Meta Joins Growing List Of Tech Firms Letting Go – Crypto Firms To Follow?

With Facebook owner Meta now joining a growing list of tech companies laying off workers, the inevitable next question becomes what crypto companies will do.

According to a report from the Wall Street Journal, “large-scale layoffs” are set to begin at Meta as early as this week. The layoffs could be the largest round in a recent wave of layoffs in the tech industry, the report said, citing “people familiar with the matter.”

The resignations at Meta followed a round of layoffs at Twitter last week, where the company’s new owner Elon Musk famously fired around half of the company’s employees.

Twitter had about 7,500 employees before Musk’s takeover, which would mean about 3,700 workers would lose their jobs.

According to the Wall Street Journal’s sources, the upcoming cuts at Meta will be smaller in percentage terms than those at Twitter, although they will most likely be larger in terms of the number of workers affected.

In an Oct. 26 earnings call, Meta CEO Mark Zuckerberg hinted that cuts were coming, saying the company needs to focus its investments on “a small number of high-priority growth areas.”

“So that means some teams will grow meaningfully, but most other teams will remain flat or shrink over the next year,” Zuckerberg said on the call, while also adding:

“Collectively, we expect to end 2023 as either about the same size, or even a slightly smaller organization than we are today.”

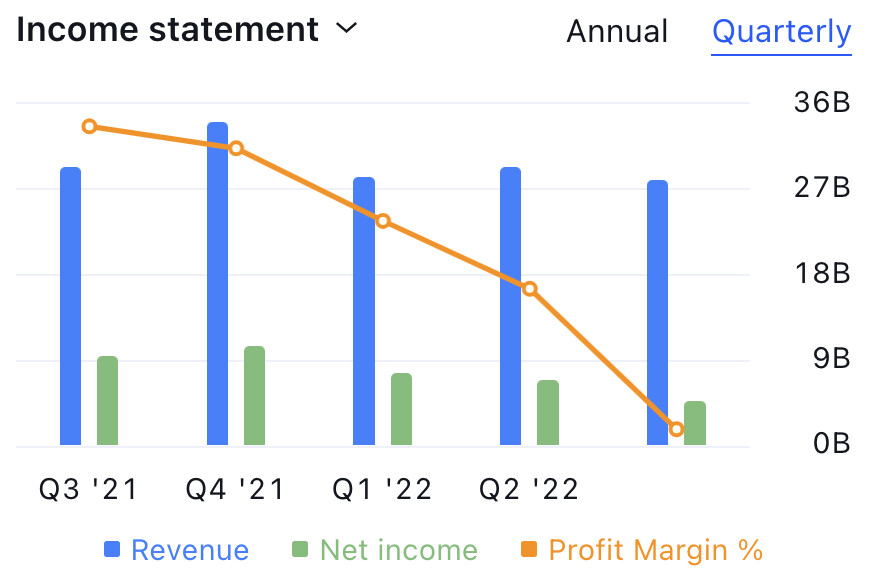

The third quarter was not good for Meta investors, and the company lost over $3.5 billion. The massive quarterly loss was largely due to massive investments that have yet to pay off in Meta’s metaverse-focused division known as Reality Labs. According to the earnings report, that division alone lost a staggering $3.67 billion for the quarter.

Should crypto companies follow suit?

The question being asked in crypto now is whether the crypto industry will follow the tech industry and also announce layoffs. The two industries are known to be closely related, sharing many of the same venture capital investors, and often trading similarly in the public stock and crypto markets as well.

In addition, crypto companies are known to be very sensitive to the prices of major cryptocurrencies. And given that crypto remains in a bear market – which has now lasted for about a year – it is not inconceivable that layoffs will also be on the agenda for crypto companies.

Redundancies in at least 3 companies so far in November

So far in November, at least three major crypto companies have announced layoffs affecting between 10% and 30% of their employees, widely followed Twitter user Wu Blockchain reported earlier this month.

Galaxy Digital, a company led by former investment banker Mike Novogratz, is reportedly looking into eliminating “as much as 20% of its workforce,” though that number is still subject to change.

“We are always evaluating optimal team structure and strategy and will share future plans when they are finalized,” Galaxy spokesman Michael Wursthorn said in a comment at the time, while also admitting that the industry as a whole “continues to face macroeconomic headwinds.”

Second, major crypto spot and derivatives exchange BitMEX has also reportedly laid off employees recently, although the company declined to say exactly what percentage of their employees were affected.

Finally, Digital Currency Group (DCG), a large firm with subsidiaries in many parts of the crypto industry, has reportedly cut 10% of its workforce as part of a restructuring process. The layoffs were necessary to position itself for its “next phase of growth,” a spokesperson said.