DraftKing Inc. (NASDAQ: DKNG ) Faces NFT-Related Lawsuit

DraftKing Inc. (NASDAQ: DKNG) is a digital sports entertainment and gaming company. They provide multi-channel sports betting and gaming technologies used by sports and gaming entertainment businesses in 17 states. Cathie Wood changed position in DraftKing, and the company is facing a lawsuit regarding NFT’s sale of the DK market.

Financial Analysis of DraftKing Inc.

Founded in 2011, with headquarters in Boston, Massachusetts, DraftKing operates through its brand in 5 states. Operate Golden Nugget Online Gaming and iGaming product and game brands in 3 states.

Ark Invest’s Cathie Wood holds the ninth most significant position in DraftKing, worth $550 million and 3.94% of their stock portfolio. She also owns 5.57% of the outstanding company shares. She first bought the position during the 1st quarter of 2021; since then, Wood has bought shares six times and sold them once. Cathie’s estimated purchase price is around $1.15 billion, at a loss of 52%.

DraftKing announced its plan to launch DK Marketplace, a platform offering curated NFT releases for USD purchases and support for secondary market transactions, on July 21, 2021. They sold the first NFT featuring football player Tom Brady on August 11, 2021, and sold from $12 to $15,000 per NFT.

The lawsuit by Pomerantz LLP examines claims on behalf of its investor. They allege that DraftKing and some of its officers engaged in unregistered securities fraud and certain illegal business activities. It also claims that the NFT sales constitute unregistered securities, and with the DK market they operate an unregistered securities exchange.

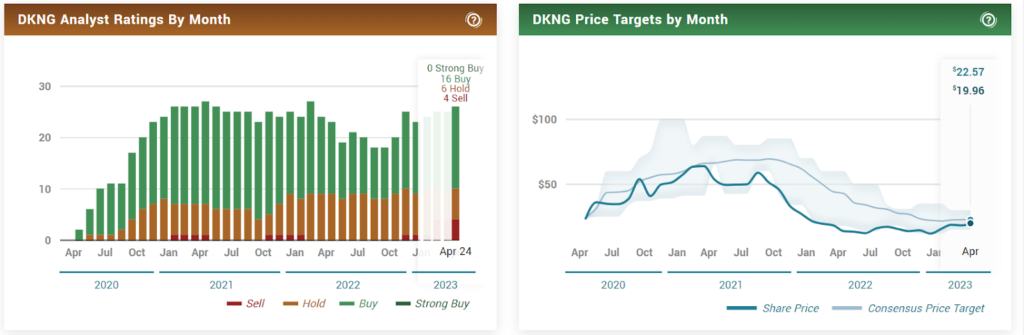

At press time, DraftKing (NASDAQ: DKNG ) was trading at $21.97 after gaining 2.76%, the previous close and open both being $21.38. With an average volume of 12.79 million shares, the market capitalization is strong at $10.144 billion. The fifty-two week change was a gain of 49.66%. The price target is $22.57, with an upside of 2.7%.

In terms of December 2022 data, revenue increased by 80.67% from $855.13 million, while EPS was $5.13, and the quarterly revenue growth increased by 80.70%. Operating cost increased by 6.37% from $599.15 million; net income jumped 25.62% from a negative $242.70 million. Net profit margin jumped 58.83% from negative $28.38.

Earnings per share (EPS) increased 37.32% from negative $0.50, and EBITDA increased 41.72% from negative 181.18M. The last income was reported on February 12, 2023, where the estimated income was $802.47 million, while it was reported at $855.133 million. This came with a surprise of 52.663 million and an increase of 6.56%. The sequel is scheduled for May 4, 2023, with expected earnings of $693.19 million.

DraftKing Inc. (NASDAQ: DKNG ) – Candle Exploration

The current position is DKNG’s third attempt at a breakout above the $21 mark towards the supply zone. It is said that the third time is the charm; it may break into the supply zone. An upward EMA and positive MACD reading support its northward momentum.

However, if the price falls, it could bounce off the $19.49 mark and consolidate below the supply zone. Moreover, the possibility of a withdrawal will depend on several factors.

Disclaimer:

The views and opinions expressed by the author, or any person mentioned in this article, are for informational purposes only and do not constitute financial, investment or other advice. Investing in or trading crypto assets comes with a risk of financial loss.