Money Laundering Act: Crypto transactions under PMLA

Money Laundering Act: Crypto Transactions Under PMLA – What Crypto Holders Should Know

Photo: BCCL

The latest step in bringing virtual digital assets under the Money Laundering Act is in line with the thinking process of the government, which has been thinking of rolling out its own digital currency. Following this, Indian crypto exchanges will have to report suspicious activity to the Financial Intelligence Unit India (FIU-IND).

Photo: ET now digital

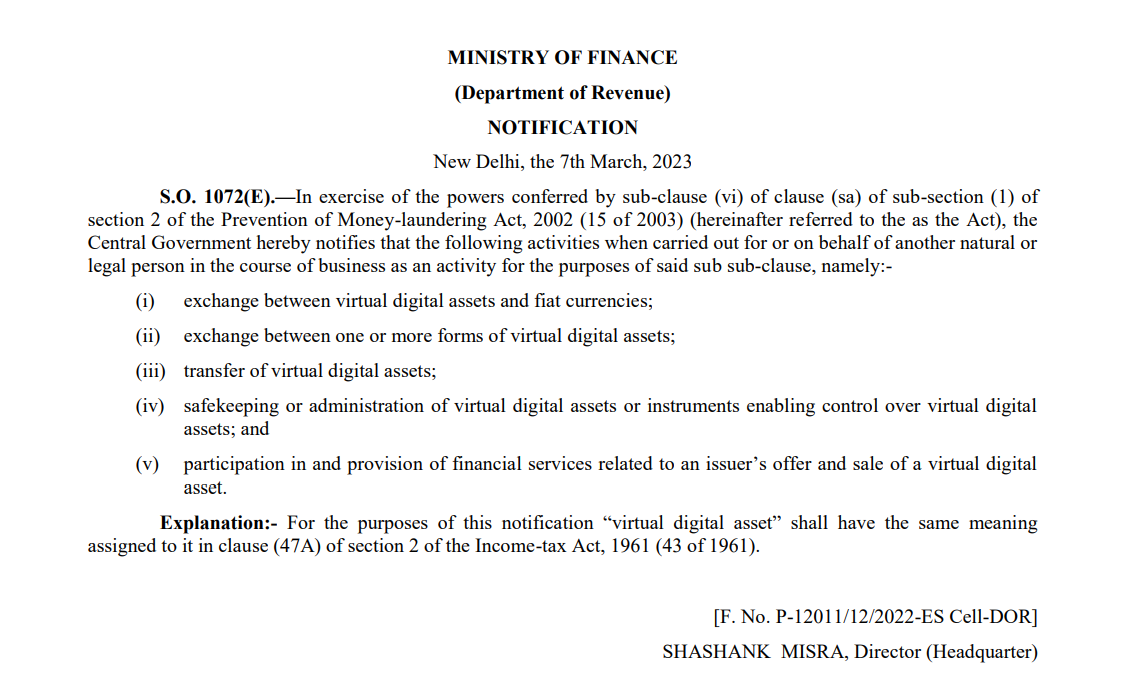

Transactions to be covered by the Money Laundering Act

– Exchange between virtual digital assets and fiat currencies

– Exchange between one or more forms of virtual digital assets

– Transfer of virtual digital assets

– Storage or administration of virtual digital assets or instruments that enable control over virtual digital assets

The Ministry of Finance also warned investors against “participating in and providing financial services related to an issuer’s offer and sale of a virtual digital asset.”

What is a virtual digital resource?

The government further added: “For the purpose of this notification, ‘virtual digital asset’ shall have the same meaning assigned to it in clause (47A) of section 2 of the Income-tax Act, 1961 (43 of 1961).”

As per Section 2(47A) of the Income Tax Act, 1961, unless the context otherwise requires, the term “Virtual Digital Asset (VDA)” means:

(a) any information or code or number or token (not Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having intrinsic value, or acting as a store of value or a unit of account including use in any financial transaction or investment, but not limited to investment scheme; and may be transmitted, stored or traded electronically;

(b) a non-fungible symbol or other sign of a similar nature, by whatever name;

c) any other digital asset, which the central government may, by notification in the Official Gazette, specify:

Provided that the Central Government may, by notification in the Official Gazette, exclude any digital asset from the definition of virtual digital asset on the terms specified therein.

How was the decision received?

.png)