Cryptoanalyst Michaël van de Poppe Outlines What’s Next for Cosmos, Aave, Elrond and Two Ethereum Rivals

A popular analyst digs into the charts to update his price targets for a handful of leading cryptoassets.

Michaël van de Poppe first says his 622,600 Twitter followers that he is keeping an eye on support levels for scalability and interoperability ecosystem Cosmos (ATOM), which recently gave up gains from the latter part of an extended rally dating back to mid-June.

“With massive levels of support here, which is reasonable for long enrolments.

If this one is lost, I’m looking at $8 next.

Holding here = potential trigger towards $18-20 in the coming month.”

At the time of writing, Cosmos is down 8.59% in the last 24 hours and priced at $10.83.

Moving on to crypto lending and lending protocol Aave (AAVE), the crypto strategist says that in light of the recent market-wide correction, he sees the altcoin as a range trade candidate with support at $80 and resistance at $103.

“This is trending down as the entire market corrects.

Fake-out above resistance and drop below $103 caused an acceleration of the correction.

Looking at $80-82 for support. Looking at $103 for decisive resistance. Distance-bound plays.”

Aave has been down in the red all week, currently down almost 15% on the day and trading at $84.31.

Also on Van de Poppe’s watchlist is enterprise-class blockchain platform Elrond (EGLD), which has been steadily declining since August 10. The analyst is surroundings two levels of support: one at $50 and then $44 if the first capitulates.

“An important level of support and confluence on multiple timeframes.

Gap is filled, which was practically the last. Arguments for a bottom around the markets may be there.

Resistance at $57. Pause there = new heights. Support: $50 and $44.”

Elrond is down 8.79% and is changing hands at $52.37. The altcoin was trading above $69 just a week ago.

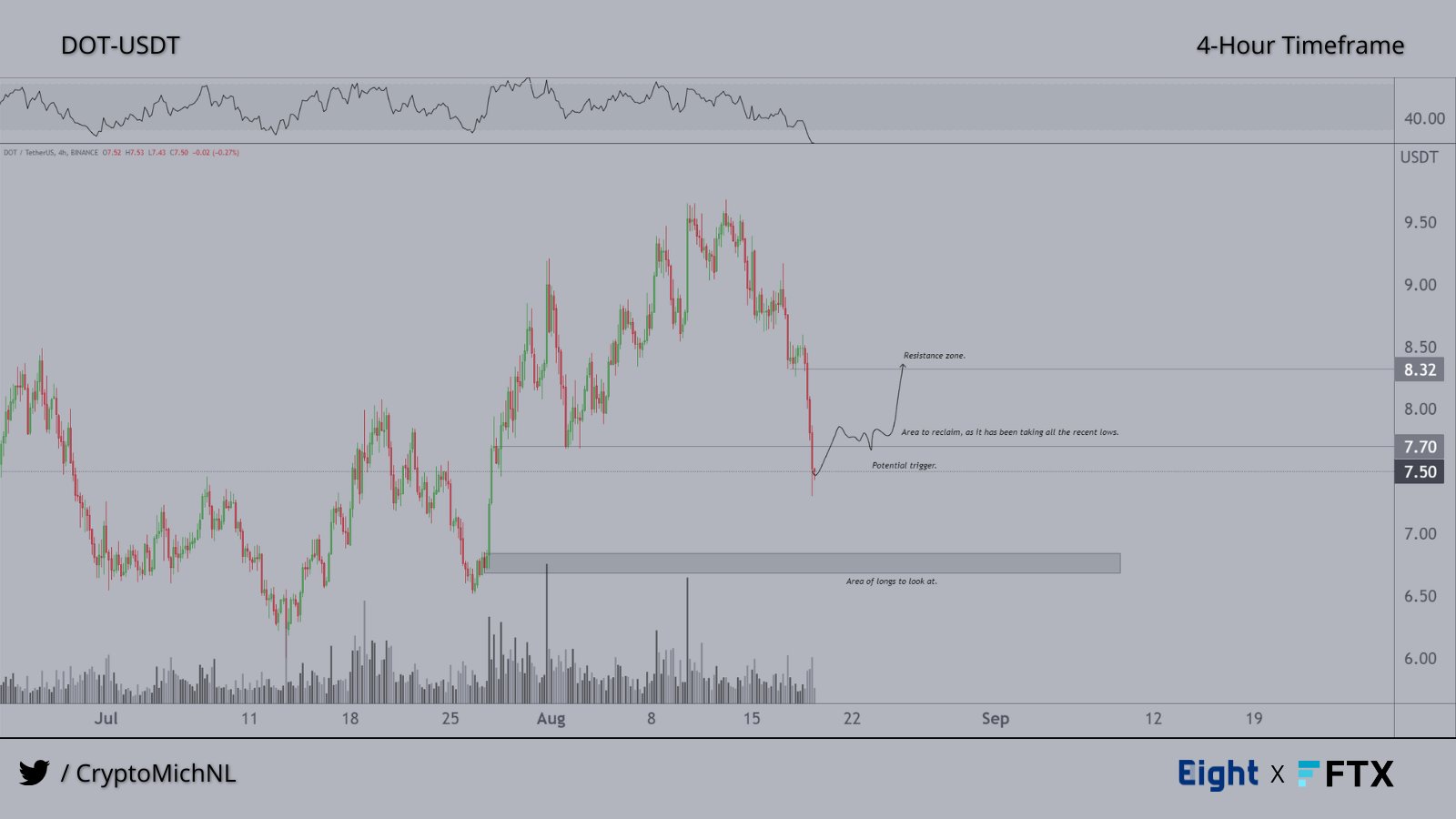

On cross-chain interoperability, Polkadot (DOT), the cryptoanalyst believes a rally to $8.40 is possible if $7.70 is recovered. However, Van de Poppe warnings on the potential for DOT to lose support at $7.

“We are looking for a trigger on this one if we retake $7.70 as a retest of $8.40 is likely.

Otherwise, the patience game happens and you have to see if sub-$7 is a trigger for too long.”

Polkadot’s price reflects the general decline in the crypto market towards the end of the week, with DOT currently in the red by almost 12.5% and valued at $7.35.

Last on Van de Poppe’s radar is EOS (EOS), an open source and decentralized platform whose smart contract capabilities make it a direct competitor to Ethereum (ETH).

In response to altcoins’ midweek rally at odds with broader market trends that was soon followed by a sharp corrective move, prevails his followers to not run for coins that are already pumping.

“Looking at the structure, you should learn a lesson from this recent move by EOS. Avoid chasing pumps!

In this case, I would look at the confirmation if we fall to $1.18 and retrace $1.30 afterwards for a long period. The same goes for regaining the $1.40 range.”

On Tuesday, EOS rose 27.9% from $1.29 to $1.65, but has since worked its way back down. At the time of writing, EOS is down 16.24% and is changing hands at $1.27.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: StableDiffusion