Retail crypto investors have lost money over the past 7 years

Retail crypto investors have lost crypto money over the years. The volatile nature of cryptocurrencies and the lack of regulation in the crypto market has led to many cases where investors have lost large amounts of money. According to the BIS report, price chasing in the crypto market is losing money.

In recent years, there has been a rise in the popularity of cryptocurrencies, with Bitcoin leading the way. As cryptocurrency prices skyrocketed, many retail investors jumped on the bandwagon hoping to make a quick profit. But for many investors, their journey into the world of cryptocurrency was painful and most lost money.

One of the main reasons why retail investors have lost money is the highly volatile nature of cryptocurrencies. Cryptocurrency prices can fluctuate rapidly, sometimes by as much as 10-20% in a single day. This makes it extremely difficult for retail investors to accurately predict price movements, leading to poor investment decisions.

Why Are Retail Crypto Investors Suffering Losses?

The price of Bitcoin reached an all-time high of nearly $65,000 in April 2021, but fell to around $30,000 in June 2021. Currently, BTC is trading below $24,000, down more than 65% from its all-time high. Retail buyers, who are individual investors with smaller amounts of capital, are typically more exposed to market volatility and may be more likely to experience losses.

Another reason for the losses experienced by private investors is the need for knowledge and understanding of cryptocurrencies’ underlying technology and market dynamics. Retail investors need proper due diligence and research to enter the market and make poor investment decisions based on hype and speculation. Moreover, the need for more regulation and oversight in the cryptocurrency market has also contributed to the losses for retail investors.

Unlike traditional financial markets, cryptocurrency is largely unregulated, leaving investors vulnerable to fraudulent activities and market manipulation.

Finally, the herd mentality of retail investors has also played a significant role in their losses. Many investors entered the market when cryptocurrencies peaked, driven by the fear of missing out on potential profits. Even after buying swings from whales or professional traders with deep pockets. But when prices fell, many retail investors panicked, compounding their losses.

Whales eat all the profits in adverse market conditions

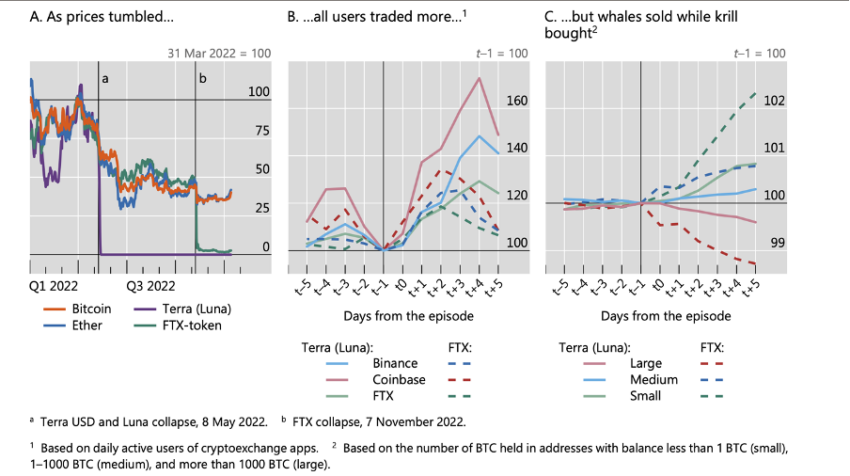

The Bank of International Settlement released a report on February 20 containing the discussed scenarios for retail investors. This is evident from last year, when the market lost billions of dollars, affecting traders significantly. Over $450 billion exited during the market turmoil following the May 2022 Terra (LUNA) collapse alone. Another $200 billion was lost after the FTX bankruptcy in November 2022.

Within the period discussed, “crypto trading activity increased markedly, with large and sophisticated investors selling and smaller retail investors buying,” the report added. This is evident in the graphs added below.

The BIS notes that despite Terra’s crash and FTX’s fall, activity on crypto-trading apps picked up after news of their failures – but more oversized owners were usually able to “at the expense of smaller investors” as they know when to sell Bitcoin and other cryptos . to retail investors before a sharp decline.

“These losses may be exacerbated by the fact that larger, more sophisticated investors tended to sell their coins just before sharp price drops, while smaller investors continued to buy,” the report said.

Retail Crypto price-chasing method loses money

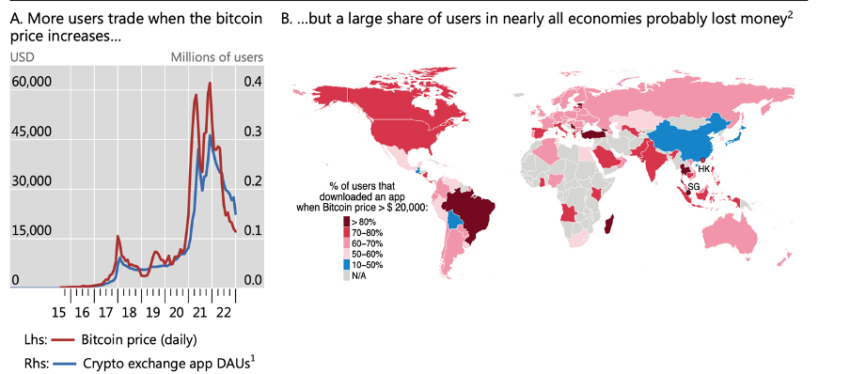

A fresh set of retail investors jumped on the crypto bandwagon, lured by good profit margins. The graph below supports the aforementioned claim. On-chain data, exchange statistics and cryptocurrency application download statistics compiled by BIS researchers suggest that most average crypto investors lost money from August 2015 to the end of 2022.

