Predicting Crypto Crisis: Bitcoin Price Could Fall 35% (BTC-USD)

The BT series

The increase in the price of the main world indices, namely the S&P 500 (NYSEARCA:SPY) and the Nasdaq 100 (NASDAQ:QQQ) by 5% this week contributed to the growth of investment interest in cryptocurrencies, which remains under pressure. The financial the situation in the world continues to worsen due to increasing inflation, which causes an increase in the cost of mining equipment.

The economic growth of China, which is the second largest Bitcoin mining country, slightly accelerated in Q3 2022, but remains at multi-year lows. Furthermore, youth unemployment remains high at 17.9%, and combined with lower housing prices, these factors could exacerbate China’s property crisis and put serious pressure on the economies of many Asian countries.

As a result, this will lead to an accelerated decline in investment interest in high-risk assets, which include cryptocurrencies such as Bitcoin (BTC-USD), Ethereum (ETH-USD) and Ripple (XRP-USD). Despite the problematic macroeconomic and geopolitical situation in the world, the price of Bitcoin remains stable and continues to consolidate in a narrow price range since September 2022.

Source: N_Aisenstadt — TradingView

In this article, we will analyze the reasons that indicate that the price of Bitcoin has not yet reached the bottom, and as a result, in my opinion, shock awaits the crypto industry, including a number of funds, including Grayscale Bitcoin Trust (OTC: GBTC) and ETFs.

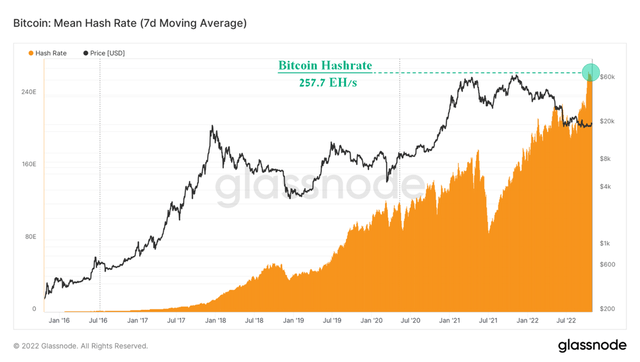

Competition among miners is reaching multi-year highs

Despite continued downward pressure on the prices of various cryptocurrencies, Bitcoin’s hash rate reached a new all-time high of 257.7 Exahash per second, up 13.2% from last month. For those unfamiliar with cryptocurrencies, the hash rate shows the total processing power of the mining equipment used in the process of mining them.

Source: Author’s elaboration, based on Glassnode

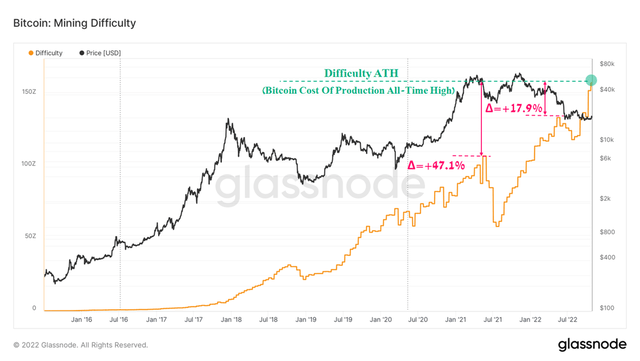

However, as the hash rate grows, the difficulty of mining increases, which shows how difficult it is to do a mathematical calculation to find a new block and consequently receive a reward for it, also systematically. This indicator increased by 47.1% compared to the peak reached in May 2021, during which the period was marked by a significant tightening of China’s policy regarding cryptocurrency trading and mining, which later led to the emigration of the mining company to Kazakhstan and the United States.

The sharp growth in mining difficulties in the last two weeks is negatively reflected in the increase in the cost of bitcoin mining, and thus there is a decrease in the cash flow of mining companies that are in dire need of it to buy more powerful and more economical. mining equipment. As a result, this creates additional financial burdens on the cryptocurrency mining industry, and in the face of tightening central bank policies, it will be more difficult for company management to find funding for their activities.

Source: Author’s elaboration, based on Glassnode

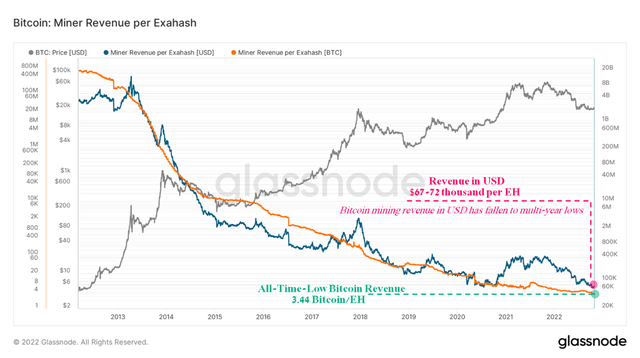

At the end of October 2022, revenue per Exahash reached a multi-year low of 3.44 BTC per Exahash per day, a 44.7% year-over-year decrease. When you convert this value from Bitcoin to dollars, the current situation is also deplorable for the industry, since the income for one Exahash is $67-72 thousand per day. This figure has already fallen below the levels at the start of the fourth quarter of 2020 after the halving.

