Bitcoin Cash is retesting a support zone as bulls look to push prices above the…

Disclaimer: The findings in the following analysis are the sole opinions of the author and should not be considered investment advice

- Although the higher timeframe market structure was bearish, an upward move could materialize for Bitcoin Cash

- The $110 region has been an area to watch for the past two weeks

Bitcoin was back at the $20.2k mark at the time of writing. This represented a short-term support zone for the king of crypto. Similarly, Bitcoin Cash also retreated to a bullish order block.

Here is AMBCrypto’s price estimate for Bitcoin Cash [BCH] in 2022-23

Another visit to this short-term zone could cause demand for BCH to rise and prices to rise. Nevertheless, the higher timeframe continued to be bearish. Therefore, lower time frame bulls can look to book profits quickly.

Bitcoin Cash is breaking out above a two-week range, but capital flows appeared to have reversed

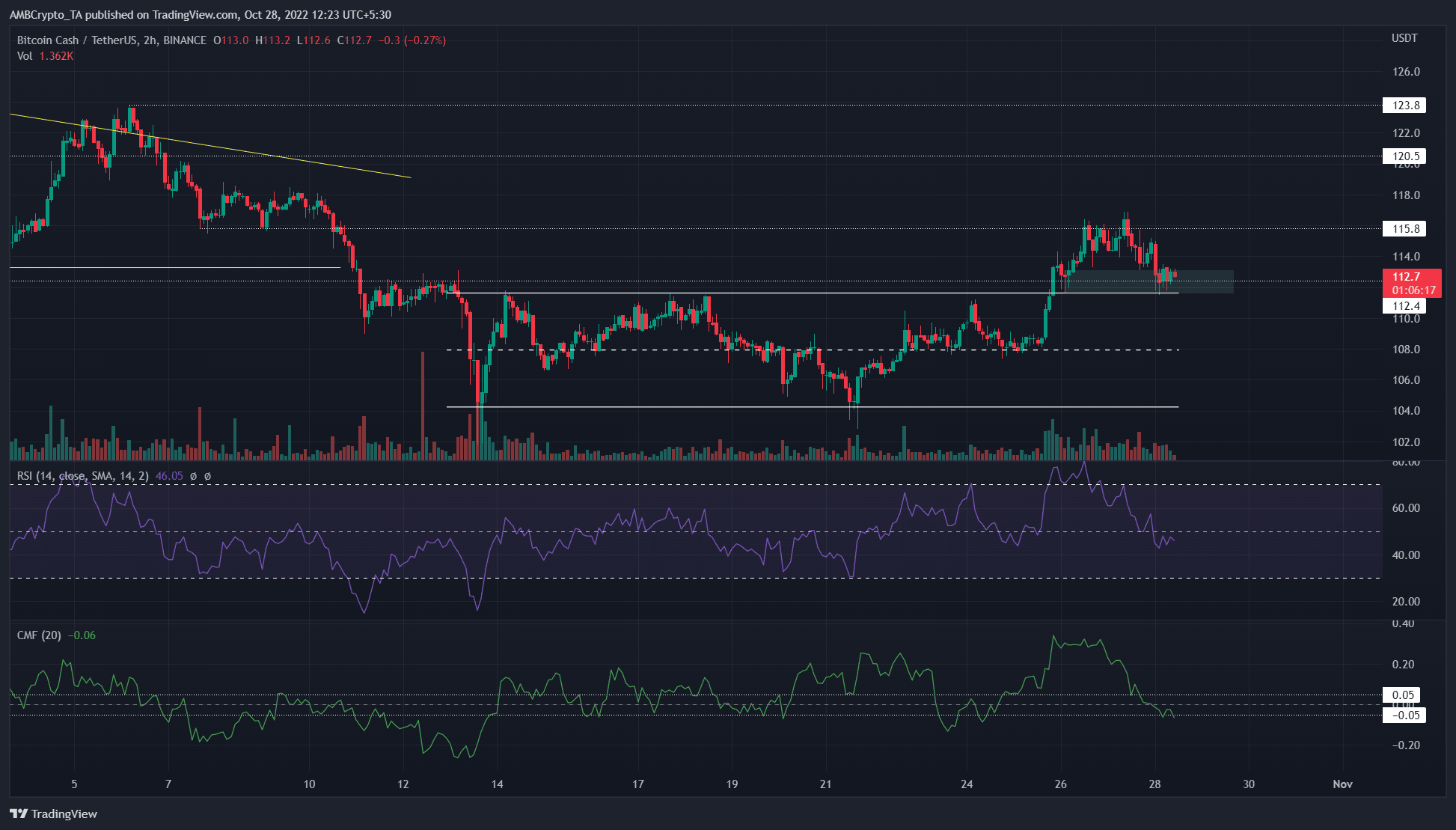

Source: BCH/USDT on TradingView

Bitcoin Cash had a rather bullish view on the lower time frame price charts. The price fell below the support level of $112.5 two weeks ago.

