HIVE Blockchain Stock: Navigating ‘The Merge’

Liliya Filakhtova

One of the biggest narrative trades in crypto since the market stopped going down in mid-June has been the renewed optimism in a merger of Ethereum’s (ETH-USD) proof of work mainnet and proof of stake Beacon Chain; now scheduled for mid-September. But a slightly underestimated component of going from work certificate to proof of stake consensus are the miners who previously secured the PoW network no longer have the same incentive in a PoS model because the transaction validation mechanism is completely different.

For Ethereum miners, this is particularly problematic because ETH mining is still done with GPUs rather than with the ASIC machines required by most other PoW networks. Ethereum miners cannot simply switch to secure Bitcoin (BTC-USD) because their machines are unable to profitably mine it. Some of the ETH miners are now upset about the change to a PoS model, and there is a proposed fork of Ethereum that is reportedly picking up some steam. According to Decrypt:

Ever since a prominent Chinese Ethereum miner announced his intention to resist the upcoming Ethereum merger and create a new, parallel network and cryptocurrency, the idea has started to gain some traction.

This effort is led by ETH miner Chandler Guo and has the support of Tron (TRX-USD) founder Justin Sun. Sun also owns the Poloniex exchange and has said the exchange will support the hard fork called EthereumPoW (ETHW-USD). I’m going to say flat out that I don’t think ETHW is going anywhere. The Ethereum community largely does not support the hard fork, and Circle has already said they will not support USDC living on a forked PoW Ethereum chain. I have shared my thoughts on ETHW with BlockChain Reaction subscribers and you can join the service with a free two-week trial to access the deeper rationale.

However, for this article there are two questions HIVE Blockchain (NASDAQ:HIVE) investors should consider going forward:

- What is the revenue impact after ETH merger on HIVE?

- What are the viable options for HIVE’s GPU machines?

Impact on HIVE Blockchain

With ETHW looking more like a stunt than a viable option for displaced GPU miners, the logical question is what will be done with these machines. This is of significant importance to HIVE Blockchain, especially because a large part of the company’s mining revenue has historically come from mining Ethereum. In HIVE’s monthly production updates, the company refers to the ETH it mines as “BTC equivalent.”

| Mining production | BTC | BTC equivalent | ETH % of total |

|---|---|---|---|

| January | 264 | 161 | 37.9% |

| February | 244.4 | 132.6 | 35.2% |

| March | 278.6 | 168.8 | 37.7% |

| April | 268.8 | 189.5 | 41.3% |

| Can | 273.4 | 185.8 | 40.5% |

| June | 278.5 | 142.3 | 33.8% |

| July | 279.9 | 185.2 | 39.8% |

Source: HIVE Blockchain

Year-to-date monthly averages for HIVE are 38% of the company’s mining output coming from Ethereum. There is a large portion of HIVE’s mining revenue that is scheduled to disappear in mid-September, and without selling the GPUs, it appears that the best case scenario regarding alternative revenue is going to be source fragmentation.

HIVE’s Post-Merge Strategy

During the production update in July, HIVE elaborated on its strategy for GPU machines following a theoretically successful merger of Ethereum into proof of stake:

HIVE’s GPU fleet consists of two types of cards, our legacy fleet is mainly RX580s, and can be reused for other GPU mineable coins. The second type is our data center cards, namely our Nvidia fleet that we announced last year when we joined the Nvidia Partner Network; these cards have other applications in high-performance computing (HPC) applications. HIVE has developed a new platform for our data center scorecards to create new revenue streams. The company foresees the establishment of new revenue streams from GPUs, such as providing HPC services for rendering, AI, ML, molecular modelingetc.

Let’s take the GPU mining angle first. The unfortunate reality for HIVE is that most GPU-minable coins are not typically used in DeFi or other on-chain activities. There is thus not a large demand for the coins which will necessitate higher coin prices and, by extension, profitable mining. Many seem to believe that once the Ethereum merger is complete, the GPU miners will shift to another cryptocurrency that can be mined profitably with the same hardware. On the surface, the obvious choice seems to be Ethereum Classic (ETC-USD), and that coin has seen one of the strongest rallies in crypto due to that speculation; up 200% since mid-July.

HIVE Blockchain

To be clear, HIVE is already mining ETC at its facility in Iceland. But it is a small MW plant compared to the rest of the company’s operational footprint.

Is ETC Mining Scalable?