Source: Author’s elaboration, based on Glassnode

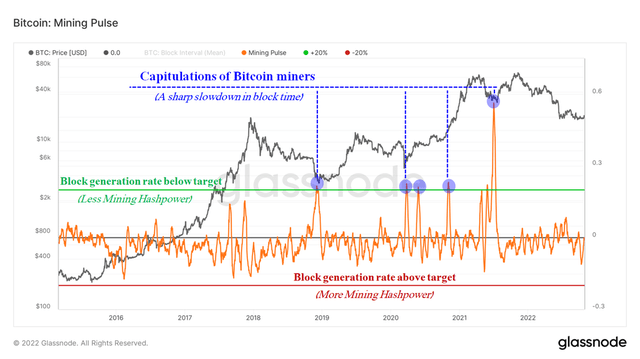

One of the most important metrics for predicting the price of Bitcoin is Mining Pulse, which monitors the activity of miners and then compares the interval of mining a Bitcoin block with a target value of 10 minutes. If Bitcoin blocks appear slower than 10 minutes, this may signal that the miners are leaving the network due to the onset of a shock event. As you can see in the chart below, there was a period of bearish sentiment after several years of high Bitcoin prices, which ended in a dramatic capitulation of the miners.

According to my calculations, the next capitulation of miners with an increase in the block interval by 20% compared to the target value will occur at the end of 2022 and will seriously test the strength of listed companies such as Riot Blockchain (NASDAQ:RIOT) ), Hut 8 Mining ( NASDAQ:HUT) and HIVE Blockchain Technologies (NASDAQ:HIVE).

Source: Author’s elaboration, based on Glassnode

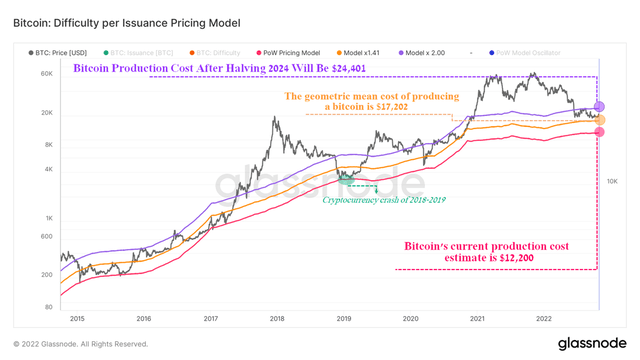

Bitcoin price prediction based on mining parameters

The system developed and described in Glassnode and makes it possible to estimate the cost of Bitcoin mining using such fundamental parameters as difficulty and issuance, it is possible to predict the most likely price ranges for “digital gold”, as when the largest market players will begin to pursue an aggressive policy to accumulate this asset. So, for example, the current estimated cost of Bitcoin mining, marked with a pink line in the chart below, is $12,200. When referring to historical data, in most cryptocrashes, including those that led to the capitulation of miners, the price reached on Bitcoin exactly the minimum values that were derived by this model.

Source: Author’s elaboration, based on Glassnode

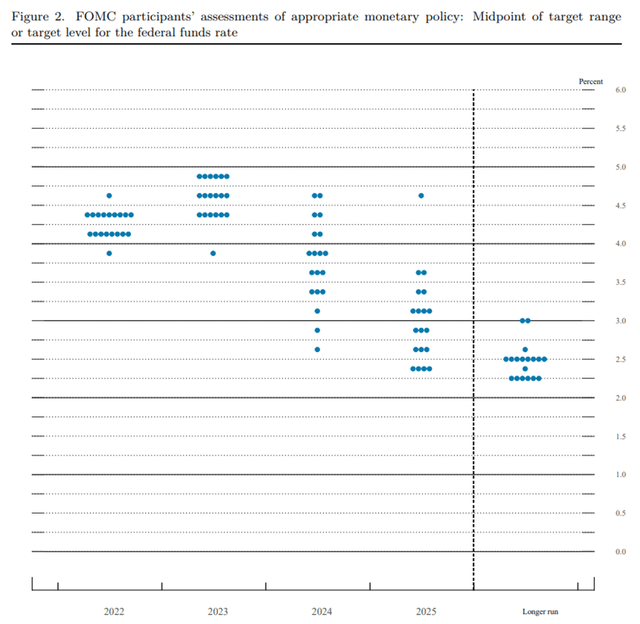

The effect of the Fed interest rate on the price of cryptocurrencies

The Federal Reserve continues to raise interest rates to combat inflation, which remains at a high level. Rising interest rates typically reduce appetite for high-risk assets like Bitcoin, while financial stocks and short-term government bonds are in the golden age. As a consequence, this means an increased likelihood that the cryptocurrency industry will continue to experience downward pressure until at least the end of 2023. The reason for this is the latest Fed forecasts, which expect to raise interest rates to the range of 4.25-4.50% by the end of 2022, and by 2023 it will be 4.50-4.75%, which will be the highest rate in the last 16 years.

