When you want to trade cryptocurrency, the first thing you do is place an order. Orders are instructions you send to exchanges to buy or sell a crypto asset. For example, the order you send can be to trade the crypto immediately or hold until a certain condition is met.

Understanding the right orders to use will help you be more dynamic with trade execution, so here are five of the most popular trade orders used in crypto trading and how they work.

1. Market order

A market order is a command that is automatically executed at the best market price. It is usually carried out immediately or at the next best opportunity. The prevailing market rate usually determines the price at which the order starts in the order book. An order book shows the demand and supply activities of a particular cryptocurrency. It is publicly available for users on an exchange to view. The order book data changes as traders add, withdraw and change orders.

A trader executing a market order only needs to enter the quantity of an asset they wish to buy or sell. The trader does not need to specify the price as the order is executed based on the best market rate.

Let’s say you want to buy 5 LTC with the price of 1 LTC at $60; you pay $300 and the trade is executed immediately. However, if you are not comfortable buying LTC at that price ($60) and want a lower price, say $50 for 1 LTC, you can create a limit order for a purchase of LTC when the price reaches $50. So now, let’s look at how a limit order works.

2. Limit Order

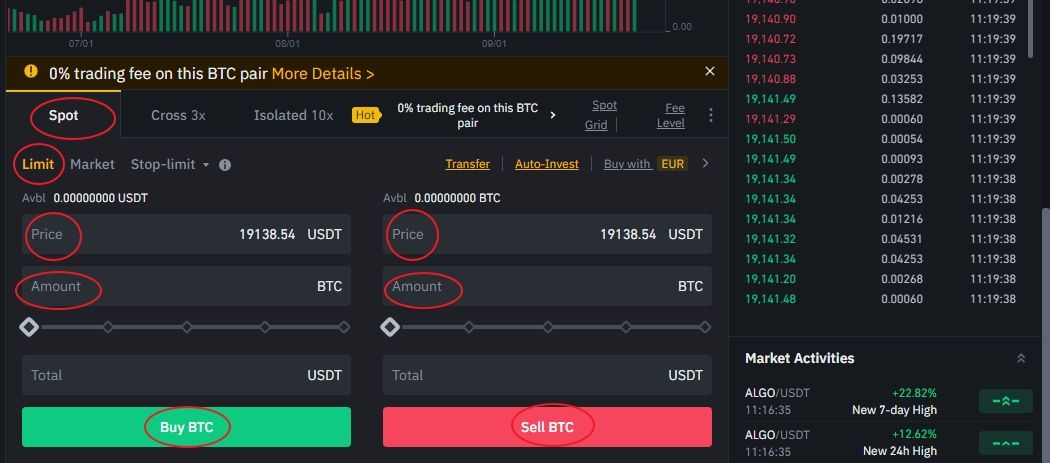

An order to buy or sell a cryptocurrency asset at a predetermined price is known as a limit order. However, limit orders are not guaranteed to execute because they are only triggered if the price reaches the point where the limit is set.

Limit orders are useful when you are not in a hurry to execute your trade or are concerned with executing trades at a specific price. They ensure that trades are executed at the desired price by preventing you from paying more or receiving less than the specified price.

A limit order can be a buy or sell order. Thus we have buy limit orders and sell limit orders. For example, you can enter a buy limit order to buy $2,000 worth of Ether when the price drops to $1,500. Similarly, with a sell limit order, you can choose to sell the same crypto when the price rises to $2000. All you have to do is place the order and wait for the price to trigger them. However, there is no certainty that the price will reach these levels, which means that the orders may not be triggered.

Other order types can also be categorized into market orders, limit orders or both based on how they are executed. For example, those that are executed immediately or almost immediately are market orders, while orders that require a predetermined price to be struck are limit orders.

3. Stop order

A stop order buys or sells a crypto asset when the price reaches the stop price. In this case, a market order is filled at the next available price to lock in profits.

Let’s say the price of a crypto token keeps falling and you have a sell stop order to limit your losses. When the price reaches the sell stop price, it will automatically trigger the order and sell the position at the next available price. This will prevent you from making more losses by getting out of the trade before it falls further.

The risk of the stop market order is that the next available price may be lower (in the case of a sell stop) or higher (in the case of a buy stop) than what you expected due to a gap in the market price. One of the ways to prevent this is to use a stop limit order. A stop-limit order is slightly more complex than a stop-market order. Let’s take a look at how it works.

