EU preparatory regulations on DeFi; Bitcoin mining difficulty reaches new ATH

The biggest news in the cryptosphere for October 10 includes Dominic Frisby’s cap on Bitcoin and gold investments, the European Commission’s tender that signals a regulatory framework for DeFi, and BitBoy Crypto’s accusations against the former SEC director for accepting bribes to declare Ethereum as a commodity.

CryptoSlate Top Stories

EU signals regulatory intent with study on ’embedded oversight’ of Ethereum DeFi

Details of the European Commission’s DeFi tender were revealed by Circle’s policy advisor Patrick Hansen.

The European Commission has launched a public tender for a study on “embedded supervision” by #DeFi on #Ethereum.

The goal is to study technology. opportunities for automated supervisory monitoring of real-time DeFi activity.

Est. tender value: 250k EUR.https://t.co/oZwb9QnLjG

— Patrick Hansen (@paddi_hansen) 10 October 2022

According to Hansen, the European Commission is working to strengthen the technical expertise on built-in monitoring mechanics of DeFi on the Ethereum network.

The Commission is making this call even though the MiCA framework released last month excludes decentralized services.

BitBoy Crypto claims former SEC director took bribes to mark ETH as a commodity

According to crypto influencer BitBoy Crypto, former Securities and Exchange Commission (SEC) Director William Hinman accepted bribes to declare Ethereum (ETH) a commodity.

BitBoy Crypto made the allegations against Hinman on October 9 through its Twitter account. Cardano ( ADA ) founder Charles Hoskinson and the Ripple community also said the allegations against Hinman are based on fact.

Interest in crypto is waning as investors pile into bonds

The Federal Reserve pushed interest rates up has negatively affected the crypto and stock markets. The Fed’s efforts to control inflation forced investors to turn to US Treasuries.

According to figures from September, the average daily trading volume registered a 17.2% increase compared to the year-on-year metric, and the total trading volume reached $25.1 trillion.

Additionally, the 10-year Treasury chart showed a 3.89% increase, while Bitcoin and Ethereum’s 10-year chart shows a 60% decline in value.

‘Horrible’ KYC risks appear as website listing Celsius users’ losses goes public

A new website was released on October 10, detailing the losses of users of bankrupt crypto lender Celsius (CEL). Angel investor Stephen Cole found the site and referred to it as “an absolutely terrible illustration of the risks of KYC.”

TrueFi issues notice of default to VC firm Blockwater on $3.4 million loan

Blockwater Technology borrowed about $16.8 million from crypto lending platform TrueFi (TRU) in 2021. It paid about $13.4 million and asked for an extension of the repayment period.

On October 10, TrueFi issued a notice of default to Blockwater Technology, asking it to repay the remaining $3.4 million.

The interest in XEN Crypto makes Ethereum deflationary

A new project on Ethereum called XEN Crypto appears to be responsible for over 40% of all Ethereum transactions and burns. Singlehandedly, XEN minting pushed the network transaction fee above $1.

So far, users have paid more than $1.8 million in gas fees to interact with the token contract.

Brazil Police, US Authorities Stop Transnational Crypto Fraud Ring Led by ‘Bitcoin Sheikh’

Brazilian Federal Police, US Homeland Security Investigations (HSI) and other enforcement agencies busted a crypto fraud ring called “Bitcoin Sheikh.”

The Brazil-based fraud ring was led by Francisco Valdevino de Silva, also known as the Bitcoin Sheikh. The group had committed crimes such as international money laundering, operating a criminal enterprise, fraud and crimes against the domestic financial system.

Exclusive to CryptoSlate

Dominic Frisby gives his views on investing in Bitcoin, gold

The author of “Bitcoin: The Future of Money?” Dominic Frisby gave an exclusive interview to CryptoSlate to talk about gold, Bitcoin and geopolitics.

Frisby said gold was his gateway to anti-fiat thinking. But as millennials become dominant in the world economy, that is no longer the case.

He said:

“As the world continues to shift towards technology and as millennials become a more dominant part of the world economy, we should expect Bitcoin to also take on an increasingly influential role in the financial markets, especially considering being a ‘recession-proof’ asset.”

He added that holding both Bitcoin (BTC) and gold would serve the best in protecting one’s financial integrity in these precarious geopolitical times.

