Cred Continues Fintech Consolidation; Dailyhunt parent lays off 150 employees

.jpg)

Also in this letter:

■ Parent company Dailyhunt and Josh will lay off 150 workers

■ RBI launches first retail digital rupee pilot on Thursday

■ Musk goes to war with Apple over ad withdrawal, 30% commission

Cred acquires CreditVidya as fintech consolidation continues

Fintech startup Cred said on Tuesday it has agreed to buy credit underwriting software provider CreditVidya in a mix of equity and cash. The acquisition is subject to necessary approvals from the National Company Law Tribunal (NCLT).

Following the acquisition, CreditVidya will continue to operate independently and its more than 200 employees will have access to Cred’s employee share ownership plan (Esop).

Founded in 2012, CreditVidya offers a loan underwriting platform that helps banks and non-banking financial companies (NBFCs) assess credit better.

Consolidation time: The acquisition comes at a time when the Indian lending sector is heading towards consolidation, as the Reserve Bank of India’s (RBI’s) first set of digital lending rules – released in September – emphasizes the role of regulated entities such as non-banks and curbs lending. distribution platforms to direct sales agents only.

We reported on November 25 that digital payments major PhonePe was set to acquire buy-now-pay-later platform ZestMoney, marking a major consolidation move in the digital lending sector.

Between the lines: While CreditVidya focuses on including first-time borrowers in the credit economy, Cred has largely focused on people with credit cards and high credit scores.

Cred has upped its credit game in the last two years. In September, it said it would pay $10 million to buy a minority stake in peer-to-peer (P2P) non-bank finance company LiquiLoans. It is also an investor in the debt market CredAvenue and operates an active credit line for its customers with Cred Cash.

Parent company Dailyhunt and Josh will lay off 150 workers

VerSe Innovation, the parent company of news aggregator Dailyhunt and short video platform Josh, has laid off about 150 employees — about 5% of its 3,000 workforce.

Pay cuts too: The company has also implemented an 11% pay cut for employees earning more than Rs 10 lakh a year.

By April, the company had raised $805 million from investors including CPP Investments, Ontario Teachers’ Pension Board, Luxor Capital, Sumeru Ventures and Sofina Group in a round that valued it at $5 billion.

VerSe co-founder Umang Bedi told us, “Considering the long-term viability of the business and our employees, we have taken steps to implement our regular bi-annual performance management cycle and made performance and business considerations to streamline our costs and our teams.”

Recipient of TikTok ban: VerSe Innovation launched Josh in 2020, after the Indian government banned the Chinese short video platform TikTok. Earlier this year, TikTok’s parent Bytedance, which was an investor in VerSe, sold its stake to other investors.

Leave year: VerSe Innovation joins a long list of tech startups and Big Tech companies that have laid off workers and implemented other cost-cutting measures amid a decline in funding this year.

Dozens of Indian startups have laid off over 15,000 employees combined this year, including Byju’s, Vedantu, Unacademy, Ola, Meesho, Chargebee, Cars24 and Udaan. Funding for Indian startups fell to $2.7 billion in the September quarter from nearly $12 billion in the same period last year, according to data from Venture Intelligence.

And as of late November, more than 85,000 tech workers in the U.S. have been laid off this year, according to a Crunchbase News report.

Read also | Unacademy’s Gaurav Munjal says rival Classplus ‘definitely overrated’

RBI launches first retail digital rupee pilot on Thursday

The Reserve Bank of India said on Tuesday that it will launch a pilot of the retail version of its central bank digital currency (CBDC), the digital rupee, on December 1. It said the pilot will cover selected locations in a closed user group comprising participating customers and merchants.

Details: Users will be able to transact retail CBDC through a digital mobile wallet offered by participating banks.

The RBI has selected eight banks to participate in the pilot. The first phase will begin with State Bank of India, ICICI Bank, Yes Bank and IDFC First Bank. Bank of Baroda, Union Bank of India, HDFC Bank and Kotak Mahindra Bank will join later.

The pilot will first be rolled out in Mumbai, New Delhi, Bengaluru and Bhubaneswar before expanding to Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna and Shimla.

The crypto tour continues: Meanwhile, troubled crypto firm BlockFi has filed for bankruptcy in the US, as the dramatic collapse of FTX continues to reverberate through the industry.

Bitfront, a US crypto exchange backed by Japan’s Line Corp, said it would cease operations in a few months, adding that the decision was not related to “recent issues related to certain exchanges that have been accused of misconduct”.