During this period, it formed a range between $112 and $104. The descent to $104 was also a move below a descending triangle, and bears had some reason to expect a bigger price drop.

Nothing came of it. Instead, following the interval formation, Bitcoin Cash has in recent days of trading risen past the interval highs. At press time, the $112 area was also retested as support. A lower bullish order block timeframe was present near this key level, and marked in cyan.

Therefore, buyers can use this withdrawal to buy Bitcoin Cash. To the north, significant resistance lies at $120.5 and $123.8. Bulls can look to book profits here. Invalidating this idea would be a 2-hour trading session close below $111.6.

Despite the bullish price action, the technical indicators did not match the findings. In fact, the RSI dropped below neutral 50 to show that bearish momentum had some strength. The CMF also fell to -0.07 to indicate significant capital outflows from the market.

Bitcoin Funding is creeping into positive territory again

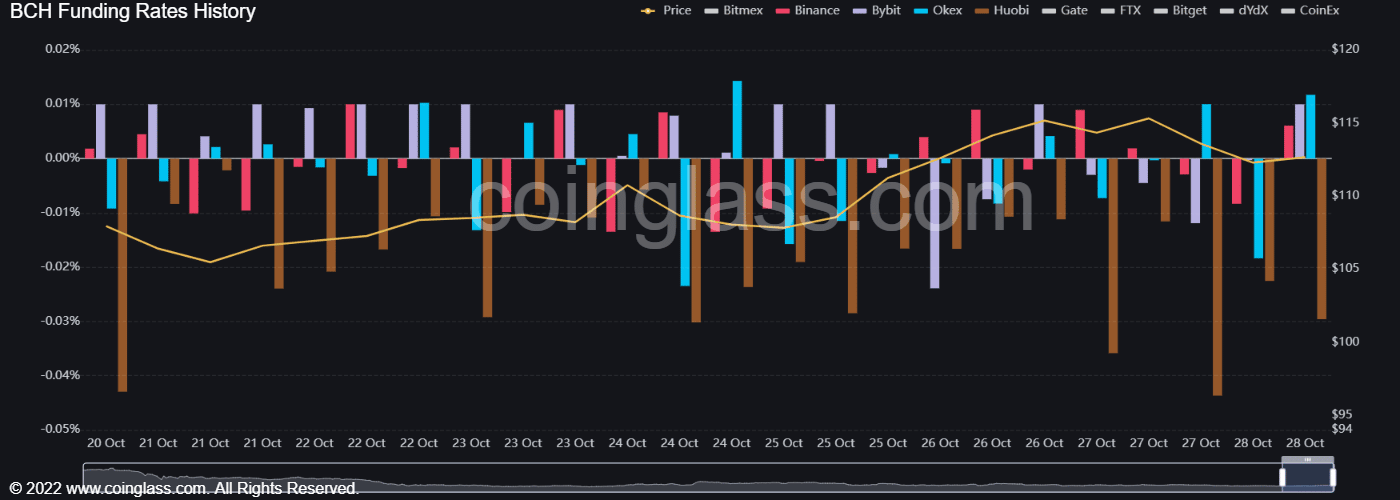

Source: Coinglass

From October 22, the price saw a sharp pullback from the lows to the $111 mark and also forced higher. In recent days, the funding rate on Binance, OKX and Bybit has been hovering around the positive territory more often.

In recent business hours, funding has increased into positive territory. This showed that short-term market speculators were positively positioned.

Although the technical indicators showed that momentum could have shifted into bearish territory, other aspects of the analysis maintained a positive outlook.

The price action of Bitcoin Cash showed a low-risk buying opportunity at press time. If Bitcoin falls below $20,000, the bullish stance may be revisited.