Bitcoin Tanks as the US Job Market Remains Hot

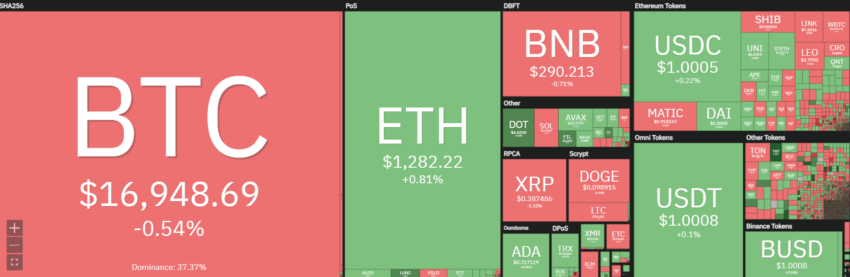

Bitcoin fell 2% to around $16,800 after the November 2022 US jobs report revealed a strong labor market, despite the Federal Reserve’s six consecutive rate hikes in 2022.

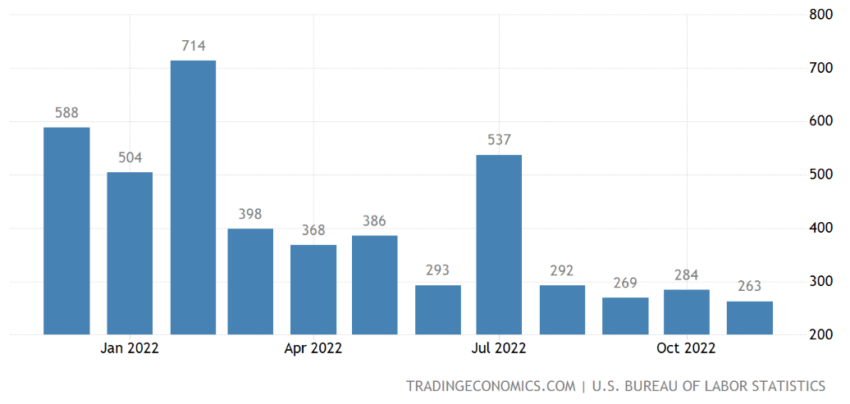

Nonfarm payrolls rose 263,000, beating the Dow Jones estimate of 200,000, while the unemployment rate matched expectations of 3.7%.

Jobs Report Signals Fed Hikes Likely to Persist

The gain in non-farm payrolls came in slightly below the revised October 2022 increase of 284,000, while average hourly earnings rose 0.6%, compared with estimates of 0.3%.

The US Bureau of Labor Statistics releases the payroll and average hourly earnings at 8:30 a.m. ET on the first Friday of each month as part of the employment situation report.

While rising employment rates and wages generally point to a healthy economy, wages growing too fast, especially in the presence of record inflation, encourage the Fed to keep raising interest rates to ensure the economy doesn’t become red-hot.

“Having 263,000 jobs added even after key rates are raised by some [375] basis points are no joke,” noted Seema Shah of Principal Asset Management. “The labor market is hot, hot, hot, big pressure on the Fed to keep raising interest rates.”

Raising policy or interest rates cools economic expansion, but if done too aggressively, it can significantly reduce employment and send the economy into a recession. Recession fears generally create selling pressure on risky assets like cryptos and stocks, driving prices into bear territory.

Cryptos shed gains accrued earlier this week around a lower-than-expected 0.2% Personal Consumer Price Index for November 2022.

At press time, XRP was down approx. 2.5%, while DOGE fell 3.78%. Solana also declined by 1.1%. Stock markets also fell, with the Dow Jones Industrial Average down 0.9%, the S&P 500 1.2%, and tech-heavy Nasdaq down 1.5%.

Elsewhere, gold is outshining Bitcoin as an inflation hedge and is trading back to its start-of-the-year price of $1,800 an ounce. In comparison, Bitcoin has fallen 63% in the same period.

Jobs report and inflation will continue to affect crypto prices

The higher-than-expected payroll number in November 2022 is the lowest job gain since April 2021, following a revised increase of 284,000 new jobs in October 2022.

The most significant adjusted increases in nonfarm payrolls were noted in the February 2022 and July 2022 jobs report. The February 2022 report revealed that nonfarm payrolls increased by 714,000 in January 2022, prompting the Fed to step in with a 25 basis points in March.

The following four reports pointed to a cooling of the labor market, which then picked up again in June 2022, when the Fed introduced its first 75 basis point hike in 2022.

On November 30, Fed Chairman Jerome Powell noted that less aggressive rate hikes could be a distinct possibility at the next Fed meeting, although most analysts do not expect a drastic drop from the past four 0.75% hikes.

They predict the Fed will raise interest rates by 50 basis points at the next meeting of the Federal Open Markets Committee in mid-December. 2022, taking the federal funds rate above the 4% mark.

The Fed meeting is likely to trigger a rally in both crypto and stocks if analysts’ estimates prove accurate.

For Be[In] Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.