It is currently not possible to move all GPU capacity from Ethereum to Ethereum Classic while maintaining miner profitability. It would require an ETC price 50 times higher than current levels to equal the amount of miner income currently generated from mining Ethereum. Due to the coin price differences, the difference in block reward revenue from Ethereum to Ethereum Classic is extreme. Since the beginning of July, the daily average earnings of Ethereum miners is $21.3 million. For Ethereum Classic, it’s only $487k. And that ETC figure is benefiting from a large increase in the coin’s price in recent weeks.

Messari/BCR

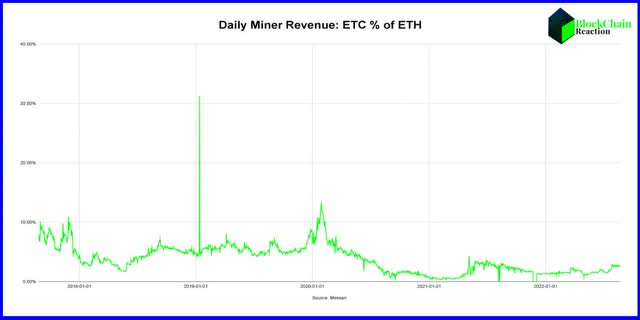

Looking at a much longer term, ETC miner earnings as a percentage of ETH miner earnings have been lower for some time and have averaged just 1.7% so far this year. Without a coalition of ETH miners and developers working together to migrate Ethereum activities from DeFi and NFT sales to Ethereum Classic (or ETHW), it is unlikely that we will see robust fundamental demand for Ethereum Classic for transactions and gas payment.

Messari/BCR

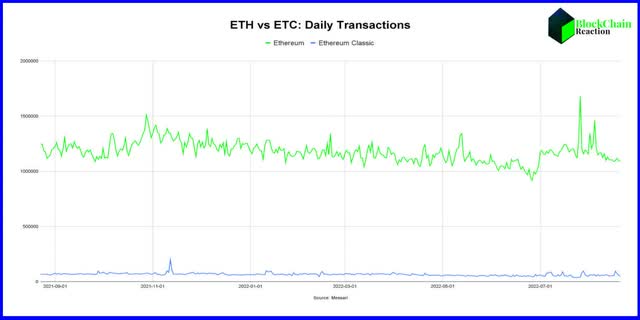

This chart shows the daily adjusted transactions of both Ethereum and Ethereum Classic according to Messari. While ETH is generally over a million daily transactions, ETC has only eclipsed 100,000 in a day twice in the past year. The bottom line is that there is not enough activity on Ethereum Classic to justify higher coin prices and without exponentially higher ETC prices, GPU miners will not find a revenue savior in Ethereum Classic after the ETH merge. The money just isn’t there.

Other possibilities?

Of course, HIVE has already noted in its own strategy briefing that pivoting to other GPU-minable tokens is not the only part of the plan. They will also look at using the machines for different computing activities altogether; including rendering and AI. A theoretical fit is Livepeer (LPT-USD) (OTCQB:GLIV). Last month I was able to chat with Livepeer co-founder Doug Petkanics for the BlockChain Reaction podcast. In our conversation, he mentioned how the GPU chips used for Ethereum mining can be used for other purposes such as transcoding video on the Livepeer network:

People who mine cryptocurrencies using GPUs, or graphics processing units, the kind of device used to mine Ethereum, for example, can continue to use the portion of those devices used to hash cryptocurrencies. But those GPUs happen to have video encoding chips on them that can’t hash cryptocurrencies; they just sit there and do absolutely nothing. And what Livepeer allows them to do is say, ‘oh, when video encoding needs to be done, we can make extra money for it without interfering with our cryptocurrency mining.’ And it is very powerful. It’s almost a hassle-free value proposition for these miners.

Video transcoding and rendering are certainly very interesting potential applications, but like ETC, there isn’t much of a revenue footprint awaiting displaced ETH miners. According to Livepeer’s website, the network has paid out just over $203k in fees. It’s not going to be done for companies like HIVE that historically generate several million dollars on a monthly basis.

Summary

Ethereum miners are in an incredibly tough position, and the HIVE Blockchain is no different. The best case scenario for HIVE in September would be if the merger is again delayed. But with the success of the testnet merger, it seems increasingly likely that this time it’s for real, and the merger will happen when the developers say it will. While I think HIVE Blockchain management is on the right track with the thinking of how to monetize the company’s GPUs post-merger, the reality, at least in the crypto market, is that it doesn’t appear to be a viable option. I believe that if the company can find non-crypto businesses willing to pay for computing services, HIVE can recoup at least some of the revenue it is losing from Ethereum’s transition to full proof-of-stake consensus. But it will probably be a very bumpy ride, and shareholders must be prepared for that. I do not personally hold HIVE shares. But if I did, I would try to reduce the exposure a bit.