Bitcoin Price Prediction As BTC Soars 14% In 7 Days – Here’s Where BTC Is Heading Now

Bitcoin’s price has seen a significant increase of 14% in the last seven days, leaving many to wonder where the cryptocurrency is headed in the near future. In this update, we will explore some of the prevailing Bitcoin price predictions and analyze the factors influencing the cryptocurrency’s recent price movements.

Bitcoin’s network difficulty predicted to experience the biggest increase of the year

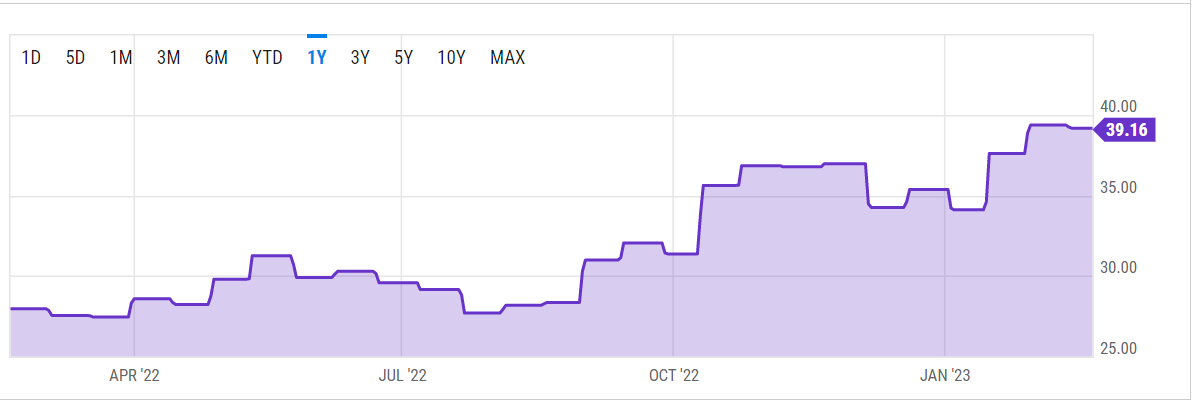

Bitcoin’s hash rate remained above 200 exahash-per-second (EH/s) throughout 2022. However, it appears that 300 EH/s will be the new normal by 2023. According to recent statistics, Bitcoin’s hash rate has averaged approximately 310 .5 EH/s over the last 2016 blocks, with block times ranging from 8 minutes 55 seconds to 8 minutes 68 seconds.

These indicators point to a significant increase in difficulty, which is expected on February 24.

The following are the results of a survey conducted by the National Institute of Standards and Technology (NIST). The estimated increase for this modification will be between 10.78% and 11.5%. The current difficulty is around 39.16 trillion hashes and the next adjustment will surely increase it to 40 trillion.

A 10.78% increase would yield a difficulty of around 43.35 trillion hashes. Regardless of the decision, an increase in difficulty will make it harder for Bitcoin miners to discover new blocks.

The expected increase in Bitcoin’s network difficulty, combined with a high hash rate and shorter block times, means that it will become more difficult for miners to discover new blocks. This could result in a decrease in the rate at which new Bitcoins are produced, potentially leading to an increase in price due to scarcity.

Moreover, the increase in Bitcoin’s hashrate and the concentration of mining power in a few large mining pools may also raise concerns about centralization and security risks. Nevertheless, the high hash rate and concentration of mining power can also improve the overall security of the Bitcoin network, making it more resistant to potential attacks.

In summary, the expected changes in Bitcoin’s network difficulty and hashrate could have a number of implications for price, security and decentralization. However, the full impact will depend on various factors, including market demand, regulatory developments and technological advances.

IoV Labs presents RIF Flyover to easily transfer between Bitcoin and Rootstock

IoV Labs, a blockchain technology company based in South America, has introduced RIF Flyover, an open source protocol designed to enable seamless transfers between the main Bitcoin blockchain and the Rootstock sidechain, resulting in faster transactions.

RIF is a decentralized infrastructure protocol suite that allows the development of scalable decentralized applications within a single ecosystem. RIF Flyover, also known as a refund protocol, is a non-custodial method that enables smoother and faster transfers between Bitcoin and the Rootstock sidechain via third-party liquidity providers.

The unique design allows for secure cross-chain transfers, as users do not need to give third parties access to their funds or private keys, unlike traditional chain bridges.

