Here’s why the NFT landscape may have changed for the better during the Bear Market

The NFT landscape has shifted towards benefit-based projects during the bear market of the past year. Here’s why this could be good for the sector.

New NFT Project Mints have shifted away from speculation over the past year

According to a report published by Ark Invest, the NFT market has gone through a bear market shift. To track how the sector has changed, the report has used data for the NFT coins that take place in each quarter of the year.

Here, the proportion of the total mint that each of the different project types has contributed to is assessed. The “Project Types” consist of Art, Avatar, Collectibles, Games, Tools, and Virtual Worlds.

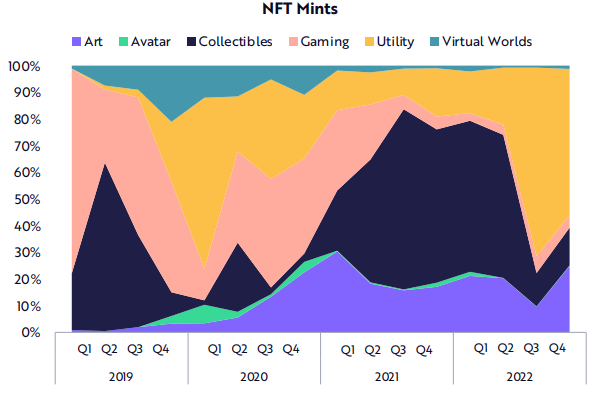

Here is a chart showing how the percentage dominance of each of these project types has changed in recent years:

Looks like utility took over during 2022 | Source: Ark's Big Ideas 2023

As shown in the graph above, way back in early 2019, the NFT market consisted mostly of collectibles and game-focused projects. Utility-based tokens took the lead around the end of the year, but it didn’t take long for their dominance to fall again.

By 2020, collectibles no longer made up much of the overall percentage of NFT coins, while utility and gaming remained strong. Art-based tokens also started to gain popularity in 2020.

Collectibles made a big comeback in 2021 as the broader cryptocurrency market saw a bull run. However, game projects had a fairly low percentage of the coins during this period.

Then, as the bear market took hold in 2022, all project types, including collectibles, gained shrinking dominance, with one NFT type taking all of the market share: utility.

Utility-based projects are those that generally have an inherent value attached to them, unlike things like collectibles whose prices are mainly driven by speculation. Examples of the type of projects that would fall under this category include ticket tokens, on-chain domain names, and digital memberships.

That the market is now focusing more on utility NFTs that have a certain underlying value can be a healthy development for the sector, according to the report. In this way, the bear period that kills the interest around speculative projects can be a blessing for the market.

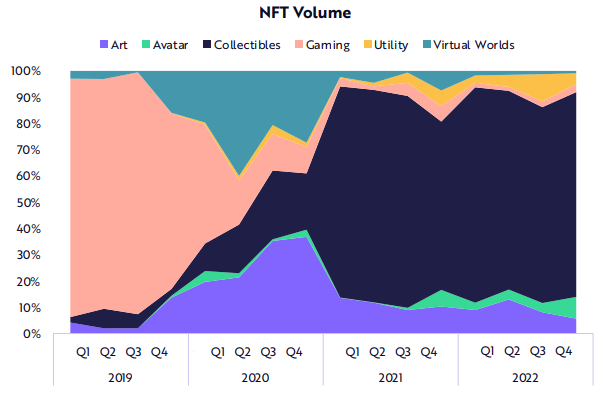

However, in terms of trading volume, the NFT sector was still heavily dominated by existing high-profile collectibles such as Crypto Punks and Bored Ape Yacht Clubs. The “trading volume” here refers to the total number of transactions that these tokens have observed.

The diagram below shows how the volume dominance of the various project types has changed over the years.

The collectibles seem to have occupied the largest volume percentage during the past couple of years | Source: Ark's Big Ideas 2023

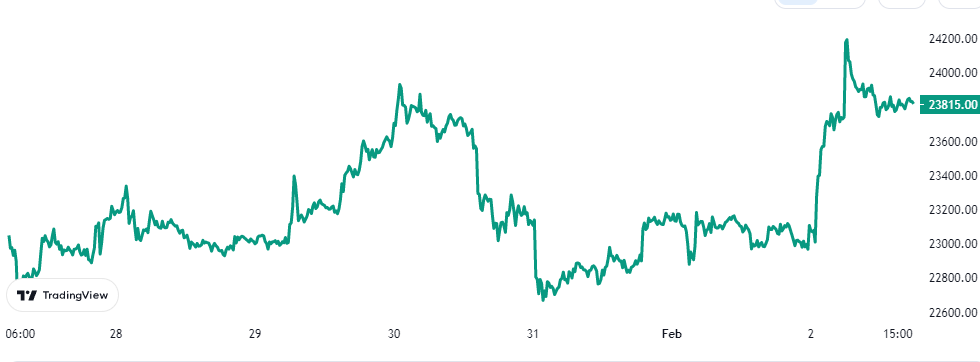

BTC price

At the time of writing, Bitcoin is trading around $23,800, up 3% in the last week.

BTC has surged today | Source: BTCUSD on TradingView

Featured image from Andrey Metelev on Unsplash.com, Charts from TradingView.com, Ark Invest