Crypto Venture Capital Grows 400% in Africa Despite Bear Market

Crypto venture capital investment grew by over 400% in Africa in 2022 to around $470 million, outpacing global VC investment’s 4% growth which saw the industry bring in around $27 billion.

According to a new report by CV VC and South Africa’s Standard Bank, African crypto firms raised around $474 million in 2022, outpacing investment in other sectors by nearly 400% and beating global crypto investment growth of 4%.

Africa’s Share of Global Crypto VC Investment Jumps to 1.8%

Seychelles and South Africa secured 81% of African funding, securing $208 million and $176 million. Crypto exchanges and custodian platforms snapped up 52% of the money.

At the same time, fintech and blockchain infrastructure and development were the second and third most funded categories, accounting for 24% and 15% of funds raised respectively. International exchange KuCoin reached unicorn status, raising $180 million in Seychelles.

In addition, the number of blockchain deals increased by 12%, including firms involved in personal identification and financial independence.

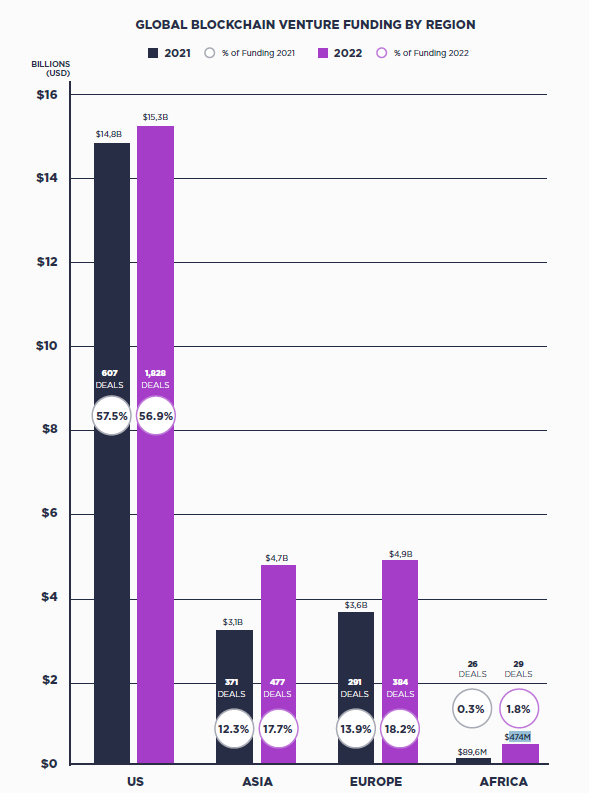

Africa’s share of $26.8 billion in global blockchain finance rose from 0.3% in 2021 to 1.8% in 2022.

However, despite the growth, the majority of crypto VC funding remains concentrated in the US (57%), Asia (17.7%) and Europe (18.2%). The US committed 10% of its year-over-year share of sector-agnostic VC funding to Asia by 2022.

Devalued currencies and regulatory ambiguity ahead

Despite the growth of crypto venture capital in Africa, a Bloomberg report earlier this year revealed that stalled growth and currency devaluation in Africa’s most developed economies may have limited funding for African startups. Such economies include Kenya, South Africa, Egypt and Nigeria.

Lazerpay, a B2B crypto payment company, recently announced it would close up shop after failing to close a successful round of financing. Last year, the firm also failed to raise money in a seed round after a key investor withdrew.

A patchwork of regulations and implicit and absolute prohibitions have complicated crypto adoption in African nations.

While cryptocurrencies are not illegal in Nigeria, banks are prohibited from engaging in cryptocurrency transactions. Nigeria’s securities watchdog, the Nigerian Securities and Exchange Control, will formalize new crypto rules in an upcoming finance law.

The Bank of Ghana, while categorizing cryptocurrencies as digital assets rather than currencies, is still working on a new framework. The bank has not yet indicated when the framework will be ready.

African-focused P2P crypto marketplace Paxful recently suspended withdrawals while key personnel depart. The platform was popular in Nigeria and Ghana.

Recently, the South African Reserve Bank issued guidance that implicitly legalizes cryptocurrencies. Kenya recognizes crypto-assets as securities, while Seychelles only requires compliance with anti-money laundering and anti-terrorist financing rules.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.