Potential impact

The launch of RIF Flyover by IoV Labs could have a positive impact on Bitcoin’s usability and overall value. By enabling faster and smoother transfers between the main Bitcoin blockchain and the Rootstock sidechain, the RIF Flyover protocol can improve the utility of Bitcoin and make it more attractive to users seeking a more efficient and seamless experience.

Bitcoin price

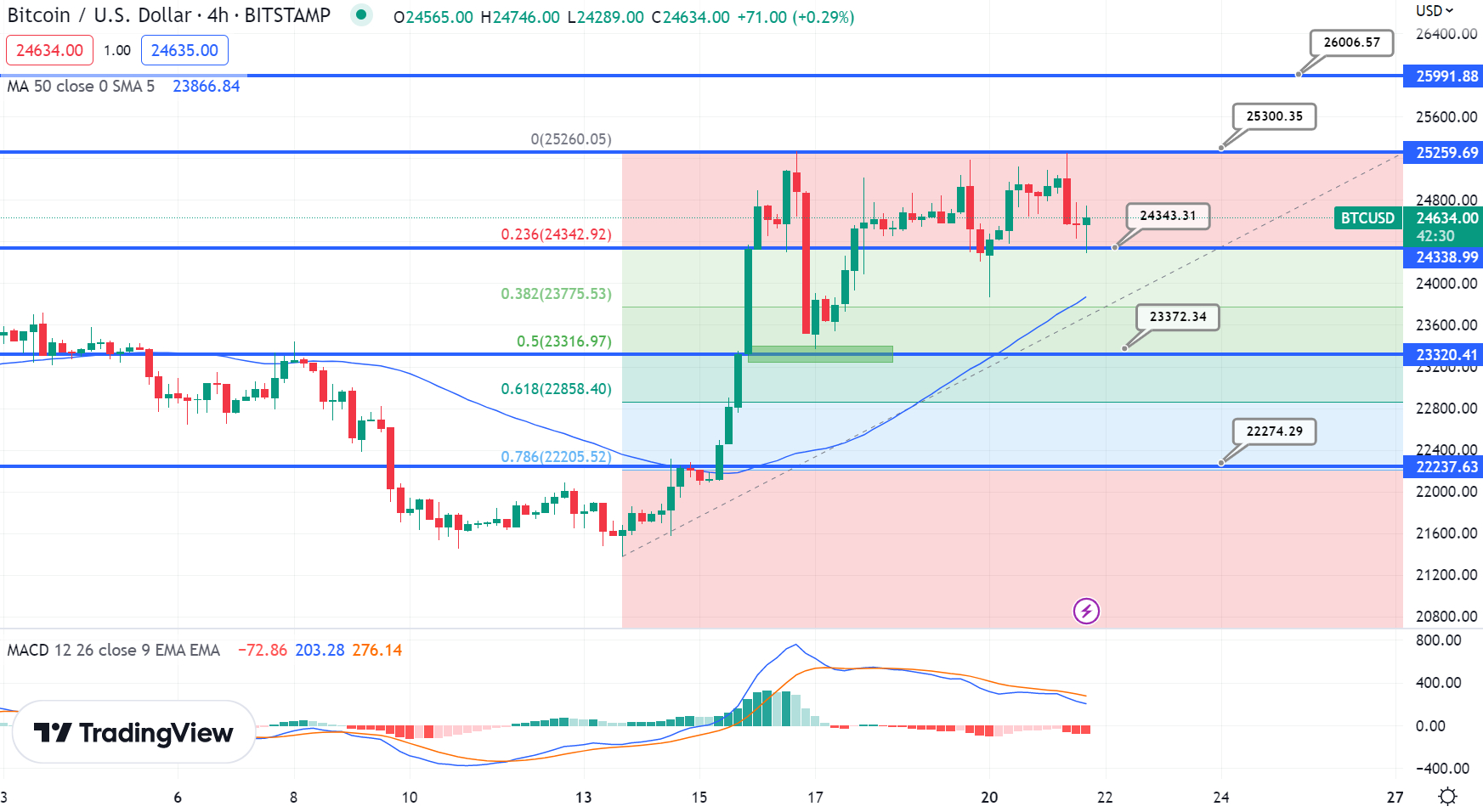

As of now, the current live price of Bitcoin is $24,650 and its 24-hour trading volume is $29.2 billion. Over the past 24 hours, Bitcoin has experienced a decline of almost 1%. With a market cap of $475 billion, Bitcoin is currently ranked #1 on CoinMarketCap.

