Private equity investment in blockchain, cryptocurrency in decline

Rapidly falling cryptocurrency prices, impending industry-specific regulation and macroeconomic headwinds are taking a toll on global private equity and venture capital investments in blockchain and cryptocurrency.

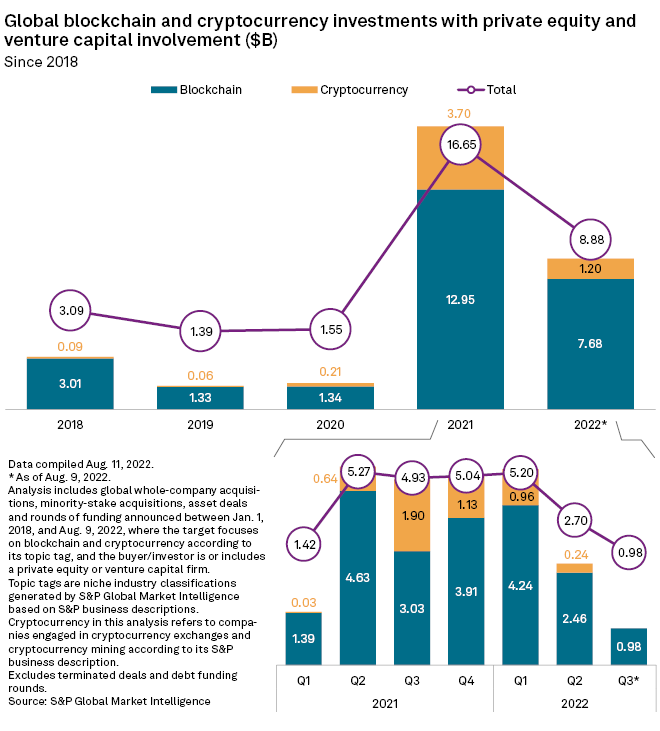

The combined global deal value for the two assets fell 48.1% quarter-on-quarter in the three months to June 30, to a combined $2.7 billion, according to data from S&P Global Market Intelligence.

A whopping $16.65 billion was invested in these assets in 2021, of which $960 million was committed to cryptocurrency.

The ambiguity of regulations of digital currency from central banks, the cost of electricity used running cryptocurrency mining farms and the ever-growing carbon footprint are among the factors hindering cryptocurrency investment.

The company’s interest [blockchain-powered applications]however, remains strong, said Alex Johnston, research analyst at 451 Research.

“Companies are looking at applying [blockchain] technology to areas such as supply chain tracking, digital identity and B2B payments. As this market gains traction, it could take the edge off the challenges of reduced confidence in the consumer space,” Johnston said.

Wider adoption will largely depend on regulators, he said.

“Blockchain providers and potential investors are looking for transparency, but where we see legislation, such as the EU’s European Securities and Markets Authority law, the focus is on blockchain as an enabler of speculative assets, rather than regulation regarding wider applicability.”

Largest 2022 PE/VC Investments in Blockchain and Cryptocurrency

New York-based blockchain technology company ConsenSys Software Inc. completed the largest funding round of 2022 to date, raising $450 million. Returning investor ParaFi Capital LLC led the round, while Temasek Holdings, True Capital Management LLC and Anthos Capital LP were among the other participants.

The Australian company Animoca Brands Corp. Ltd., which provides gamification, blockchain and artificial intelligence technologies for mobile products, raised $409.9 million. Investors included 10T Holdings LLC, Alpha Wave Global LP and Sequoia China Investment Management LLP.

The cryptocurrency exchanges FTX Trading Ltd. and West Realm Shires Services Inc. raised $400 million each in separate financing rounds backed by private equity firms.