Research: A New Version of Bitcoin Mining

Bitcoin mining and its energy consumption have recently been the subject of many heated debates. As governments and institutions around the world continue to introduce new measures to combat pollution and climate change, Bitcoin’s energy-guzzling network sticks out like a sore thumb.

Various data aggregators and trackers work around the clock to provide the market with the exact amount of energy the network consumes. Many offer interesting comparisons with the goal of illustrating how much power Bitcoin requires.

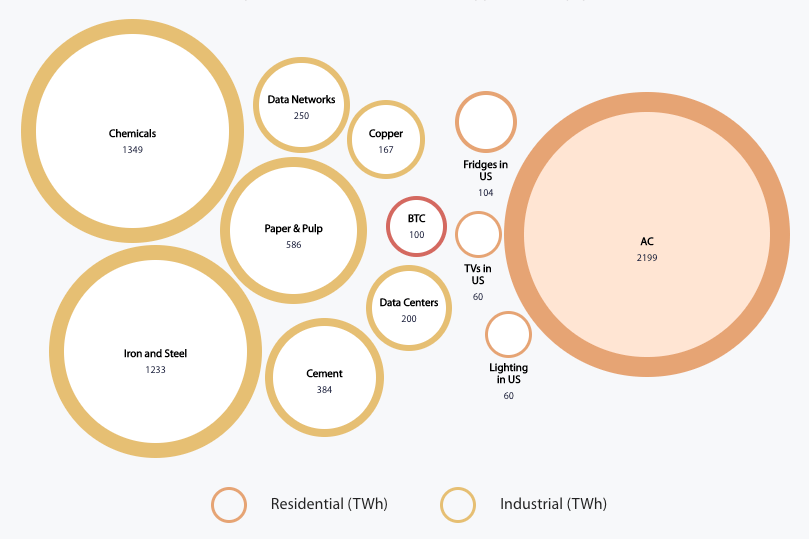

For example, some data shows that the amount of electricity consumed by the Bitcoin network in a single year could power the entire University of Cambridge for 758 years. The network’s one-year energy consumption could also power all the tea kettles used to boil water in the UK for 23 years. Bitcoin also uses more electricity than all the refrigerators and TVs, and almost twice as much electricity as all the lightning in the entire United States

Although popular, this narrative does not paint a clear picture and willfully obscures the wider context.

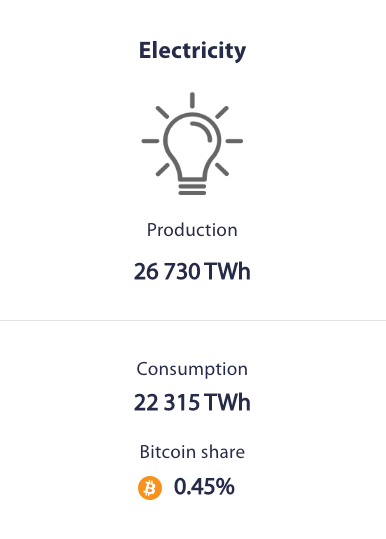

Data analyzed by CryptoSlate shows that Bitcoin’s share in the global consumption of energy is minimal. According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin’s share of global electricity consumption is only 0.45%. This estimate may be slightly off today as it is based on global energy statistics from 2018, but still puts Bitcoin’s consumption into a wider context.

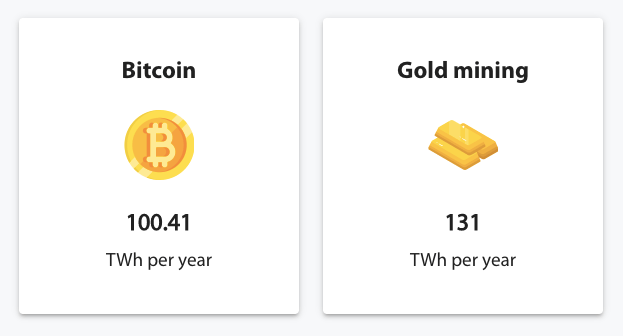

Comparing the energy consumption of the Bitcoin network to gold further illustrates this point. Estimates from 2019 showed that gold mining uses around 131 TWh of energy per year. Buy the effects of gold mining on the environment do not stop with the consumption of electricity. Assessing an industry’s impact on the environment requires looking at the amount of pollution it causes – i.e. the carbon dioxide it releases into the atmosphere, the land it deforests, the water sources it pollutes, etc.

And while experts still debate the sustainability of gold mining, the direct impact it has on the environment is visibly higher than Bitcoin mining.

However, governments and institutions around the world are not fighting to impose strict bans on gold mining.

Unlike gold and other energy-guzzling industries, Bitcoin mining is extremely mobile. Untethered to any particular location, miners move wherever power is cheap and plentiful, setting up new facilities quickly and efficiently around the world.

The mobility of Bitcoin miners was best seen in the summer of 2021 when a government ban on crypto-related activities in China left thousands of mining operations looking for alternative locations. At the time, miners located in China’s hydropower-rich provinces accounted for nearly three-quarters of the Bitcoin hash rate.

Faced with an imminent ban in China, the miners quickly regrouped and began moving — some to neighboring countries like Kazakhstan, and others overseas to the United States

Those who moved their business to the United States benefited from the welcoming attitude of states such as Texas and Wyoming. Bitcoin miners, in addition to their mobility, also have a unique advantage when it comes to energy consumption – they are not competing with other industries for the same energy resources.

