First bitcoin ETF loses record amount in first year

One year after its record-breaking launch, the world’s first exchange-traded fund that tracks the price of bitcoin has lost more of investors’ dollars than any other ETF debut.

Asset manager ProShares launched its Bitcoin Strategy fund in October 2021, and it immediately became the most successful new ETF in history, raising more than $1 billion in its first week of trading on the New York Stock Exchange.

Bitcoin enthusiasts hailed the launch as the moment crypto joined the world’s largest stock market and was incorporated into mainstream investment strategies for both retail and institutional buyers.

But one year into its existence, the fund has lost money on an unprecedented scale, according to data from Morningstar Direct for the Financial Times.

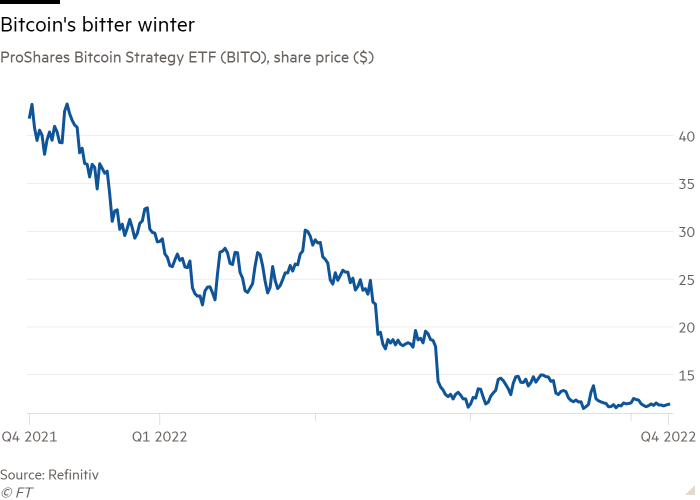

The 70 percent share price drop also makes this the sixth-worst-performing debut ETF of its type of all time, in a test for investors during what has come to be known as the “crypto winter.”

“We’ve seen funds trickle out of the gate like this, but rarely do they attract so much in assets so soon after launch as [this] did,” said Jeffrey Ptak, head of ratings at Morningstar Research Services.

The ETF, known as BITO, has attracted inflows consistently throughout its life, with only light withdrawals. But even with net income of $1.8 billion in its debut year, assets now stand at $624 million. Combining the timing of the influx and the 70 percent drop in the fund’s share price, Morningstar calculates that BITO has lost $1.2 billion of investors’ money, making it by far the biggest loser.

Other ETFs have fallen further in the first year, but they have all been by far less. The Global X Blockchain ETF (BKCH) — another crypto-related fund — fell 76.7 percent in its first year of operations through July, but peaked at $125 million and now has just $60 million.

ProShares said in a statement that “since its launch, BITO has closely followed bitcoin, which is what we believe our shareholders want from the fund”.

At the time of the BITO launch, ProShares CEO Michael Sapir said it was a milestone for the $8.4 billion ETF industry, on par with the first US equity fund in 1993, the first bond fund in 2002 and the first gold fund in 2004. BITO’s wildly anticipated launch helped push the price of bitcoin from $63,000 on launch day to record highs near $70,000.

But last November it became clear that US interest rates would start to push higher, hammering speculative assets. The ETF has tracked the 69 percent slide in bitcoin itself, while the cost of maintaining the futures contracts it relies on has also eaten into profits. The token has been trading at around $20,000 for four months.

Earlier this year, Jeff Dorman, chief investment officer at asset management firm Arca, said that “Bitcoin . . . has completely lost its narrative — it’s not an inflation hedge, it’s not uncorrelated [to other assets] and it does not act defensively’.

Some investors remain loyal to the crypto cause. Buyers “remained extremely loyal to the long-term thesis for bitcoin,” said Todd Rosenbluth, head of research at consultancy VettaFi, with net inflows of $87 million into BITO over the past six months despite the price crash.

“The fund has not seen the outflows that one would expect given the performance,” Rosenbluth said. “The pendulum has swung away from certain investment tasks this year. Historically, it can swing back in favor, but the challenge is whether the asset manager has confidence in keeping the product afloat, he said.

Additional reporting by Scott Chipolina

Latest news about ETFs

Visit our ETF Hub to find out more and explore our in-depth data and comparison tools