Implementing APIs to Drive Fintech Growth: The Rise of Banking-as-a-Service

Banking as a service (BaaS) is revolutionizing the way traditional banks and fintech companies work together to offer banking services to consumers.

BaaS allows fintech companies to offer their customers a comprehensive suite of financial services, including account opening, money transfer and credit card issuance, without having to build and maintain their own banking infrastructure. Instead, they can partner with a traditional bank that provides the necessary infrastructure and regulatory licenses to provide these services.

Mobile banking is growing in popularity, with 78% of the US population using it by 2022, and an estimated 3.6 billion digital banking users worldwide by 2024. As younger generations such as Gen Z and millennials take over the banking market, it will be critical for banks to integrate mobile services if they want to remain competitive.

Advantages of BaaS

The advantages of BaaS are many. For fintech companies, it enables them to offer a more comprehensive suite of financial services to their customers, which can increase customer loyalty and retention.

It also provides a more seamless and convenient experience for customers, who can access all their financial services from a single platform. For traditional banks, it provides a new revenue stream and a way to reach new customers.

How to offer BaaS

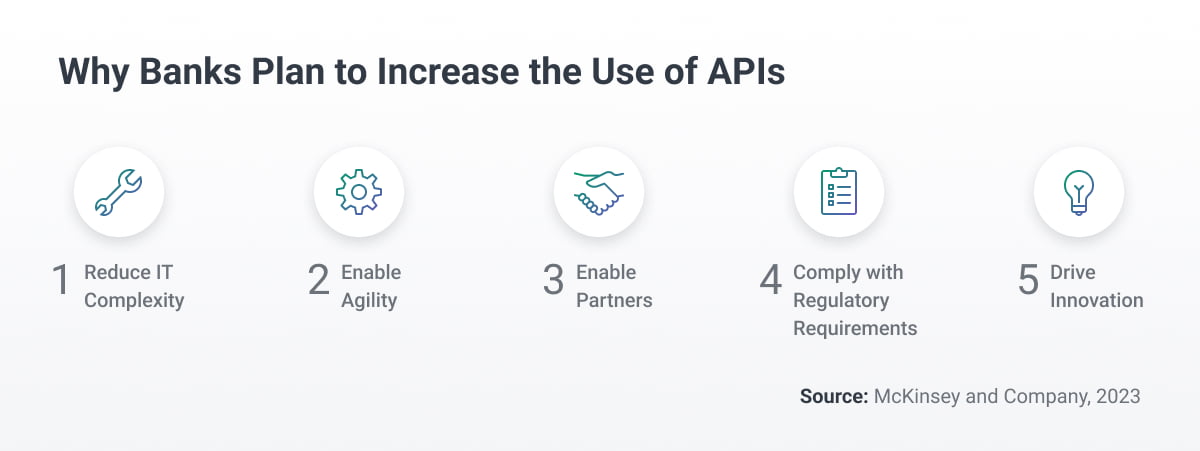

To offer BaaS, a fintech company typically needs to partner with a traditional bank that has the necessary infrastructure and regulatory licenses. The fintech company can then use the bank’s APIs to access and offer these services to its own customers.

The fintech company may also need to integrate its own systems with the bank’s to enable smooth and secure transactions. Compliance with relevant regulations and necessary security measures is also essential to protect customer data and transactions.

