Fidelity plans NFT marketplace and financial services in Metaverse

Newly filed trademark applications outline a long list of possible paths for the company in the Metaverse.

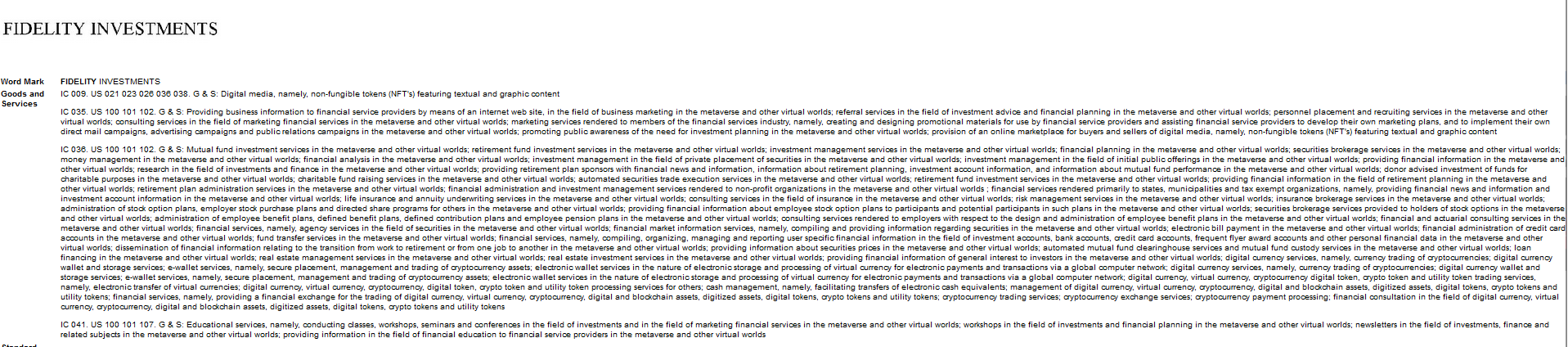

$4.2 trillion asset management firm Fidelity Investments has filed US trademark applications for a range of Web3 products and services, including a non-fungible token (NFT) marketplace and financial investment and crypto trading services in the metaverse.

This is according to three trademark filings filed with the United States Patent Trademark Office (USPTO) on December 21, which were also highlighted by licensed trademark attorney Mike Kondoudis in a tweet on December 27.

#Rendering have plans for the metaverse!

The company has submitted 3 trademark applications covering

▶️ NFTs + NFT Marketplaces

▶️ Metaverse investment services

▶️ Virtual property investment

▶️ Cryptocurrency trading

… and more!#NFTs #Metaverse #Crypto #Web3 #Challenge #Finance pic.twitter.com/op9fg80e7z— Mike Kondoudis (@KondoudisLaw) 26 December 2022

One of the firm’s key areas of focus appears to be the Metaverse, with Fidelity indicating that it can offer a wide range of investment services within virtual worlds, including mutual funds, pension funds, investment management and financial planning to name a few.

It also appears that metaverse-based payment services may be in the works, including electronic bill payments, money transfers, and “financial management of credit card accounts in the metaverse and other virtual worlds.”

As for crypto, the filings indicate that the firm may also launch Metaverse trading and management services, along with offering virtual currency wallets.

“Electronic wallet services in the form of electronic storage and processing of virtual currency for electronic payments and transactions via a global computer network; digital currency, virtual currency, cryptocurrency digital token,” the filing states.

Fidelity Investments Trademark Filing: USPTO

In addition, Fidelity outlines that it can provide educational services in the Metaverse in the form of “conducting classes, workshops, seminars and conferences in the field of investments and in the field of financial services marketing.”

“Providing business information to financial service providers by means of a website on the Internet, in the field of business marketing in the metaverse and other virtual worlds; referral services in the field of investment advice and financial planning in the metaverse and other virtual worlds,” a filing states.

NFTs are also on Fidelity’s plans, saying it may also launch an “online marketplace for buyers and sellers of digital media, namely non-fungible tokens”, but further details on such are sparse.

The latest filings from Fidelity show that the firm has not been deterred by the intense bear market in 2022 and recent FTX implosions, and is instead looking to increase its exposure and offerings in Web3.

The firm essentially outlined as such and called for stronger regulation when responding to a November 21 letter from crypto-hating senators Elizabeth Warren, Tina Smith and Richard Durbin, who had asked Fidelity to reconsider its Bitcoin

BTC ↓ $16,871 retirement products due to the “volatile, tumultuous and chaotic” nature of cryptoassets.

A Fidelity spokesperson told Cointelegraph at the time that the company has “always prioritized operational excellence and customer protection” and noted that “recent events” in the crypto industry have only “underscored the importance of standards and safeguards.”

It’s also worth noting that back in October, Fidelity was reportedly looking to bolster its crypto unit by hiring 100 new employees, which provides a stark contrast to a number of crypto firms that have laid off a significant amount of staff this year.