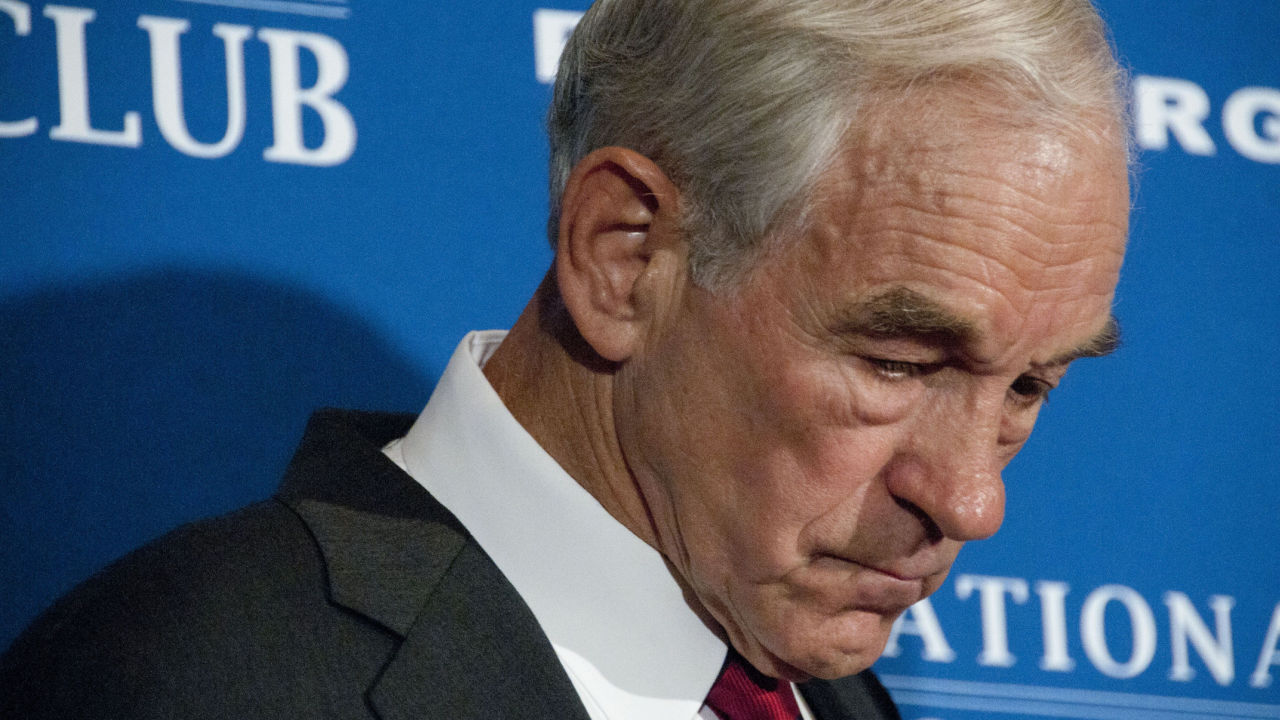

Former House Representative Ron Paul has presented his stance on the financial crisis facing the United States. Paul stated that the continued use of quantitative easing (QE), a policy used to increase the money supply, and the decades of near-zero interest rates are what fueled the current financial crisis facing the United States.

Ron Paul believes that the Federal Reserve policies created the current US financial crisis

Ron Paul, former representative and presidential candidate, has recently spoken about the financial crisis facing the United States. According to him, the policies that the Federal Reserve used to maintain a welfare state at the expense of creating deficits have created the current economic difficulties for the country.

Paul tired:

Today’s economic difficulties stem from the Fed’s decade of near 0% interest rates and quantitative easing (QE). These created a decade of uneconomic investments. Every imaginable bad idea got funding.

Paul criticized loose monetary policy which he says allowed bad debt to be created with credit going to unprofitable investments, and this situation is now becoming unsustainable for tightening economic conditions. Paul explained that “as much as a ‘hangover’ after consuming too much alcohol is painful, so is it when false prosperity crashes with economic reality.”

“Fed is unconstitutional”, but part of the solution

Paul, a longtime critic of the validity of the existence of the US central bank and its faculties, praised the action of the institution that is currently trying to curb inflation by raising interest rates, although this has affected the banking system according to government spokesmen.

On this, Paul noted:

Rising interest rates under Powell are the cure and the way back to a form of economic sanity. The Fed shouldn’t exist. It is unconstitutional and immoral. But rising interest rates are not the source of our problems. The big mistake was 0% interest rates and QE.

Paul has alerted the public to the progress of the de-dollarization process and the effects that loss of reserve currency status could have on the U.S. While he believes that the de-dollarization process has recently accelerated, with the recent activities of the BRICS bloc, he stated that this is likely to take longer than some predictions indicate, and that there is no established timeline for this to happen.

What do you think of Ron Paul and his opinion on the Federal Reserve’s role in the US financial crisis? Tell us in the comments section below.

Sergio Goschenko

Sergio is a cryptocurrency journalist based in Venezuela. Describing himself as late to the game, he entered the cryptosphere when the price surge occurred during December 2017. He has a computer engineering background, lives in Venezuela and is influenced by the cryptocurrency boom on a social level, offering a different point of view on crypto success and how it helps the unbanked and underserved.

Image credit: Shutterstock, Pixabay, Wiki Commons, Al Teich / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.