Bitcoin mining farms can utilize energy resources at the point of production instead of getting power through the regular power grid. This means miners are able to soak up excess energy that would otherwise be lost or wasted – both reducing its impact on the environment and increasing profitability.

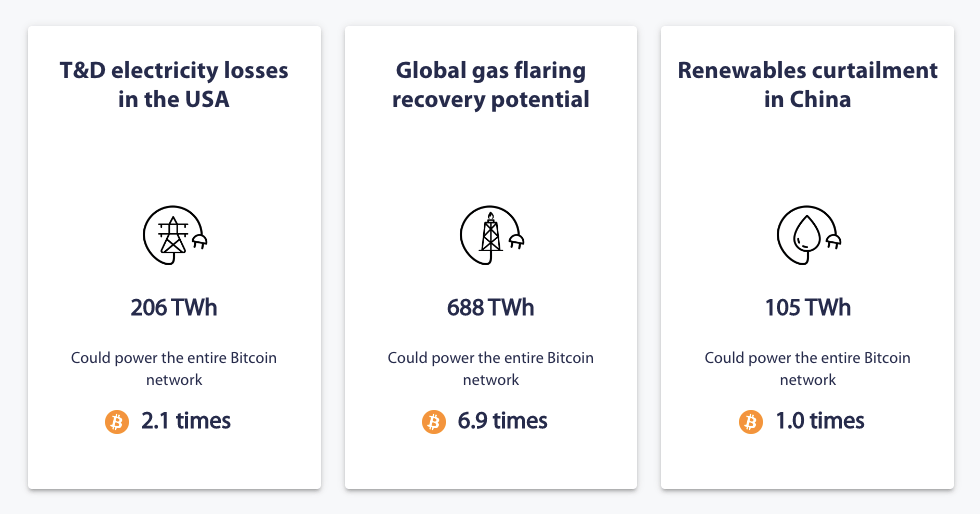

According to the US Energy Information Administration (EIA), between 2016 and 2020, around 5% of all electricity transmitted and distributed through the power grid was lost. These losses amounted to around 206 TWh of electricity, which is enough to power the entire Bitcoin network 2.1 times. The natural gas lost through flaring and venting at oil fields can create 688 TWh of electricity, enough to power the entire Bitcoin network 6.9 times.

Some Bitcoin miners have seen the potential in these energy losses. Bitcoin miners in Texas have turned off their ASICs to return power to the grid when demand is high and gobble up excess energy when demand is low.

Several companies are also working to exploit the natural gas found in oil fields. They use the gas that would otherwise have been flared or vented into the atmosphere to power generators that produce electricity used by Bitcoin miners. By killing two birds with one stone, this approach reduces the impact of natural gas on the environment and makes it profitable.

Another very important but often overlooked point when discussing Bitcoin’s sustainability is its effect on the economy.

Data centers around the world use twice as much electricity as the Bitcoin network, but their economic value is so high that any discussion of sustainability is out of the question. Air conditioning systems consume almost 220 TWh of energy each year and are rarely the target of aggressive environmental marketing.

Bitcoin’s increasing energy consumption may provide economic prosperity that outweighs any effects it may have on the environment.

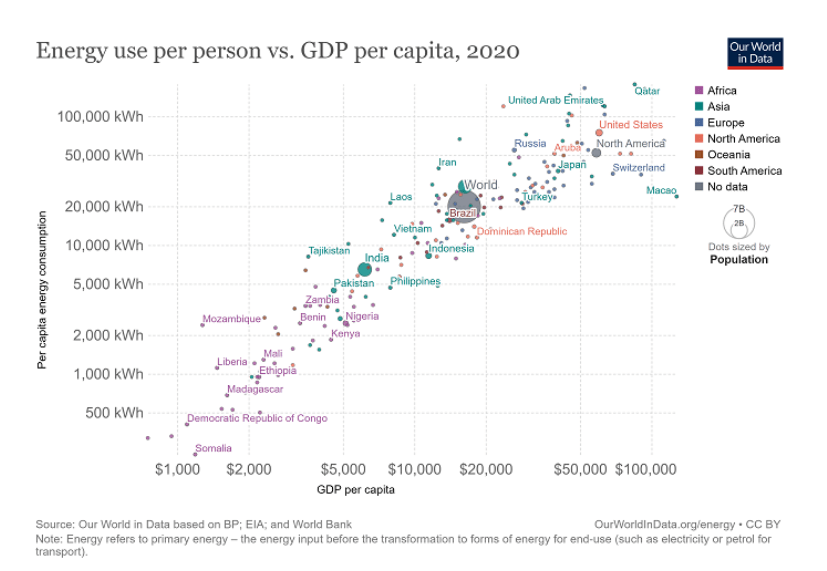

Countries with high energy use universally rank high on the GDP per capita scale, which shows that increased consumption correlates with increased living standards. Qatar, the United Arab Emirates, the United States, Switzerland, Japan and Macao rank high in terms of GDP, and all use large amounts of electricity per capita.

Looking at Bitcoin mining through the eyes of economic prosperity and GDP shows that it is not the environmental disaster many make it out to be. While we cannot be sure that increased energy consumption effectively leads to economic abundance, we know for sure that the correlation is too high to ignore.

Increasing energy consumption caused by an influx of Bitcoin miners will lead to a growth in a highly skilled workforce, provide a significant increase in income and improve surrounding infrastructure. All while absorbing excess energy, renewable energy and energy that would otherwise be wasted.