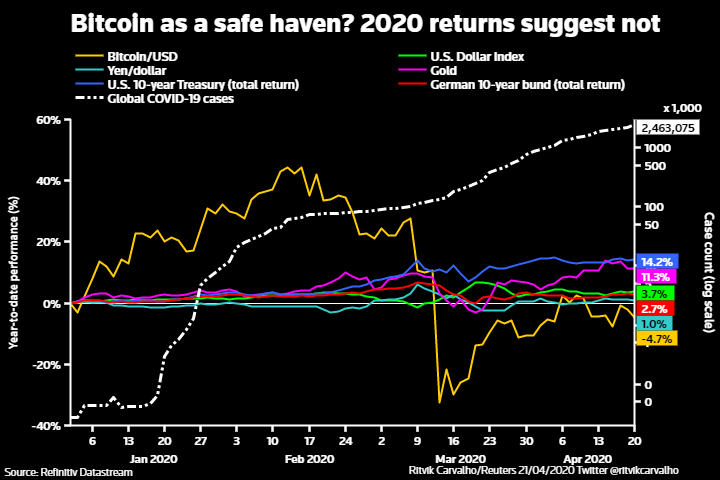

While Bitcoin may appear to be an attractive hedge against inflation, it comes with its own set of risks. Cryptocurrency markets are notoriously volatile, with prices often experiencing wild swings. This volatility could undermine Bitcoin’s role as a stable store of value for Argentines, exposing them to potential losses. In 2021, for example, Bitcoin’s price fell by over 50% in just a few months, demonstrating the potential risks associated with relying on cryptocurrencies as a store of value.

As cryptocurrencies gain popularity, governments around the world are grappling with how to regulate them. In some cases, this has led to regulatory violations, which can significantly affect the value and usability of cryptocurrencies such as Bitcoin. Argentines who rely on Bitcoin as an inflation hedge could be at the mercy of such measures, potentially jeopardizing their financial security.

China has aggressively clamped down on crypto use, banning ICOs and shutting down exchanges. If Argentina follows suit, it could limit Bitcoin’s effectiveness as an inflation hedge.

Cryptocurrencies require internet access and digital literacy, potentially excluding many from Bitcoin’s benefits. Bridging the digital divide and improving accessibility is critical to crypto viability.

In Argentina, approximately 82% of the population has internet access. Leaving a significant number of individuals without the means to use cryptocurrencies. Furthermore, the complexity of managing digital wallets and understanding the intricacies of cryptocurrencies can pose a barrier to adoption for those with limited digital literacy. Addressing these challenges is critical to ensuring that Bitcoin can truly serve as an effective hedge against inflation.

Lessons from other countries

Argentina is not the first country to consider cryptocurrencies as a potential solution to economic struggles. Venezuela, another country facing hyperinflation and economic turmoil, launched its own cryptocurrency, the Petro, in 2018. However, the Petro has met with skepticism and has failed to gain widespread adoption, serving as a warning to nations looking to embrace cryptocurrencies that a panacea.

El Salvador, on the other hand, has adopted Bitcoin as legal tender in an effort to strengthen its economy and provide financial inclusion to its citizens. While it is still early to determine the long-term effects of this move, El Salvador’s experience could offer valuable insights for Argentina as it considers adopting Bitcoin to fight inflation.

Mapping the Future of Cryptocurrencies in Argentina

The suggestion by Michael Saylor that Argentines should consider Bitcoin as a hedge against rampant inflation has received considerable attention. While cryptocurrencies offer certain advantages, such as security, decentralization, and financial autonomy, there are potential disadvantages to consider, such as market volatility, regulatory violations, and accessibility challenges.

Ultimately, for Bitcoin to work in Argentina, it is important to manage risks and promote safe, fair adoption. Politicians, regulators and the public need open dialogue and cooperation to find the best path for the country’s economy.

In addition, the experiences of other countries such as Venezuela and El Salvador can offer valuable lessons as Argentina navigates the complex world of cryptocurrencies. Whether Bitcoin can truly ensure the nation’s financial stability remains to be seen. Still, the conversation surrounding Bitcoin’s or other cryptocurrencies’ role in fighting inflation is far from over.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.