Canton Offers ‘Killer App’ for Blockchain Interoperability

[gpt3]rewrite

The Canton Network has been launched to provide the privacy requirements of private blockchains and the interoperability of public blockchains to financial institutions.

The network provides a decentralized infrastructure that connects independent applications built with Daml, Digital Asset’s smart contract language. Participants on the network include ASX, BNP Paribas, Cboe Global Markets, Deutsche Börse Group, EquiLend and Goldman Sachs.

Eric Saraniecki, Digital Asset

Eric Saraniecki, head of strategic initiatives and co-founder of Digital Asset, told Markets Media: “The real killer app of blockchain is interoperability. We wanted to show the world that it is possible to create that interoperability without having to be on a completely transparent public blockchain.”

Regulated financial institutions need the control, security, safety and soundness to run their own applications with their own permissions in their own environment. However, interoperability is only available on public blockchains that require full transparency.

Saraniecki said: “It’s very important to be able to provide a third way apart from the public or private blockchain boxes. That’s the north star we’re trying to give everyone.”

He explained that the Canton protocol was designed from the ground up to meet privacy requirements while being interoperable. In contrast, other blockchains inherited many design decisions from Bitcoin.

The Canton network is gaining meaningful early traction according to Saraniecki.

“In the Canton area, we process well over $1 trillion every month,” he said. “We expect it to be $1 trillion a day by the end of this year.”

While these are large volumes, Saraniecki said they are not large in terms of financial volumes, so there is still a lot of opportunity.

“I also strongly believe that we will see experiments this year around cash and digital securities,” he added.

For example, institutional investors want to be able to use digital assets for repos or securities lending and Saraniecki said there are some interesting use cases being explored around using digital assets as collateral. Or a digital bond and a digital payment can be assembled across two separate applications into a single atomic transaction on the Canton Network, guaranteeing simultaneous exchange without operational risk.

will change L1s going forward. We no longer advertise a chain and hope they come. They are already here.

— Yuval Rooz (@YuvalRooz) 9 May 2023

Saraniecki believes Canton can accelerate the use of tokenization by institutions by, for example, allowing tokens on a platform to become qualified security and connect to a lending platform.

Blockchain solutions such as Deutsche Börse Group’s D7 post-trade platform and Goldman Sachs’ GS DAP™ can be connected, while maintaining privacy and permissions. As more Daml-built applications go into production this year and beyond, the number of connections on the Canton Network is expected to grow exponentially.

Saraniecki said his primary focus over the next year will be making the first connections to be able to very clearly articulate the benefits of a handful of case studies.

Canton Network participants will begin testing interoperability capabilities across a variety of applications and use cases in July.

Institutional Crypto Survey

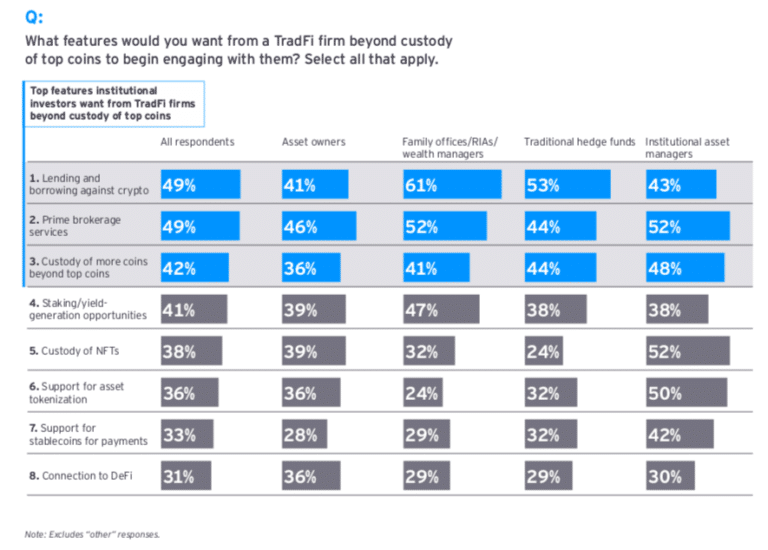

Institutions expressed greater confidence in traditional financial institutions in the digital asset sector in EY’s latest institutional crypto survey in April 2023

“44% of respondents suggest they would prefer to engage with a TradFi firm over a crypto-native firm for custody, while only 10% would prefer to engage with a digital native over a TradFi,” the survey said.

EY said TradFi firms will need to expand their capabilities beyond storing coins to meet demand for services such as lending and borrowing against crypto and provide premium brokerage services.

Source: EY

Institutions also see tokenization as very promising and are looking to move faster towards investing in tokenized assets as well as tokenizing their own assets over the next two years. The survey said that hedge funds in particular are the most positive about their timeline to start investing.

EY-Parthenon conducted a survey of more than 256 institutions about their feelings, usage and plans regarding blockchain and digital assets.

Almost all, 89%, of institutions rank regulatory uncertainty and 87% rank lack of trusted actors as primary concerns when considering a significant investment.

[gpt3]

![Cyber Security in Fintech Market Report [of Pages 127] | Growth, Trends, Size, Share, Competitive Landscape, SWOT Analysis, Forecast Analysis to 2022-2029 Cyber Security in Fintech Market Report [of Pages 127] | Growth, Trends, Size, Share, Competitive Landscape, SWOT Analysis, Forecast Analysis to 2022-2029](https://www.cryptoproductivity.org/wp-content/uploads/2022/08/Social-Media-Graph-01-1-500.png)