Are you looking to ensure that your digital assets – held by your favorite crypto exchange – are safe and secure? The need for reliable and responsible methods to verify the solvency of crypto exchanges is becoming increasingly important, especially as the crypto industry evolves.

Proof of reserves (PoR) seems to be the answer to this need.

What is proof of reserves in crypto?

In November 2022, FTX, a giant in the crypto exchange community, declared bankruptcy. This happened shortly after customer funds were misused – FTX allegedly mixed investor deposits with its trading operations. Since the collapse of FTX, investors have demanded various types of audits and certifications from their crypto-custodians to confirm that the funds held match the investors’ deposits.

Proof of reserves is an audit process that confirms that an exchange’s reserves can cover the customer’s balance. The PoR, usually conducted by an independent third-party audit contractor, assesses the soundness of the crypto exchange.

A PoR audit can also prove that exchanges hold the assets they claim to have. And this evidence will promote transparency and increase customer confidence in the financial institution.

PoR audits seek to prevent misuse of funds, where crypto exchanges use their customers’ funds for other purposes.

How does proof of reserves work?

Crypto exchanges or companies often engage third-party auditors to conduct a PoR audit. The auditors then publish their findings, bringing investors up to date on the financial health of their exchange.

There are various steps involved in a PoR audit.

1. Asset Verification

First, the crypto exchange sends its assets for a physical audit. The auditor then calculates the total balance of the assets. This balance calculation also includes liabilities, such as outstanding customer withdrawal requests.

2. Cryptographic methods

The audit contractors use cryptographic methods to prove that the institution actually owns these assets. These mathematical algorithms secure digital data and prevent unauthorized access or falsification.

Common examples of cryptographic methods crypto exchanges use to verify ownership of declared assets are digital signatures, hashing, and zero-knowledge proofs, to name a few.

3. Public accounts

Public ledgers are one of many ways crypto exchanges provide proof of reserves. The exchange’s transaction history and balance will appear on a public ledger, like a blockchain explorer. This provides even more transparency and is instrumental in building trust between the crypto exchange and its investors.

