Bitcoin Price Prediction When $10 Billion Trading Volume Comes – Where Is BTC Heading Now?

The most famous cryptocurrencies, Bitcoin and Ethereum, end the week on a bearish note, with both coins continuing to lose value. Bitcoin recently fell below $28,000, while Ethereum has fallen to $1,800.

The most famous cryptocurrencies, Bitcoin and Ethereum, end the week on a bearish note, with both coins continuing to lose value. Bitcoin recently fell below $28,000, while Ethereum has fallen to $1,800.

Although Bitcoin reached $28,500 earlier this week, the rally was short-lived as the price quickly fell. Likewise, Ethereum failed to reach $1,800 on Sunday morning, causing investors to worry.

However, the reason for the latest decline can be traced back to the news that Binance, a leading crypto exchange, is facing crypto regulations in the US and Dubai.

The Virtual Assets Regulatory Authority (VARA) in Dubai has told Binance, which received an MVP license from the authority in September 2022, to provide more information about the company’s ownership structure, governance and audit procedures.

Furthermore, the broad-based US dollar has gained traction due to previously released US jobs data showing that the US economy is growing, increasing the likelihood that the Federal Reserve will have to raise interest rates next month.

This was proven by market participants, who now believe there is a 70% chance that interest rates will rise, which is likely to negatively impact Bitcoin prices.

Binance is under regulatory scrutiny in Dubai and the US, potentially affecting Bitcoin prices

As previously mentioned, Dubai’s Virtual Assets Regulatory Authority (VARA) has ordered the leading cryptocurrency exchange, Binance, to submit more details regarding the company’s ownership structure, governance and audit procedures.

This measure is part of the UAE city’s efforts to meet the challenges of cryptocurrencies with tough laws and ensure compliance with the highest regulatory requirements. Binance management has said that it has provided all important responses to VARA through its regulatory and fiduciary duties.

So this growing legislation constrains Binance, which is already under pressure from the US Commodity Futures Trading Commission. VARA’s investigation into Binance and other foreign crypto exchanges is likely to affect the current Bitcoin price rally as investors appear cautious due to the increased regulatory scrutiny.

This could lead to reduced demand for cryptocurrencies, ultimately affecting their prices.

Analyst predicts Bitcoin rally to $130,000 by year-end using Elliott Wave Theory

According to a popular analyst who uses a technical analysis method known as the Elliott Wave theory, the price of Bitcoin could reach $130,000 by the end of this year. This theory suggests that when a coin is in a bullish trend, it goes through five waves, with the first, third and fifth waves indicating rising prices.

Since this is a good sign, investors may buy more bitcoins in anticipation of increasing value, which may affect the price.

US Nuclear Bitcoin Mining Sees Impressive Results

TeraWulf, a company in the United States that mines cryptocurrencies, has just opened the first Bitcoin mining facility in Pennsylvania that runs on 100% nuclear power.

Over 9,200 miners have already been powered up at the Nautilus facility, leading to a 50% increase in the company’s average hash rate since February.

Meanwhile, the company also operates a hydro- and nuclear-powered mining facility in New York, contributing to an average production rate of 7.5 BTC per day, or $208,973 per day at current Bitcoin prices.

This was seen as important news that would positively affect the Bitcoin price. It shows that people are becoming more interested in and investing in mining, which shows that people are becoming more confident in the future value of cryptocurrencies.

Bitcoin price

The ongoing battle between optimistic bulls and cautious bears persists as Bitcoin remains confined within a tight trading range between $27,600 and $28,900.

Technical analysis suggests that the BTC/USD pair is showing a downward trend. However, it may face resistance near the $28,250 level.

If Bitcoin breaks through this resistance level, its value could rise to $28,900 or even $29,250. Conversely, if a downtrend continues, significant support is expected around the $26,500 and $25,500 levels.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

To stay updated with the latest ICO projects and altcoins, it is advisable to regularly consult the expert-curated list of the top 15 cryptocurrencies to watch in 2023.

Doing so will help you stay well informed about new trends and opportunities within the crypto market.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

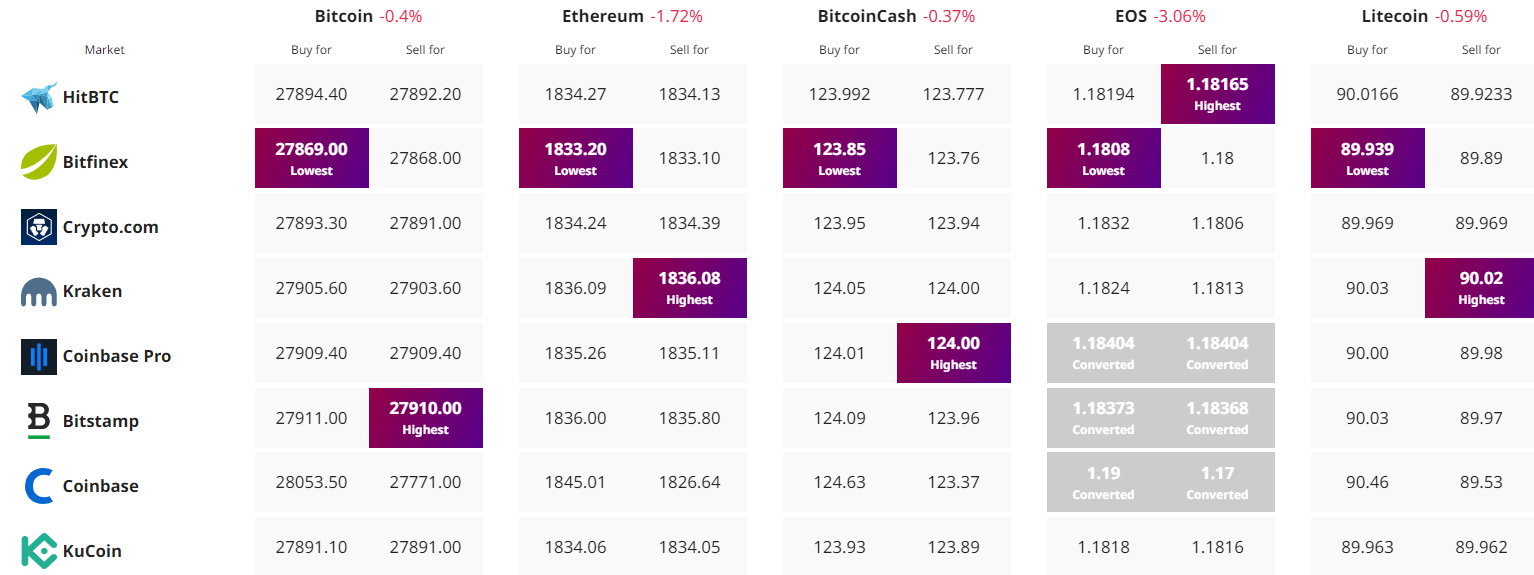

Find the best price to buy/sell cryptocurrency