Source: Federal Reserve System

The stock market continues to react negatively to Fed rate hikes, partly due to fears that the performance of companies that actively used low-interest loans in 2020-2021, but now have to issue senior bonds with higher coupon rates and thus increase the cost of servicing the debt. So, for example, Meta Platform’s (NASDAQ:META) and Amazon’s (NASDAQ:AMZN) shares came under the most severe selling pressure this week due to a decline in operating income in Q3 2022, both year-over-year and the previous quarter.

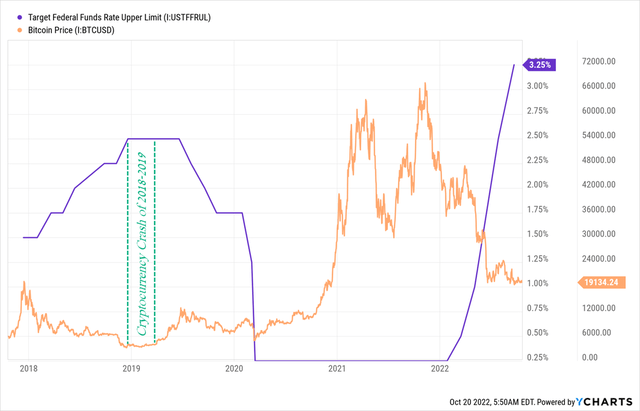

Looking at the historical data, one can see evidence of a correlation between the Fed rate and the price of Bitcoin. Then on January 5, 2022, the FOMC published minutes indicating the need to raise the rate. Within the same day, the price of Bitcoin fell by more than $3,000, and five days later, the decline was about 16.3%.

Source: N_Aisenstadt — TradingView

Looking at the crypto crash of 2018, the price of Bitcoin continued to fall during the Fed rate hike. However, when the Fed stopped its policy tightening in early 2019, the downward pressure on the Bitcoin price ended and the crypto market stabilized. And by the second quarter of 2019, the price of Bitcoin reached $12,000, thus showing an increase of 275% in just four months.

Source: Author’s elaboration, based on YCharts

Technical Analysis of Bitcoin

When predicting the price movement of Bitcoin, I use the Elliott Wave Theory, as this method has proven itself and, when used correctly, has a relatively low error, especially when analyzing cryptocurrencies. From November 8, 2021, a correction wave (IV) began to form, in which the wave Ⓦ was formed in the form of a zigzag (“A”-“B”-“C”), and at the moment an intermediate wave ⓧ continues to form.

When you switch from the weekly time frame to the 4-hour time frame, you can see the formation of wave (Y) from October 17, 2022, which is included in the structure of wave ⓧ. With a high degree of probability, it will take the form of a double zigzag, and as a result, I expect the price of Bitcoin to rise to $23,800-24,200. After that, the corrective movement of this asset will continue up to the range of $12,700-$13,600 per BTC, where the smart money will begin to accumulate “digital gold” in anticipation of the formation of the final global impulsive wave “V” and Bitcoin halving in 2024.

Source: N_Aisenstadt — TradingView

Conclusion

Periods of low volatility are extremely rare for Bitcoin, and similar periods to the current situation could be observed both before the sharp collapse in cryptocurrency prices in December 2018, and at the beginning of the epic rally in the first half of 2019. Despite the over 70 % decline in the price of Bitcoin from multi-year highs and the slowdown in the global economy, the Bitcoin hash rate has risen significantly this week to another all-time high.

On the one hand, this is a signal that indicates an increase in interest in mining the largest cryptocurrency by market capitalization, but on the other hand, it reduces the margins of mining companies that already have problems with liquidity. From a fundamental standpoint, the cryptocurrency market continues to correlate with the stock market. In the current period of interest rate hikes from the Fed, there are therefore no significant assumptions that could indicate the imminent start of a Bitcoin bull run.

In addition, the current period in which central banks are resorting to tightening policies is leading to a decrease in appetite for high-risk assets, which include cryptocurrencies. In terms of technical analysis, I expect a slight upward movement in the price of Bitcoin to the $23,800-24,200 range. However, this will be followed by a 40% retracement to a strong support zone formed in the $12,700-$13,600 price range per BTC.