After three years of dormancy, a massive ether whale participating in the project’s first token sale, also known as the Genesis initial coin offering (ICO), spent 145,000 ether worth just over $276 million using today’s ethereum rates.

Mega Ethereum Whale distributes 145,000 Ether to 9 different addresses

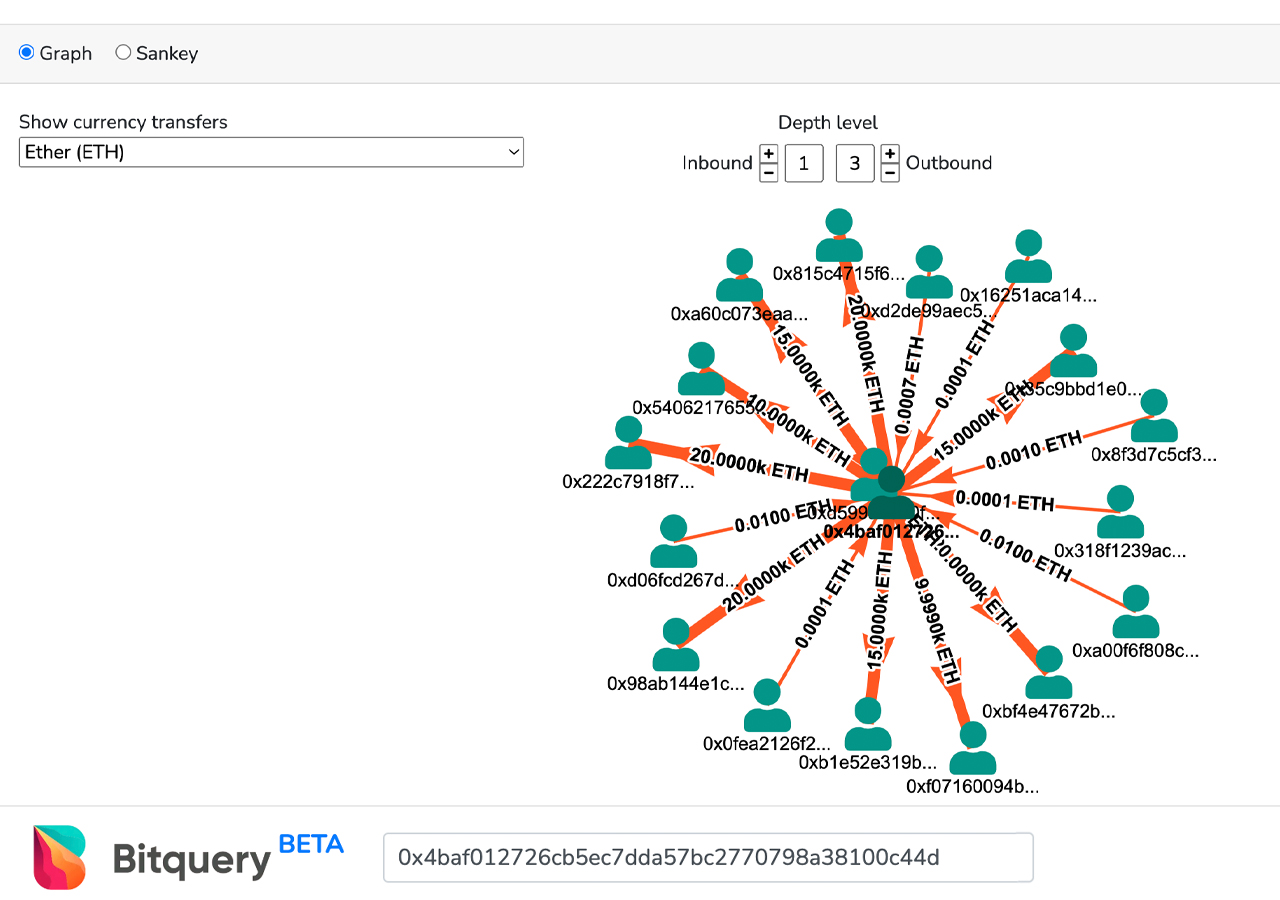

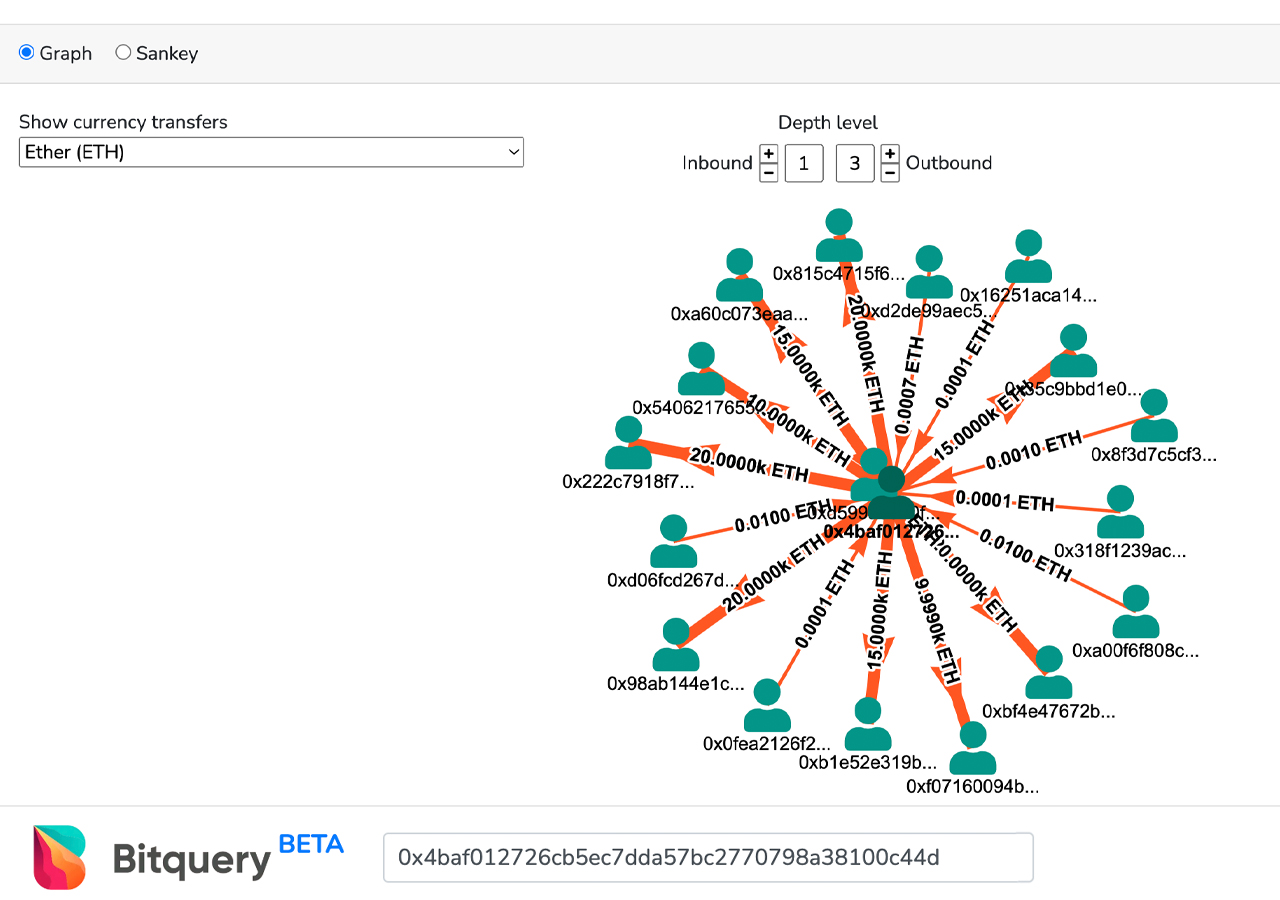

On August 14, 2022, onchain data indicates that a whale that participated in the Ethereum Genesis ICO has moved 145,000 ETH to various addresses. The funds were worth $276 million using current ETH exchange rates. It was the first time the Genesis ICO participant spent coins since 2019, when 5,000 ETH left the whale’s wallet. At the time of writing, the address currently has 0.1177 ETH worth $22.4 after clearing 145,000 Ether.

The transfers on Sunday were sent in multiple batches of 5,000 ETH, 10,000 ETH and 20,000 ETH increments. The whale ended the transfers with a final transfer of 10,000 ETH sent at 12:18 (UTC). The wallet owner also transferred 918.89 canto utility token (CANTO) after sending the last 10,000 ether from the wallet. Statistics show that the address currently has $26,770 worth of ERC20 tokens in its wallet as well. Most of the ERC20 token value ($26,439) is held in omisego (OMG).

The address also has an Enjin-made “Protocol of Quick Response” non-fungible token (NFT) worth 0.02 ETH or $38. Before the whale sent out 145,000 ETH, the whale also sent out 5,000 ETH on July 31, 2019, when ether changed hands for $220 per coin. This July 2019 transaction was approximately $1.1 million in USD value. The 145,000 ether sent on Sunday were sent to nine separate blockchain addresses.

