Tether bought 52,000 Bitcoin with crypto traders’ money

Tether reportedly bought 52,670 Bitcoin (BTC) with the interest it earned from government treasuries backing its USDT stablecoin.

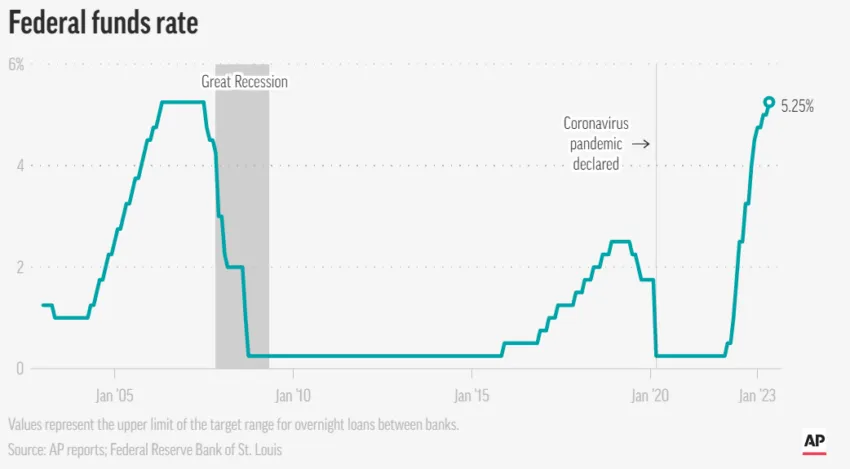

Treasury yields have risen significantly amid a roughly 500 basis point increase in the federal funds rate over the past 13 months.

Tether Confidence Booms Amidst Rival Misery

In addition to Bitcoin, the firm has $3.3 billion worth of gold bullion and $140 million in corporate bonds.

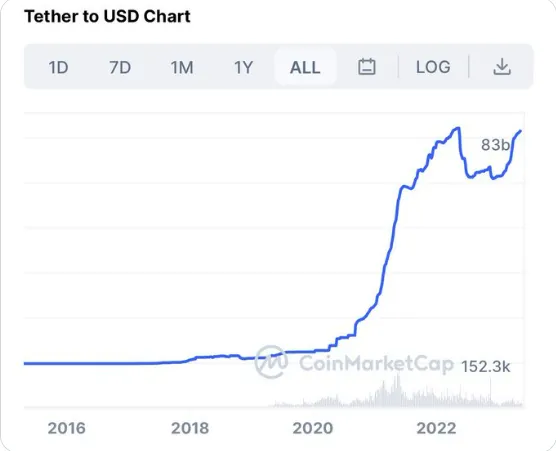

USDT issuance has also increased despite the opportunity for investors to earn higher returns in the banks. There is now $83 billion worth of USDT in circulation, revealing a healthy desire for digital dollars outside the US banking system.

Crypto investors buy stablecoins to trade digital assets without a dollar bank transfer. Stablecoin issuers hold the value of their assets at $1 through on-chain or off-chain assets.

USDT issuance benefited from a regulatory crackdown on rival stablecoin BUSD, as regulators in New York ordered Paxos to stop minting.

Competitor Circle suffered a blow when it lost access to deposits backing its stablecoin in a failed bank on the weekend of March 10.

Tether denied exposure to Silvergate Capital after the firm filed for voluntary liquidation.

Tether gives one USDT for every dollar deposit it receives. It uses the deposits to buy liquid financial instruments it can sell if customers redeem USDT. It does not insure customer deposits.

The firm has been criticized for excessive USDT printing. It recently approved around 1 billion USDT for exchange of chains and future mints.

Tether rides wave of Fed policy to $1.5 billion profit

Twitter user girevik the blame Federal Reserve (Fed) and US Treasury to aid Tether’s Bitcoin purchases by raising interest rates to 16-year highs.

Tether holds a significant portion of its USDT reserves in Treasury Bills sold by the US Treasury Department at a discount or face value. A buyer can redeem the bill before the maturity date of four to 52 weeks.

The interest earned depends on how close the redemption date is to the maturity date. Higher interest rates affect the discount prices on promissory notes and how much profit the buyer can realize on redemption.

Tether made a $1.5 billion profit on Treasury yields bolstered by rising interest rates in Q1 2023.

The Wall Street Journal recently wrote a scathing article accusing Tether of using shell companies to gain access to US banks after Wells Fargo stopped offering banking services in 2018.

Tether denied the allegations. It previously claimed it is registered with the Financial Crimes Enforcement Network and follows the agency’s anti-money laundering rules.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.