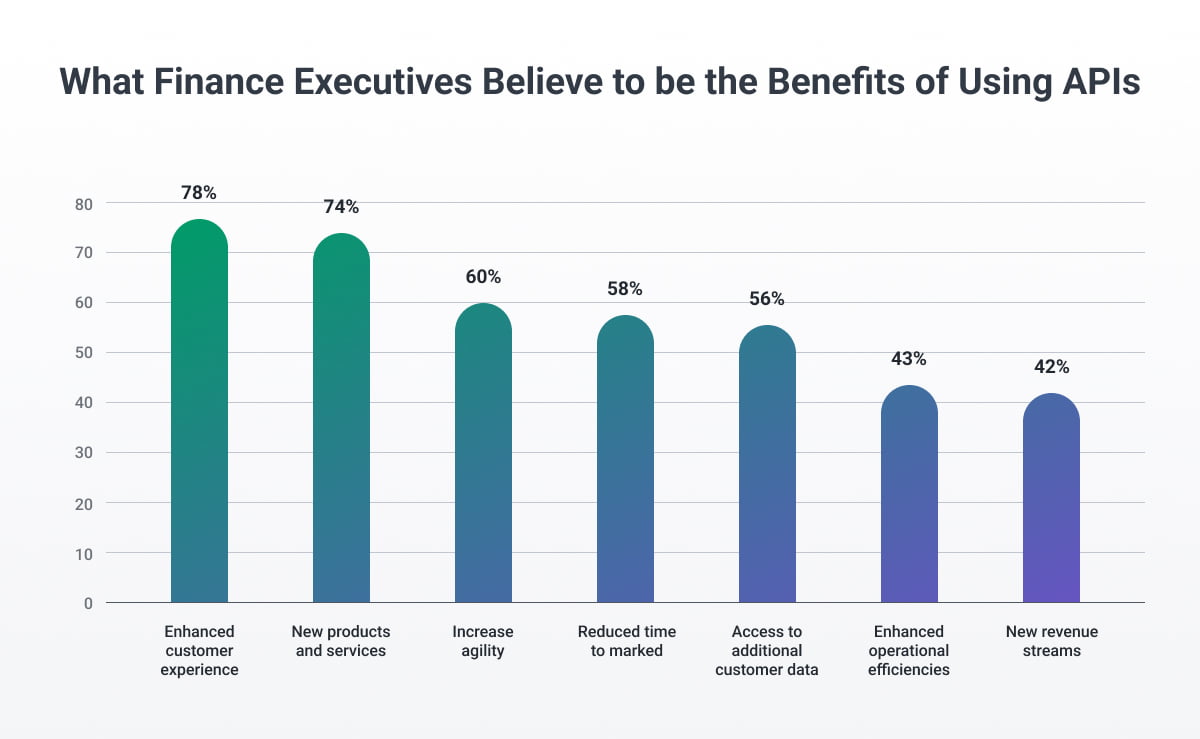

In 2023, the implementation of APIs will drive the growth of BaaS. APIs provide a standardized way for fintech companies to access banking services, making it easier for them to integrate these services into their own platforms. This will enable fintech companies to expand their services faster and easier. Fintech companies can also customize their services to better meet the needs of their customers.

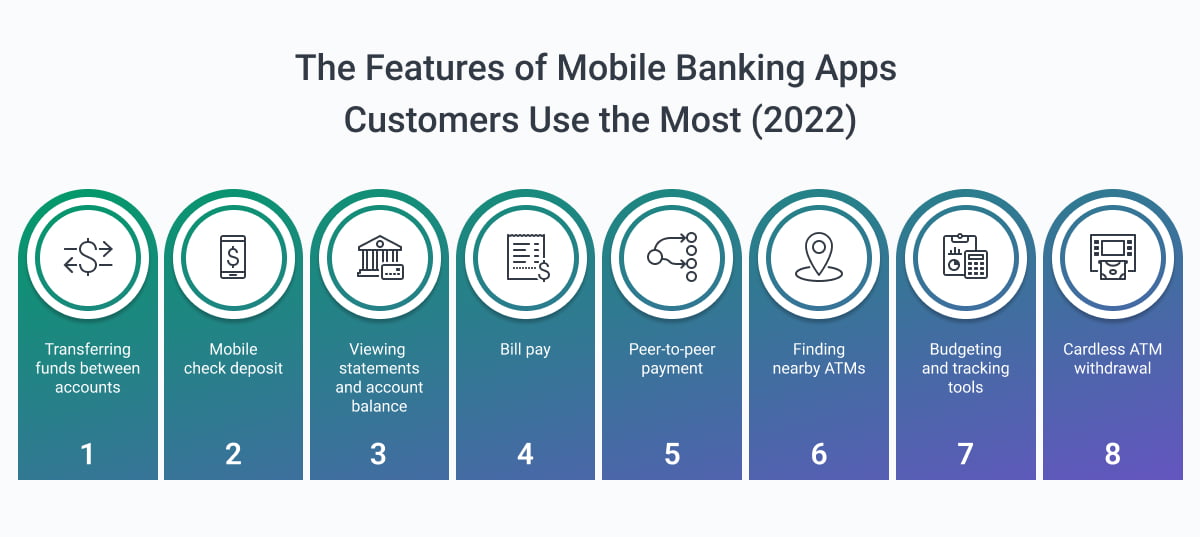

Features that mobile banking apps should prioritize

The most popular features of mobile banking apps in 2022 included account management, bill payment, and mobile check deposit. Customers value the convenience of being able to manage their finances from anywhere, anytime.

By offering these features through BaaS, fintech companies can offer a more comprehensive suite of financial services to their customers, while traditional banks can reach new customers and increase their revenue.

The trend towards BaaS is expected to continue in 2023 as fintech companies seek to expand their services and reach new customers. Implementing APIs will be critical to enabling BaaS to grow, as they provide a standardized way for fintech companies to access banking services.

As the popularity of mobile banking continues to grow, it will be critical for banks to integrate mobile services into their offerings to remain competitive.

With the right partnerships and implementation strategies in place, BaaS has the potential to transform the banking industry and provide consumers with a more comprehensive and convenient banking experience.