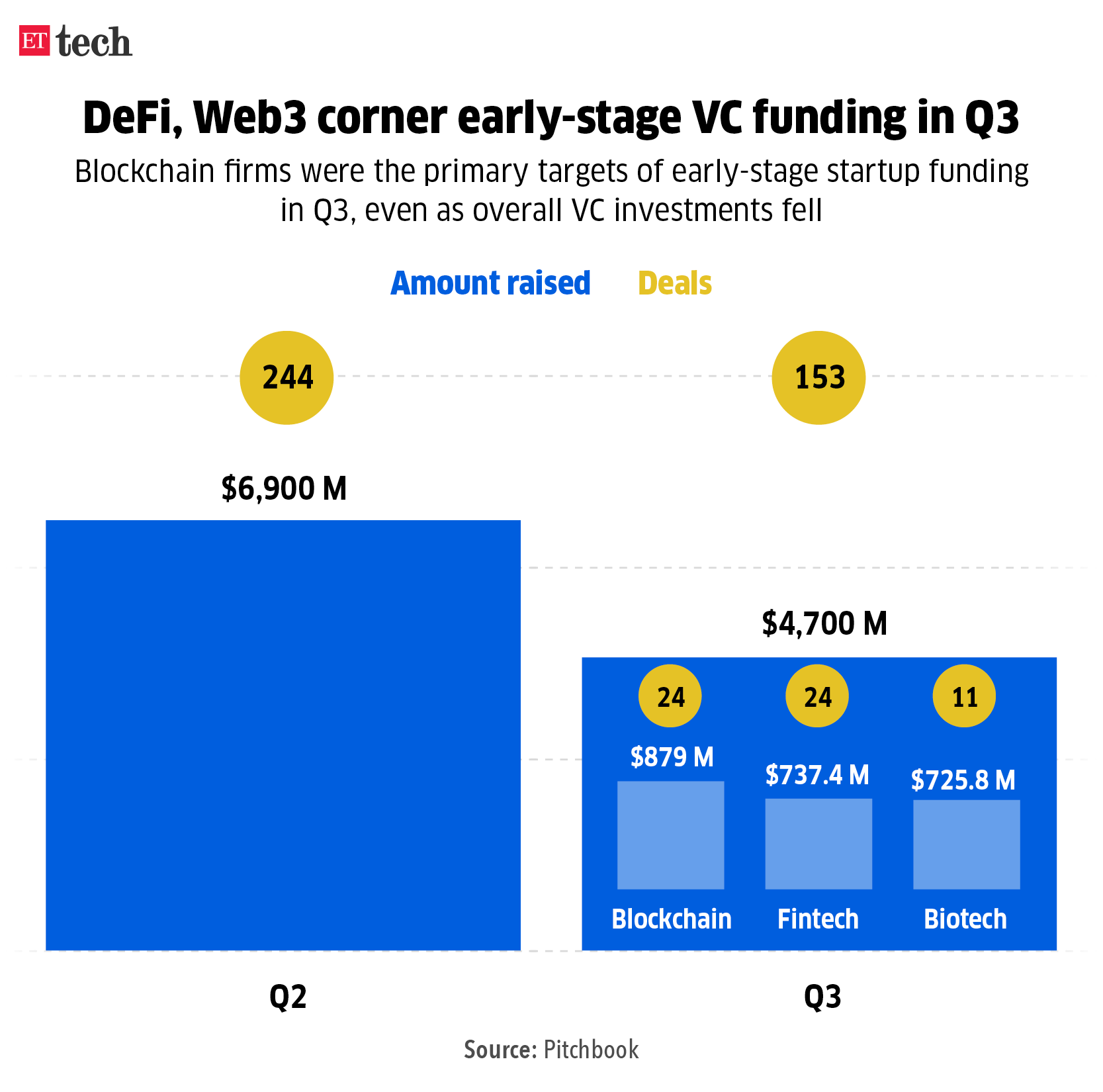

Infographic Insights: Decentralized finance (DeFi) and Web3 were the primary targets for early stage funding from some of the top private investors in the third quarter (July-Sept), research firm Pitchbook said on Tuesday, even as overall venture capital investment fell.

But the outlook for funding in the current quarter has darkened due to the collapse of FTX earlier this month.

Elon Musk declares war on Apple over ad withdrawal, 30% commission

To say that Elon Musk thrives on chaos is a huge understatement. After firing many of Twitter’s top executives, laying off more than half of the company’s employees and telling the rest to commit to a new “hardcore” Twitter or quit, the world’s richest man has decided to take on the world’s richest company.

Apple tweet storm: In the past 24 hours, Musk has accused Apple of threatening to block Twitter from its app store without saying why, saying it has all but stopped advertising on the social media platform. He said Apple pressured Twitter with demands for content moderation and asked if they “hate free speech.”

Also on Musk’s list of complaints was the up to 30% fee Apple charges developers for in-app purchases.

Twitter under Musk is working on a revamped version of its premium service Twitter Blue, which will cost users $8 a month but give the company 30% less, thanks to Apple’s commission.

Apple avoids Twitter: The world’s most valuable company spent an estimated $131,600 on Twitter ads between Nov. 10 and 16, down from $220,800 between Oct. 16 and 22, the week before Musk ended the Twitter deal, according to ad tracking firm Pathmatics.

In the first quarter of 2022, Apple was the top advertiser on Twitter, spending $48 million and accounting for more than 4% of total revenue for the period, the Washington Post reported, citing an internal Twitter document.

Urban Company awards stock options worth Rs 5.2 crore to 500 partners

Urban Company said it has allotted company shares worth Rs 5.2 crore to around 500 of its “service partners” across India under its Partner Stock Option Plan (Psop). Announcing the plan in March, the company said it aimed to award shares worth Rs 150 crore to thousands of service partners over the next five to seven years.

Details: It said 30% of Psop recipients were female partners from the beauty and wellness space. Bangalore had the most partner shareholders at 26%, followed by Delhi-NCR (22%), Mumbai and Pune (16% combined) and Hyderabad (15%).

Protests: Urban Company’s decision to set aside stock options for gig workers came a few months after hundreds of female beauticians protested against the company in October 2021, demanding better pay. The company told us it would not shy away from “doing the right thing for its stakeholders”.

Fipkart’s record purchase: On Tuesday morning, we reported, citing sources, that Flipkart will soon buy back stock options worth $700 million from current and former employees as part of PhonePe’s new funding round. This is likely to be the largest Esop buyback till date in the Indian startup ecosystem.

Today’s ETtech Top 5 newsletter was curated by Zaheer Merchant in Mumbai and Siddharth Sharma in Bengaluru. Graphics and illustrations by Rahul Awasthi.