From a technical point of view, Bitcoin is currently trading sideways and has been confined to a narrow range between $24,300 to $25,300. It appears that many investors are waiting for the release of the US Federal Open Market Committee (FOMC) meeting minutes before making any major moves grip.

The FOMC meetings can have a significant impact on the cryptocurrency market as they provide insight into US monetary policy. Investors often follow the minutes closely to gain a better understanding of the future direction of interest rates, inflation and economic growth.

Given the anticipation surrounding the FOMC meeting minutes, it is no surprise that Bitcoin is trading in a relatively tight range. However, once the protocol is released, it is possible that we may see some movement in the cryptocurrency markets as investors react to new information or insights provided.

If Bitcoin’s price were to fall below the current support level of $23,750, the next support level would be at $22,850. This level is determined by the 50% Fibonacci retracement mark, a commonly used technical analysis tool that identifies potential support and resistance levels based on previous price action.

Buy BTC now

Bitcoin Alternatives

CryptoNews has released an in-depth analysis of the top 15 cryptocurrencies that investors may want to consider for 2023. The report provides valuable insights to help investors make well-informed investment decisions.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

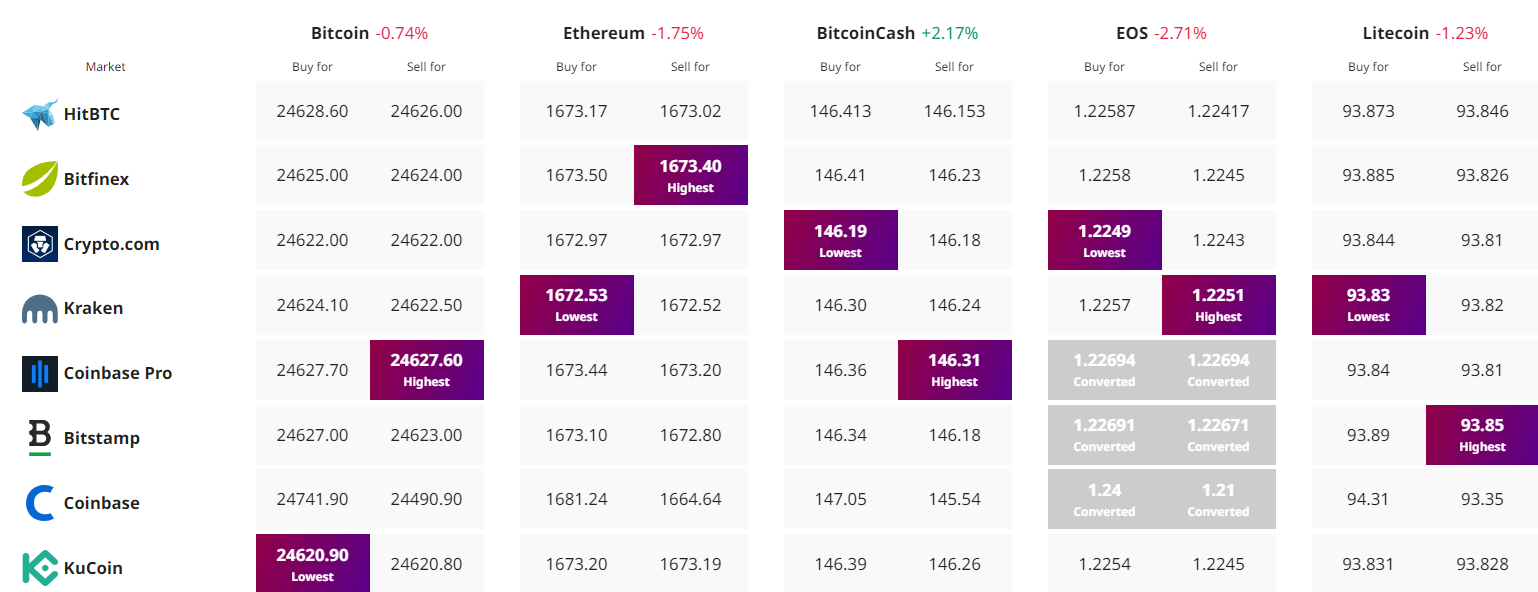

Find the best price to buy/sell cryptocurrency