Merkle Tree Proof of Reserves

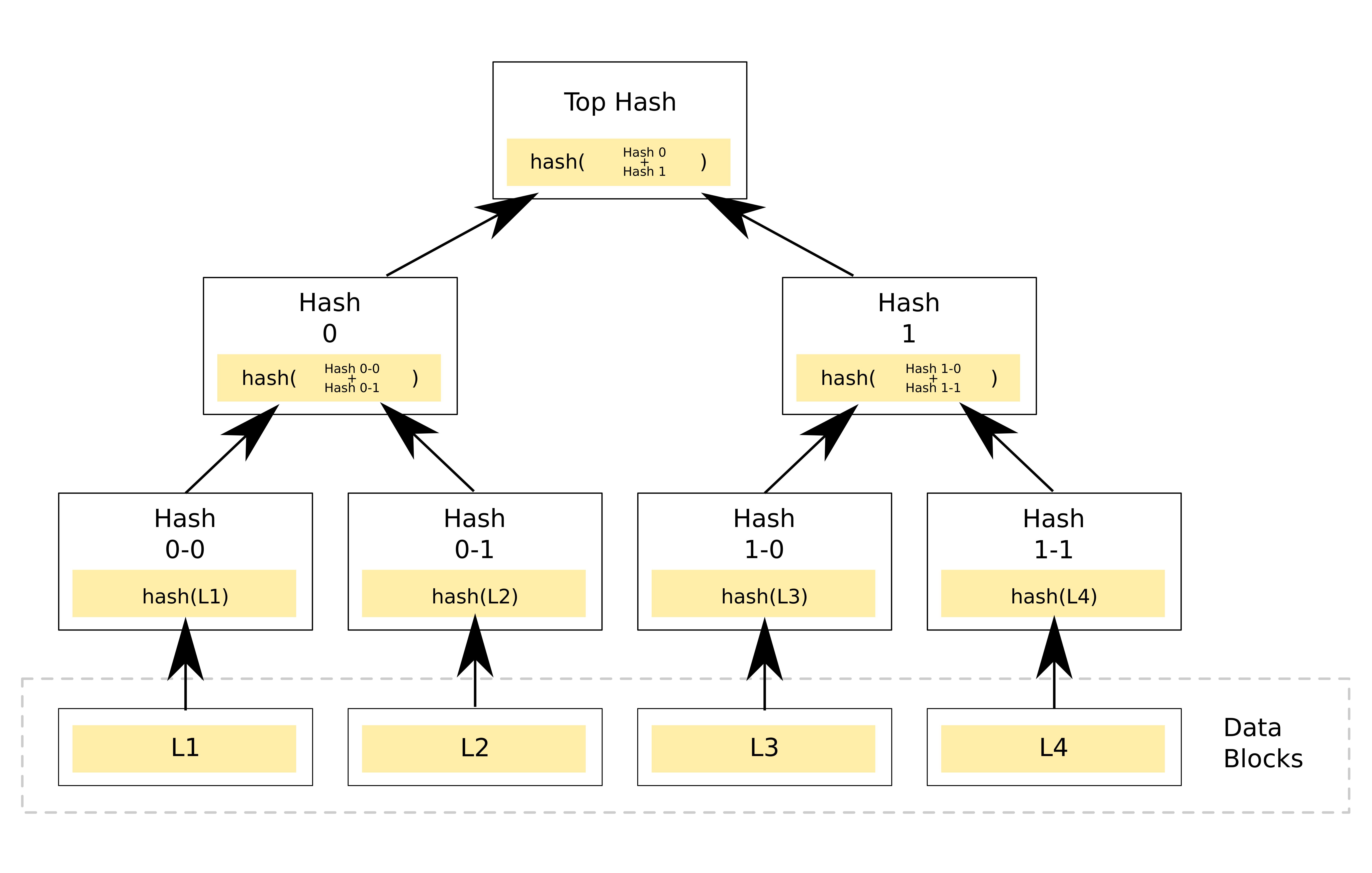

Most crypto exchanges use a Merkle Tree Proof of Reserves to provide cryptological proof of their holdings. With the Merkle tree, blockchain transaction data is encrypted and allows you to properly audit the total holdings of the exchange. You can even verify your transactions that contributed to your total balance.

A Merkle tree PoR works just like other types of PoR. The first step is asset balance verification, where the exchange’s assets are calculated, including the cryptocurrency and fiat currency balance.

Hash generation – a cryptographic method – is the next step. Here, the asset data is processed through a hash function. Each hash is a unique code assigned to each data item to form leaf nodes, which are the bottom layer of the tree. Then these hashes are paired together to form parent nodes that are one layer above the leaf nodes and are continuously connected as parent nodes until a root node is formed.

A root node is the entire data set of the Merkle tree. To demonstrate the PoR, the audit contractors present the root node and a set of hashes. The root node shows that the crypto exchange actually owns the assets it claims to have, while the set of hashes provides proof of the specific assets owned by the exchange.

Merkle tree-based PoR may be published at regular intervals, either weekly, monthly or quarterly, at the stock exchange’s discretion. However, some exchanges provide real-time certificates online on their websites.

Benefits of Proof of Reserves for Investors and the Crypto Industry

Binance CEO Changpeng Zhao set the ball rolling for PoR by calling crypto exchanges to start publishing their Merkle tree PoR. Then, on November 25, 2022, Binance announced its first batch of PoR audits, becoming the first crypto exchange to do so.

Other crypto exchanges deemed safe soon followed, including Kraken, Coinbase, Gate.io, and Gemini.

PoR has various advantages for the exchanges and their customers. Here are some of those benefits:

1. Transparency

PoR allows crypto exchanges to publish their assets in a verifiable and transparent manner. As a result, customers can verify that their crypto exchange actually holds their digital assets. In this way, trading platforms promote a trusting relationship with their customers.

2. Reduces the risk of insolvency

PoR shows customers that their exchange has enough to meet their withdrawal requests. In this way, PoR helps to reduce the risk of insolvency, which can happen when most exchange clients try to withdraw all their funds due to uncertainty.

3. Risk management

PoR helps crypto exchanges identify potential risk factors by providing an overview of all assets and holdings. This information enables exchanges to manage risks and better respond to other preconceived threats.

Limitations on proof of reserves

The biggest limitation for proof of reserves is that customers do not know the exchange’s true solvency risk. Crypto exchanges usually provide a snapshot of their holdings. However, this snapshot does not describe the company’s liabilities or holdings. So while the whole process may seem transparent, customers are still in the dark about the real risk of the exchange’s insolvency.

Additionally, while publishing PoR is commendable, note that past performance is no guarantee of future success. PoR audits typically give investors a false sense of security that can be misleading, especially during periods of high market volatility.

Keep a close eye on your crypto exchange despite proof of reserves

The purpose of proof of reserves is to prevent crypto exchanges from running fractions – the exchange’s profits by using customers’ deposits as loans. Several trusted, popular exchanges publish their PoR audits to reassure investors about the safety and stability of their assets.

While this process promotes transparency, it does not tell the whole story. Therefore, you should carefully monitor the activities of your chosen crypto guardian to avoid falling victim to the false sense of security that PoR can provide.