Ethereum Is Flying From Exchanges As Bitcoin Moves In The Opposite Direction: Crypto Analytics Firm IntoTheBlock

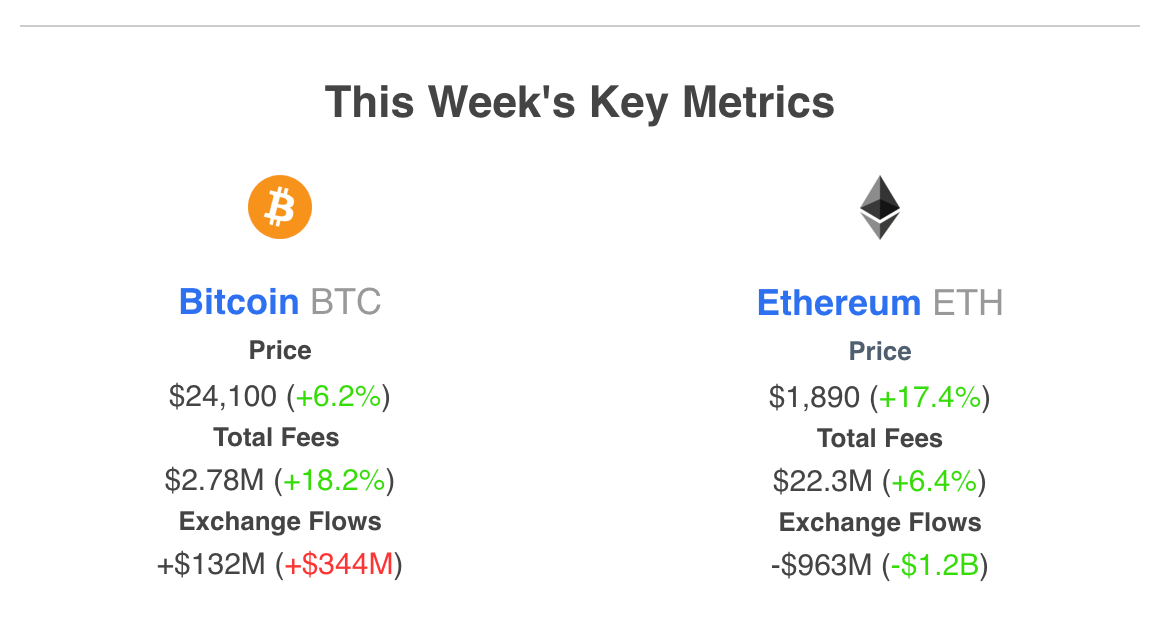

Ethereum (ETH) is leaving crypto exchanges at a rapid pace this week, while Bitcoin (BTC) is moving in the opposition direction, according to Lucas Outumuro, head of research at research firm IntoTheBlock.

In a new analysis, Outumuro notes that Ethereum recorded nearly $1 billion in net outflows in the past week, which he says suggests “strong buying activity” and points to potential accumulation.

According to IntoTheBlock, net flow is measured by getting the amount of inflows of any crypto-asset into centralized exchanges minus the outflows.

Conversely, Bitcoin’s weekly centralized exchange recorded net inflows of $132 million, potentially signaling selling pressure.

A 2021 study published by crypto analytics firm Santiment indicates that large increases in exchange inflows tend to lead to an average price drop of 5% for cryptoassets.

Despite the difference in exchange flow, both cryptoassets saw an increase in fees and on-chain activity, according to Outumuro.

Outumuro also notes that investors have held onto Bitcoin with high prices: 60% of the BTC supply has been held for more than a year, and a record 24.3% has been held for more than five years.

BTC is trading at $24,621 at the time of writing. The top-ranked crypto asset by market capitalization is up 2.75% in the past day and more than 5% in the past week.

ETH is trading at $1,966 at the time of writing. The second-ranked crypto asset by market capitalization is up nearly 5% in the past 24 hours and more than 14% in the past seven days.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/DM7/pikepicture