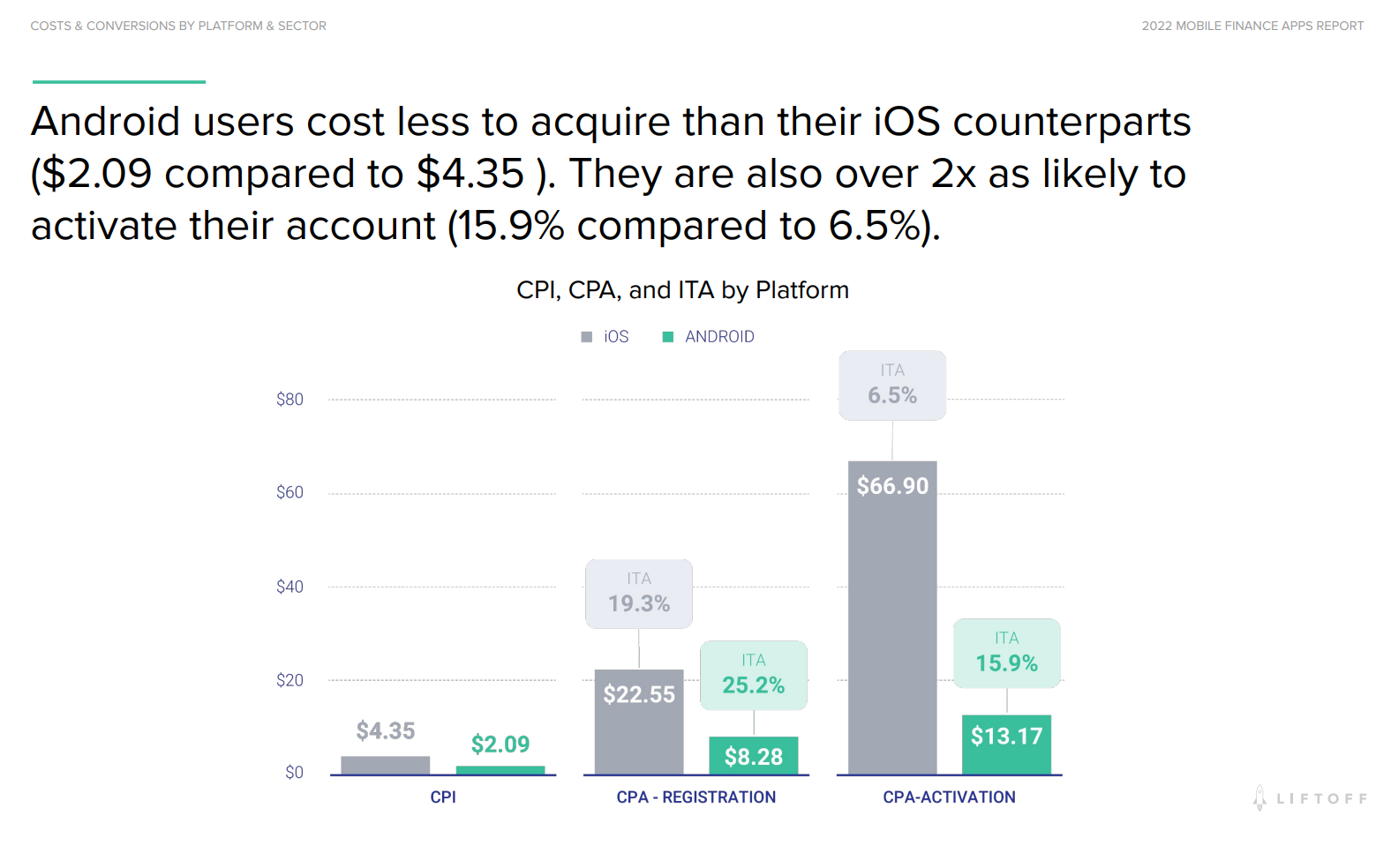

A study reveals that fintech applications cost half as much across Android devices as opposed to Apple, and also note twice as many users.

Fintech is a branch of web apps that is gaining a lot of traction these days because I guess everyone is obsessed with getting that bag, hustle, or whatever new catchphrase we’ve come up with to work ourselves to death chasing a dream made for us by corporate overlords who amass most of our wealth. While the term is most often associated with cryptocurrency and the blockchain, it refers to any advancement made towards online finance. This can include the development of automated web exchange, big data and even cloud storage and computing. With the world moving ever faster towards web development, it was only a matter of time before everyday economics would become an integral part of the internet landscape.

I feel that most individuals are attracted to crypto and fintech as concepts because they hypothetically represent the one thing that everyone is constantly chasing for easy money. There is minimal work and the results can be exorbitant, never mind that most exchanges can have a big impact on either the individual buying or selling. They are huge scams and I think I’m pretty sure of my stance on this. Enough of my complaining, though; let’s move on to the data we’re analyzing today. App marketing company Liftoff reveals that the average cost of a fintech app on Android is approximately USD 2.33 this year, while iOS platforms average around USD 4.35. Much of this difference can be attributed to the fact that the Play Store and its peers have relatively looser policies and fees for app publishers than the App Store.

However, many individuals who buy into an app spend before they either sign up or even remain active on such a platform. Android, again, takes the lead in that regard with the registration numbers being much higher for them as opposed to iOS users. I think this can be linked to Apple devices and how much they cost. Being able to afford an iPhone means that you are at least dependent on a relatively stable income, and therefore less prone to fads like cryptocurrency. Android users, on the other hand, don’t seem to have such reservations.

Read next: In Brazil and China, consumers spend the most on top games, the report shows