Would We Use Bitcoin In An Apocalypse?

If a nuclear war or a deadly pandemic suddenly rocked the globe, would we all suddenly flock to Bitcoin? To put the matter simply, it is difficult to say. But decentralized non-fiat currencies are customizable in ways that others are not.

Imagine that. An event of seismic proportions suddenly shakes the globe. It could be a new financial crisis that makes the crash of 2008 look like a short market correction. It could be a catastrophic invasion of a country that breaks the global economy. (An invasion of Taiwan by China, for example.) Or it could be a pandemic many times deadlier than COVID-19. Or even a nuclear war. Whatever causes it, let’s imagine a world that is deeply destabilized. Perhaps unrecognizable.

Can we use Bitcoin in an apocalypse?

Can we use the world’s most famous cryptocurrency in the event of an apocalypse? Well, that depends on your definition of an apocalypse. But the short answer is probably yes.

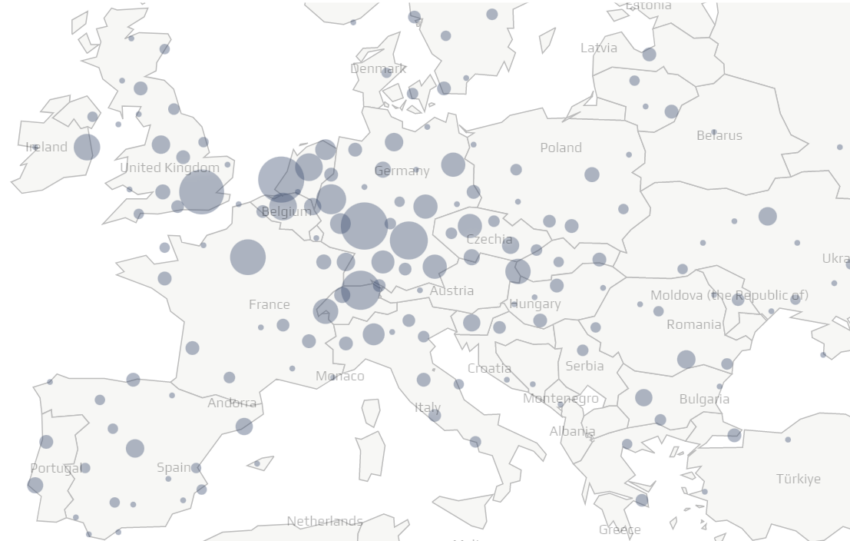

The Bitcoin network consists of a number of nodes. (You can actually see a list of the world’s reachable nodes here. Although this is only a conservative estimate of the actual number.) The job of each node is to verify each transaction and block. Since Bitcoin is built on an immutable blockchain, it requires that each transaction or block conform to the rules of the Bitcoin protocol.

If a transaction or block does not follow the rules, the node will reject it, preventing it from being added to the blockchain.

The good news is that the Bitcoin network needs relatively few nodes to function efficiently. Essentially, any apocalyptic scenario would have to wipe out virtually every node to render the network unusable. In the unthinkable event of a nuclear war, where large parts of the planet become uninhabitable, it is highly likely that many Bitcoin nodes will go permanently offline. (Especially when you consider that very few of us keep our computers in a nuclear-proof bunker.)

An event like this can make it more difficult to validate transactions and blocks. Fewer nodes will also make the network less decentralized and more susceptible to manipulation. But fundamentally, the network would survive, and new nodes would inevitably follow.

What about the Internet?

Bitcoin is a digital currency that was born on the internet. It would not have been invented without it. But would survive without it?

In short, yes.