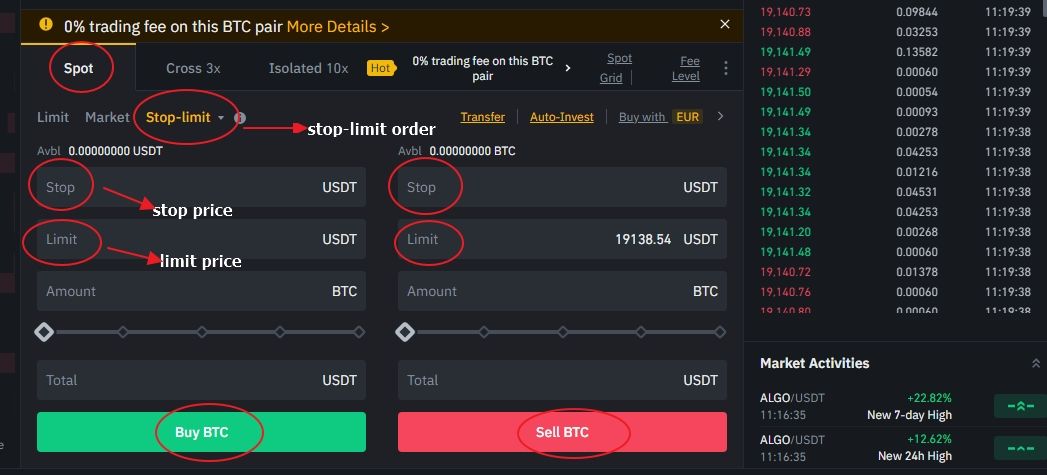

4. Stop-Limit Order

As the name suggests, a stop-limit order combines stop and limit orders. It executes limit orders at the predetermined price when the market reaches the stop price.

When using a stop-limit order, you must enter a stop price and a limit price. The stop price triggers the limit price when the price reaches the stop price. For example, let’s assume one ether is $1300 and you want to buy the token when it shows bullish momentum. You can specify the stop-limit order; in this case a buy-stop limit order, with the stop price at $1330 and a limit price of $1360. If the price moves above $1330 (the stop price), the order will be triggered, creating a limit order.

Buy stop-limit orders are placed above the current market price, while sell-stop limit orders are below the market price. The order is suitable for traders who want protection against price volatility.

5. Subsequent stops

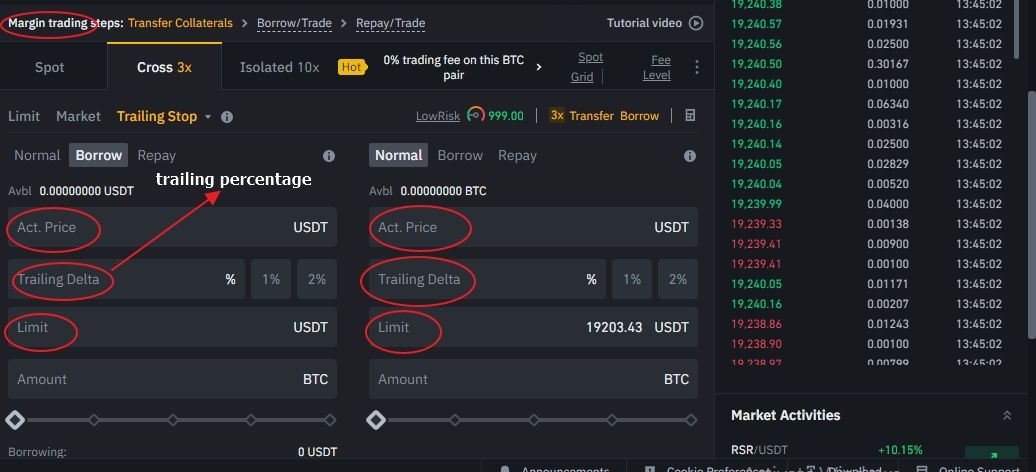

A trailing stop helps you lock in your profits and limit your losses when trading. It is usually set at a trailing amount or percentage from the market price. As the price moves, the trailing stop price also moves by the predetermined trailing percentage or amount. If the price moves back, the trailing stop does not move as it only moves in one direction. A trailing stop can be a limit order or a market order.

If you add a 10% stop loss to a long position, your profit will be locked in if the price drops 10% from the top after executing the buy order.

So what is the difference between a trailing stop and a stop loss? A stop-loss order helps you reduce losses and is usually set manually. A trailing stop, on the other hand, locks in profits while reducing losses. It is more flexible than a stop-loss and tracks market prices automatically.

Now you can be more dynamic with your orders

As an active crypto trader or someone looking to invest in crypto, you need to familiarize yourself with these order types and understand how they work. They will help you be more dynamic with your orders in different market situations. You don’t always have to monitor the market to execute a trade at the desired price since you can give instructions through orders.