XRP trading volume rises to billions of dollars on South Korean crypto exchanges

Join the most important conversation in crypto and web3! Secure your place today

The South Korean crypto trading craze has apparently returned fueled by the rise of XRP tokens.

Trading volume for XRP surged into billions of dollars on UpBit, Bithumb and Korbit, three of Korea’s top exchanges by volume, on the back of the token’s 26% rise in the past week.

Over the past 24 hours, XRP trading accounted for 37% of all volume on Bithumb, 18% of all volume on UpBit and a staggering 50% of all volume on Korbit, data from CoinGecko and CoinMarketCap show. These volumes were against the US dollar on UpBit and against the Korean won on Bithumb and Korbit.

Bitcoin (BTC) and Ether (ETH) typically account for the majority of trading activity on these exchanges, making XRP volume an anomaly.

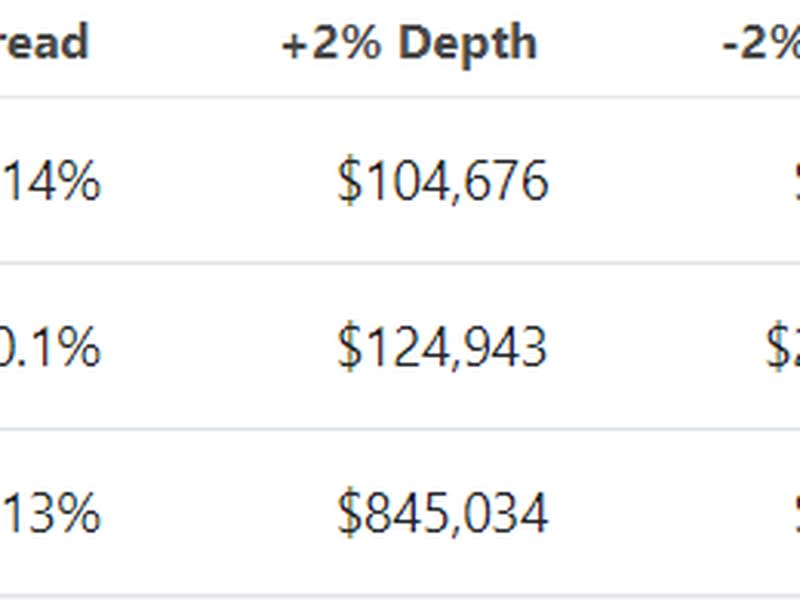

UpBit led global XRP trading volumes with over $790 million worth of tokens traded in the last 24 hours. Crypto exchange Binance, by comparison, traded for a relatively smaller $720 million, CoinGecko data shows.

In crypto circles, South Korean traders are notorious for driving euphoric rallies on tokens. The so-called Kimchi Premium comes from the region – where bitcoin prices on local exchanges can trade at a premium of as much as 30% compared to international counterparts, driven by local demand.

Some of this volume can be attributed to wash trading, a manipulative technique where traders continuously buy and sell the same asset to increase volumes to create a false impression of market activity.

The interest in XRP comes amid speculation that the token could be classified as a commodity by the US Commodity Futures Trading Commission (CFTC), after the CFTC classified bitcoin and ether as commodities in a lawsuit against Binance.

This in turn could damage the US Securities and Exchange Commission’s (SEC) case against Ripple where the regulator claims that XRP tokens are securities. Classification as a commodity could mean that Ripple wins the case – which some traders consider bullish for XRP.

“The bullish impulse stems from Ripple’s case against the SEC, where optimism for Ripple’s victory appears to be becoming more dominant,” Lewis Harland, portfolio manager at Decentral Park Capital, said in a market update on Wednesday.

“Maybe that Ripple win sets off a bullish impulse down the (alt-season) risk curve,” Harland added.

![#[Herald Interview] The world’s first festival of NFT film, art on the way – starts in Newport Beach #[Herald Interview] The world’s first festival of NFT film, art on the way – starts in Newport Beach](https://www.cryptoproductivity.org/wp-content/uploads/2022/10/20221026000545_0-120x120.jpg)