Bitcoin rally as PCE price index comes in below expectations

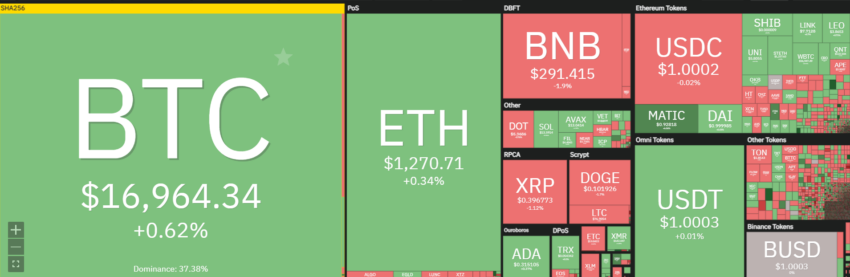

Bitcoin rose 1.5% as the US core personal consumption goods index for October 2022 came in 0.1% lower than analysts’ estimate of 0.3%.

The PCE price index, which measures changes in consumer spending and is released monthly by the US Bureau of Economic Analysis, revealed that prices of goods and services rose 0.2% month-on-month in October 2022. The so-called core PCE price index excludes food – and energy prices.

PCE price index of 0.2% has Bitcoin rallying

Shortly after the release of the core PCE price index, Bitcoin was up 1.5% in the previous 24 hours to cross the psychological $17,000 mark before falling to $16,988.

The world’s largest cryptocurrency continued a rally that began after Fed Chairman Jerome Powell hinted in a speech on November 30, 2022 that the central bank could slow its interest rate hikes at the next meeting of the Federal Open Markets Committee in December 2022.

“It makes sense to moderate the pace of our rate hikes as we approach the level of restraint that will be sufficient to bring down inflation,” Powell said.

Ethereum was also up about 0.3% to trade at $1,268.49 at press time, with Solana gains of 1.2% before falling back to 0.5%.

The S&P 500 gained 5.38%, and the Dow Jones Industrial Average rose 5.67%. The Dow later fell 400 points in anticipation of US employment data, due on December 2, 2022.

The PCE price index provides a broader picture of macroeconomic conditions

The latest PCE data also revealed that the core PCE price index was up 5% from a year ago, compared with a year-on-year increase of 5.2% in September 2022.

The Federal Reserve began using the PCE price index as the overall indicator of the level of inflation in the United States in 2012. Unlike its predecessor, the Consumer Price Index, the PCE price index tracks a broader range of goods and services that fall under the durable goods and nondurable goods categories . However, it is unable to capture minor fluctuations in the prices of everyday items such as breakfast cereals and clothing.

Despite the fact that the CPI has not been the Fed’s leading indicator of inflation for the past ten years, investors are still happy to mine monthly CPI numbers for optimism, which is often reflected in stock market behavior. Bitcoin rose along with the S&P 500 and Dow Jones futures on November 10, 2022, as the so-called core CPI for October 2022 came in 0.3% below market expectations of 0.3%.

PCE price index rally could mark short-term upside for Bitcoin

Bitcoin’s rally in tandem with the stock market could be a sign that the cryptocurrency may be more vulnerable to macroeconomic movements in the medium to short term, even as the industry struggles with the fallout from the collapse of major crypto exchange FTX.

The rally to $17,000-plus in early trade on December 1, 2022, was the highest level since the Bahamian stock market collapsed under the weight of mass withdrawals in early November 2022.

“The de-risking rally comes at just the right time for Bitcoin,” said Oanda’s Craig Erlam.

Eight managing director and technical analyst Michaël van de Poppe noted that the news was positive.

But some experts still believe that Bitcoin is unlikely to take off on a major rally soon and will face resistance from the June 2022 price of $17,600.

Before the collapse of FTX, Bitcoin followed the stock markets closely, as investors in both stocks and crypto danced to the beat of the Federal Reserve’s tightening monetary policy. The central bank has raised interest rates six times in 2022 in response to a booming US economy, fueled in part by excess stimulus money from the pandemic.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.