None of the nine addresses associated with the 145,000 ethereum have used coin escrow, and some of the addresses have the CANTO token that was sent from the original address. It is worth noting that the term “spent” in this article simply means the transfer of ETH from one address to another. There is really no way to know if the coins were “sold” or not “intended to be sold” on the open market.

So-called ‘sleeping cryptocurrencies’ are waking up all the time, and after being dormant for three years, it’s not really that long in the grand scheme of things. For example, on August 10, 2022, the btcparser.com blockchain parser captured 41.55 BTC that originated 11 years ago or June 19, 2011. Bitcoins officially ‘woke up’ at BTC block height 748,851 when they were spent. Blockchain parsers always catch “sleeping cryptocurrencies” waking up. However, the aforementioned ETH whale is far more colossal in size, compared to the old bitcoiner who transferred 41 BTC from 2011.

Tags in this story

‘dormant cryptocurrencies’, $1.1 million, $276 million, 145,000 ETH, 2019, 5,000 ETH in 2019, blockchain parser, Btcparser.com, CANTO, CANTO token, canto utility token (CANTO), ETH, ETH whale, ETH, ETH whale Ethereum, Ethereum (ETH), Ethereum Genesis ICO, ethereumwhale, etherscan, Genesis initial coin offering (ICO), July 31, 2019, OmiseGo (OMG), whale, whales

What do you think of 145,000 Ethereum spent after being dormant for three years? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 5,700 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.