Research highlight

Research: Bitcoin Mining Difficulty Adjusts Over 13%, Highest Since May 2021

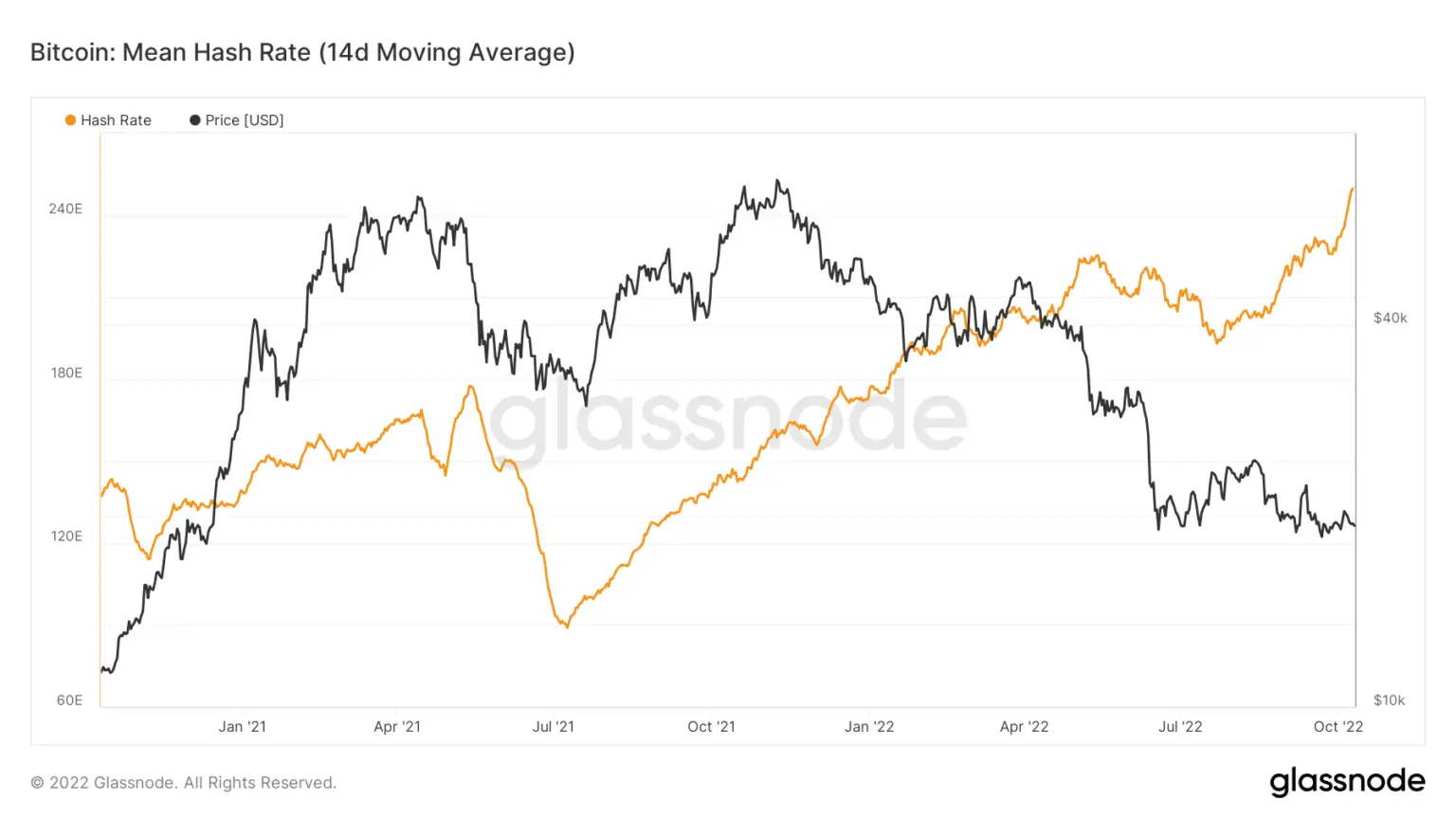

The Bitcoin network’s total hash rate hit an all-time high following a sharp increase in mining difficulty. The rate reached 240 EH per second and it is expected to increase further.

The current rate is roughly three times more than the network’s July low. At that point, the hash rate had dropped to around 89 EH/s, a two-year low.

News from the entire Cryptoverse

FTX V2 will be launched on November 21

Stock exchange giant FTX’s founder Sam Bankman-Fried tweeted about the upcoming improvements to the FTX exchange. SBF said the platform will get a new order matcher, lower latency API paths and other features, all of which will launch on November 21 as FTX V2.

TeraWulf increases operating capacity

Carbon-free Bitcoin mining company TeraWulf announced that it increased its mining capacity by more than 1.6 EH/s. The announcement also included news of $17 million in new capital. Approximately $9.5 million was in a non-brokered private equity placement, while the remaining $7.5 million was under incremental proceeds under the company’s term loan.

Crypto market

According to CryptoSlate data from the last 24 hours, Bitcoin (BTC) fell by 1.24% to trade at $19,235, while Ethereum (ETH) also fell by 0.87% to trade at $1,309.