The report claimed:

“Data on major crypto trading platforms during August 2015-December 2022 shows that a majority of crypto app users in almost all economies lost their bitcoin holdings.”

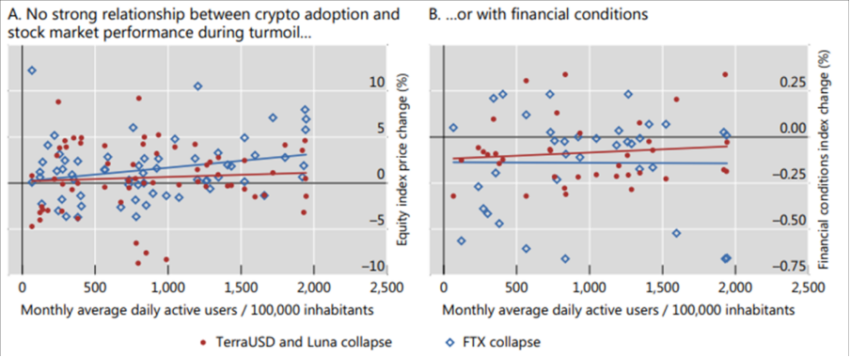

Many BTC owners/investors lost money across different geographies. Unsurprisingly, losses were higher in various emerging economies such as India, Turkey, Brazil and more. But here’s the part that caused a stir in the crypto market: According to the BIS study, the devastation unleashed by the collapse of recognized crypto institutions had no serious impact on the broader financial market. BIS researchers insisted that “crypto crashes have little impact on broader economic conditions.”

Data collected by the BIS team pointed to the weak correlation between crypto losses and stress in the broader financial market.

“Despite crypto’s large user base and the significant losses for many investors, the market turmoil of 2022 had little discernible impact on broader financial conditions outside the crypto universe, underscoring the largely self-referential nature of crypto as an asset class.”

To inject some stability, the team at BIS recommended the following:

Recently, the head of the BIS, Agustin Carstens, has publicly declared fiat as the superior form of money compared to crypto. This may not be the case given the pitfalls that the former still contains, which are covered by BeInCrypto.

Taking the opposite path: A crypto path

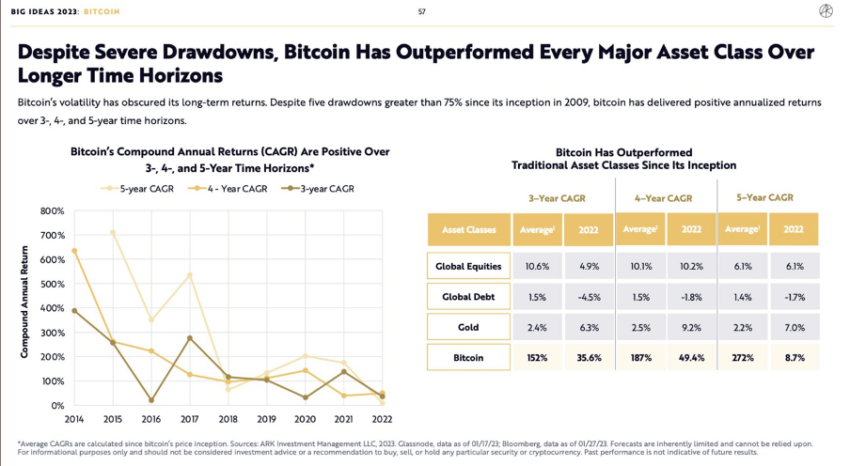

Despite obvious censure against Bitcoin and the general crypto market, Bitcoin has outperformed significant asset classes over the years.

Meanwhile, the daily correlation coefficient between BTC and the S&P 500 (SPX) entered negative territory for the first time since Nov. 2022. This is really a confidence pitch for Bitcoin to not only disconnect from the traditional stock market, but will also have a chance again to capture investors’ valuation as a hedge against inflation.

Nevertheless, the crypto infection was serious. It goes without saying that this niche, but emerging crypto market has a lot of room for development. Especially compared to fiat currencies.

With a relatively neutral approach, Travis Kling, a key figure behind a crypto asset management firm, spoke to BeInCrypto. Despite Carstens declaring the fiat a winner, Kling would not necessarily claim it as “winning”.

“Bitcoin has not acted as a store of value. It acted as an unprofitable SAAS stock. This does not seem to change anytime soon. BTC will likely move as an unprofitable SAAS stock in the future. It is the opposite of DXY , which proves the big boy’s point.”

Finally, he concluded by drawing a parallel to the apparent price correction. ‘BTC’s price is about the same as it was five years ago. And if you look at what has been accomplished in this ecosystem over these five years and where it boils down to today in 2023, it doesn’t look like we’re headed for victory over fiat. Not even close.’

But again, he stands by crypto and believes in the ‘potential for this technology to make the world a better place. And I will do everything I can to help fulfill this potential.’

Regardless, if the crypto market wants to compete with participating players, it needs to ensure better investor protection. This is not the case at the time of writing.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.