Forget “tober”, the crypto market is at risk of further losses

Despite the expectation of a “until” crypto market, Bitcoin still sat below the $20,000 level as social volumes continued to decline.

A new month is often accompanied by positive social feeling and new gains for assets. For Bitcoin and the larger cryptocurrency market, the bearish blues are still playing out despite entering October.

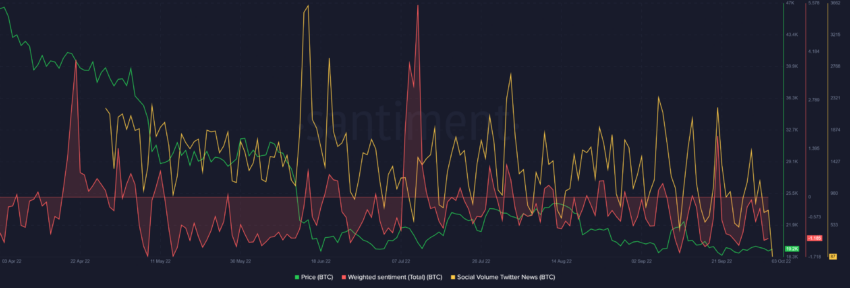

Social data from Santiment showed a weighted BTC sentiment score of -1.185, while the Twitter news social volume metric fell back to its lowest levels since April 2022. Low social volumes and a drop in weighted sentiment highlighted that talk of BTC on social media has taken a hit, indicating that interest in the top cryptocurrency by market cap has waned.

Maximum pain for BTC HODLers?

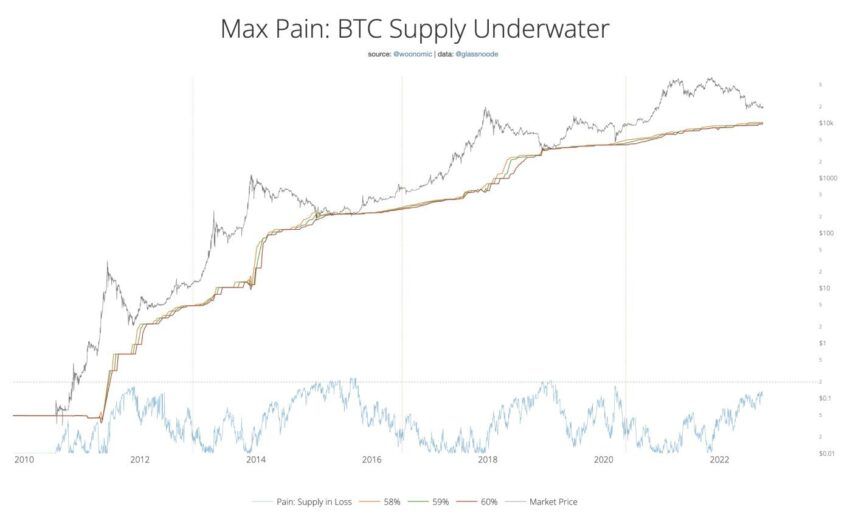

Bitcoin analyst Willy Woo pointed out that maximum pain levels had not yet been reached, which could mean that BTC HODLers have yet to hit a bottom. Looking at the chart below showing BTC supply at a loss, it is clear that during previous cycles the BTC price bottomed out when around 60% of Bitcoins were trading below the purchase price.

This time, a similar situation has yet to be seen. According to supply in loss, the current BTC bottom can be reached around $10,000. But since “the structure of this current market is very different,” it’s hard to say whether $10,000 could really be the bottom.

The crypto volumes are holding

On the weekly chart, Bitcoin’s price has been moving in a tight range between $23,700 and $18,800 since June 2022. The weekly RSI shows no signs of a breakout, as sellers continue to dominate buyers.

A positive sign is the steadily increasing volumes since April, suggesting that retail traders are still in the game even though OGs have remained neutral.

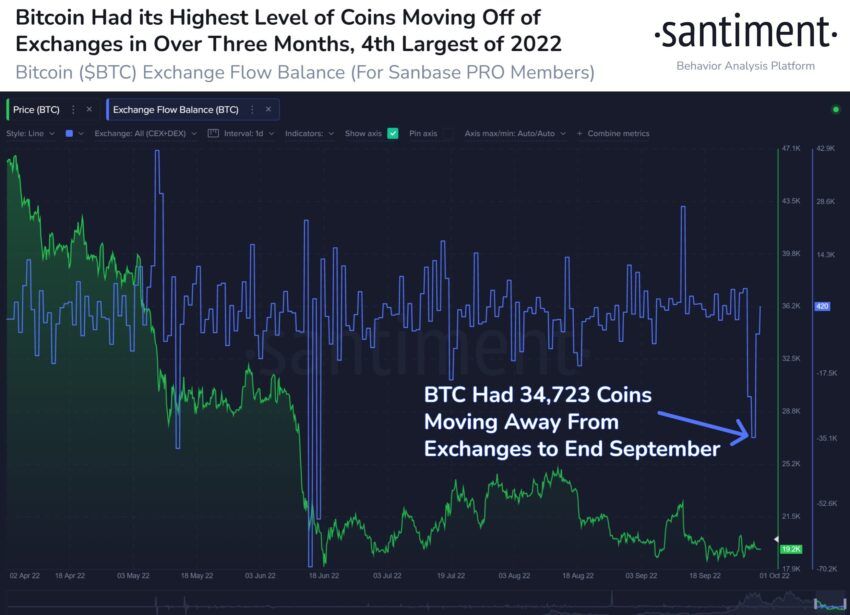

Bitcoin recently saw the highest number of coins move from exchanges during the last quarter and acted as a bullish signal. However, it has not been enough to push the price above key resistance levels.

Data from Santiment showed Bitcoin saw 34,723 BTC move off exchanges on September 30, indicating what could be a hint of trader confidence heading into Q4. The last time this much BTC left exchanges was on June 17, and prices jumped +22% in the month that followed.

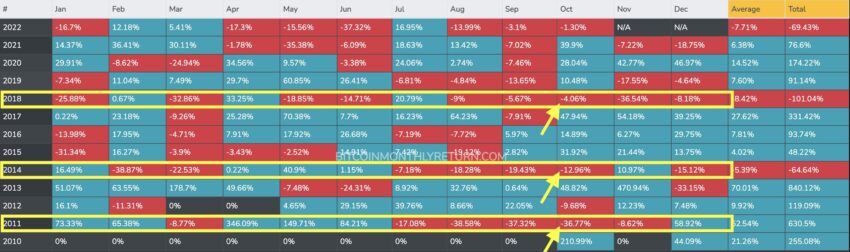

While the high outflows may present some short-term bullishness, October is unlikely to turn into ‘Uptober’ for crypto HODLers this time around. Notably, while October has been a bullish month during bull markets, BTC has never performed well in October during bear markets.

That said, the correlation between BTC and stock prices, especially technology stocks, has seen steady growth. Macroeconomic concerns around inflation, geopolitical climate and monetary policy have kept BTC prices down, thus also affecting the broader market.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.