Fintech startups cheer as RBI releases digital lending rules

RBI’s working committee’s recommendations are a step forward in addressing issues related to lack of transparency, data protection and privacy, as well as user consent. Image: Shutterstock

RBI’s working committee’s recommendations are a step forward in addressing issues related to lack of transparency, data protection and privacy, as well as user consent. Image: Shutterstock

IIndia’s fintech startups that had been in a bit of a quandary following the Reserve Bank of India’s (RBI) diktat on prepaid instruments and loans earlier this year on Wednesday welcomed the sweeping digital lending rules released by the central banker.

The RBI published the rules following the recommendations of a working committee on digital lending, divided into those that have been accepted for immediate implementation and those that have been accepted “in principle but require further examination”.

“RBI has shown consumer centricity … we welcome the regulation,” Gaurav Chopra, founder and CEO of IndiaLends, an online lending platform provider, said in an email.

“Most new customers today borrow for the first time, and an increasing proportion comes through digital channels. That is where we believe a framework ensures that responsible players are rewarded for working in the consumer’s interest,” Chopra added.

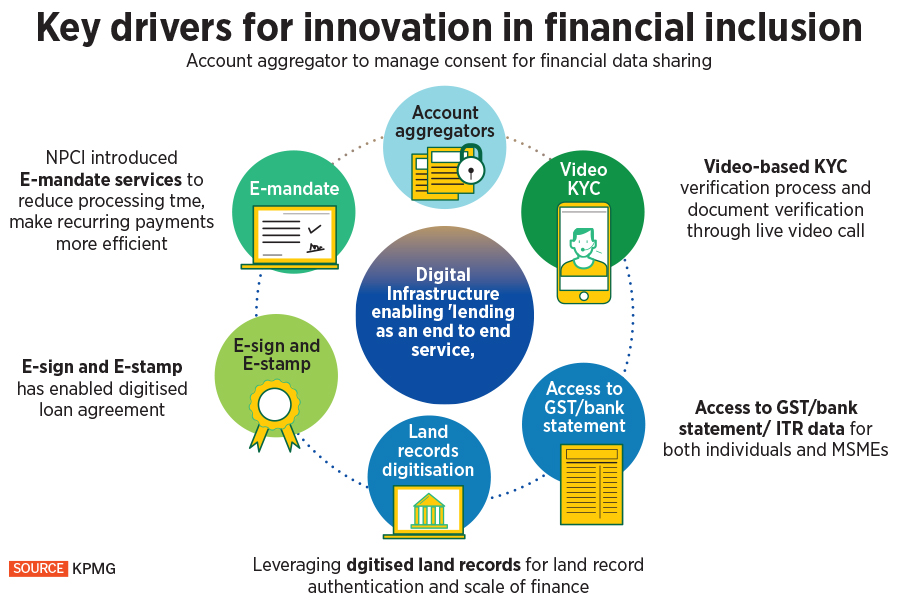

India’s fintech revolution is widely seen as a success on the order of a billion people. Starting with UPI or the Unified Payments Interface, India is adding financial infrastructure, including the account aggregator platform, and – in the broader e-commerce market – ONDC or the Open Network for Digital Commerce, which has been backed by the world’s biggest tech companies, including Amazon and Microsoft.

India’s fintech revolution is widely seen as a success on the order of a billion people. Starting with UPI or the Unified Payments Interface, India is adding financial infrastructure, including the account aggregator platform, and – in the broader e-commerce market – ONDC or the Open Network for Digital Commerce, which has been backed by the world’s biggest tech companies, including Amazon and Microsoft.

The subcontinent is also seen as one of the most promising markets for financial products such as BNPL or ‘buy now pay later’.

Entrepreneurs like Chopra say the RBI working committee’s recommendations are a step forward in addressing issues related to lack of transparency, data protection and privacy, as well as user consent.

The clarity on the rules will “only increase consumer trust and confidence in the credit system and will allow players like us to continue our business without changes to our business model,” says Chopra.

Highlights

Some of the highlights of the rules are as follows: All disbursements and repayments of loans shall be made only between the bank accounts of the borrower and the regulated entity (such as a bank or an NBFC) without any pass-through/pool account of the lending service provider (such as a fintech startup) or a third party.

- Any fees or charges payable to the lending service provider in the credit intermediation process must be paid directly by the regulated entity and not by the borrower.

- A standardized key facts statement (KFS) must be given to the borrower before the execution of the loan contract.

- An all-inclusive cost for digital loans in the form of annual percentage rate (APR) is necessary to be disclosed to borrowers. ÅOP must also be part of KFS.

- Automatic increase of the credit limit without the express consent of the borrower is prohibited.

- A cooling-off or look-up period during which borrowers can terminate digital loans by paying the principal and the prorated APR without any penalty must be provided as part of the loan contract.

- Regulated entities must ensure that they and the lending service providers engaged by them have a suitable case manager to deal with fintech or digital lending related complaints. Such a complaints officer must also process complaints about their respective digital lending apps.

- The details of the Complaints Officer must be clearly indicated on the website of the regulated entity, its lending service providers and on the apps, as applicable.

- If a complaint lodged by the borrower is not resolved by the regulated entity within the prescribed period (currently 30 days), consumers can file a complaint under the Reserve Bank-Integrated Ombudsman Scheme.

- The new rules also specifically deal with data that is collected via digital channels. Data collected by digital lending apps should be needs-based, should have clear audit trails and should only be done with the express prior consent of the borrower.

- Borrowers must have the ability to accept or refuse consent to the use of specific data, including the ability to revoke previously given consent, in addition to the ability to delete the data collected from borrowers by the lending apps and lending service providers.

Also Read: Fintech innovation has laid the foundation for branchless banking: BharatPes Suhail Sameer

Also Read: Fintech innovation has laid the foundation for branchless banking: BharatPes Suhail Sameer

Digital loan apps

Any loan obtained through a digital lending app – such as the many smartphone apps available today – must be reported to credit reporting companies by the regulated entities, regardless of the nature or duration of the loans.

All new digital lending products offered by regulated entities over trading platforms involving short-term credit or deferred payments must be reported to the credit bureaus by the regulated entities.

Smartphone apps from fintech startups and banks have brought innovation to the financial system, using data and technology to simplify the customer experience of borrowing, Saurabh Puri, chief business officer for credit cards at Zaggle, a fintech startup offering various financial services in particular to business customers, said in an email.

Lenders and borrowers benefit from easy customer acquisition, credit assessment, loan approval, disbursement, repayment and customer service. However, there are concerns that have surfaced that include privacy violations, unfair business practices, charging exorbitant interest rates and unethical recovery practices, says Puri.

Lenders and borrowers benefit from easy customer acquisition, credit assessment, loan approval, disbursement, repayment and customer service. However, there are concerns that have surfaced that include privacy violations, unfair business practices, charging exorbitant interest rates and unethical recovery practices, says Puri.

RBI’s rules will help mitigate these concerns, bringing in transparency and increasing customer confidence, he says.

“Overall, this will help the industry grow in an orderly manner, encouraging innovation,” he adds.

Check out our Monsoon discounts on subscriptions, up to 50% off website price, free digital access with print. Use coupon code: MON2022P for print and MON2022D for digital. Click here for details.