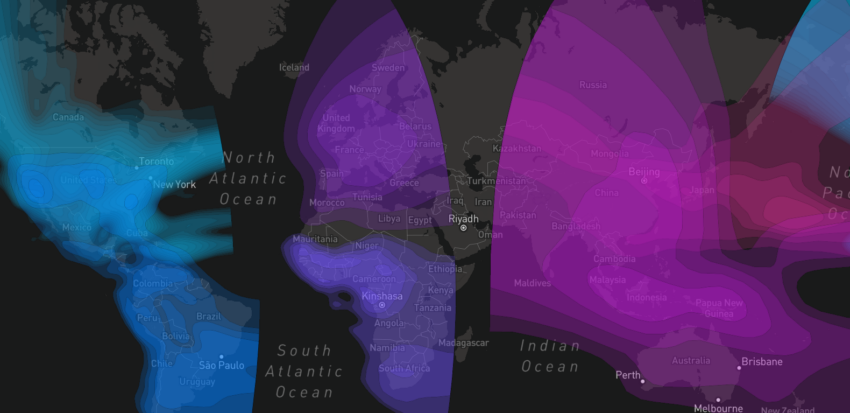

As of 2018, there is a solution should the internet suddenly become unavailable. Blockstream operates a network of communications satellites that broadcast the Bitcoin blockchain globally. It allows people without internet access to receive validated transactions and blocks. The network is completely free to use, although you do need a computer and an antenna to access it.

There are also some other disadvantages. At the time of writing, it does not provide universal coverage. There are some notable dark spots, including large parts of Siberia, Iran, the Arabian Peninsula, the Caucasus, much of western Russia, parts of Central Asia, and the island of Madagascar.

You can also send your Bitcoin over a mobile network. Last year, South African developer Kgothatso Ngako launched a new SMS-based service called Machankura that allows users to access Bitcoin using their feature phones without internet access.

The service uses the GSM network to allow users to send and receive Bitcoin by dialing a number and entering a five-digit pin, effectively creating a Lightning address. However, Machankura is a custodial service, which goes against the Bitcoin ethos of “not your keys, not your coins.”

Would we use Bitcoin?

So we have established quite concretely that Bitcoin can survive an apocalypse. But wanted do we use Bitcoin? That is a much more difficult question to answer.

The first barrier to Bitcoin becoming a de facto world currency in the event of a disaster is the current state of Bitcoin adoption. Glassnode puts the number of active Bitcoin addresses (i.e. those that have recently sent or received funds in BTC) at about 1 million as of March 17, 2023. That’s about 0.0125% of the world’s population and far too low a number for a fair analysis .

TripleA estimates that crypto ownership is at about 4.2%, which is a much better number. (I assume all crypto owners are familiar with Bitcoin.) That still leaves 95.8% of the world’s population who do not own any cryptocurrency. Even if we assume that 20% of the global population has used crypto at some point in the past, that still leaves 80% who are essentially unaware of this technology.

That lack of awareness will affect how many people use crypto as a store of value or to trade. It will also severely limit the number of suppliers who accept it as payment. In Vietnam, where almost 20% of the population owns crypto, this may be an obstacle that can be overcome. In the UK, a country where 6% own crypto and which has its own recognized, widely used fiat currency, the prospect is less compelling.

The pros

Of course, this analysis assumes that a disaster will not completely eradicate people’s trust in fiat currency. (A big assumption, but not entirely unbelievable.)

However, there are reasons why Bitcoin may win out in the end. Bitcoin is considered highly secure due to its hashing algorithm, SHA-256. The algorithm creates a huge number of possible hashes, with the odds of tampering or duplicate hashes being less than one in 115 quattuorvigintillion. More than the number of atoms in the known universe, making Bitcoin virtually unhackable.

It also operates on a decentralized network, not controlled by any central authority or government. If traditional institutions are no longer trusted, this will be a huge boon for the currency. It is also censorship-proof and will remain open and accessible, even in the event of a global dictatorship.

Unlike currencies issued by a central bank, Bitcoin has a limited supply of 21 million coins, meaning it cannot be inflated or devalued. In a post-apocalyptic world where traditional fiat currencies may become worthless due to hyperinflation, Bitcoin may start to look like a much safer bet.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.