Bitcoin May Spiral to $200T in 9 Years Demand Cryptography

Blockstream CEO Adam Back took to Twitter to claim that Bitcoin could reach a market cap of $200 trillion in about nine years.

The British cryptographer based his findings on BTC movement over the past decade. He explained that Bitcoin went up 2.036x per year or 1200x in a decade. This gives his market cap estimate of $200 trillion for Bitcoin at the end of two halvings.

Not sure about adoption, but capital letters can spiral

Back stated: “I’m not sure if adoption is slowing down, nor is volatility reducing; there are other factors. The new cycle people who learn to hoard/stack, who over time make it their mission to buy and freeze as much #bitcoin as possible, even resorting to leverage (volatility creator).

The cryptographer is of the opinion that adoption could create outbreaks of hyperbitcoinization. He explained that rapid viral adoption can destroy a weak currency in a hyperinflationary frenzy. He maintains that if the public witnesses a fiat currency disintegrating, they may become more pragmatic and react quickly to defend their savings.

Next Bitcoin halving in one year

Back noted: “So I think things will get ‘interesting’ in the next two halvings. And fast. We don’t have a lot of time to scale technology. We need a place for the next billion users to own their own UTXO, their own keys, with censorship-resistant cold storage, without weakening the main chain’s security.”

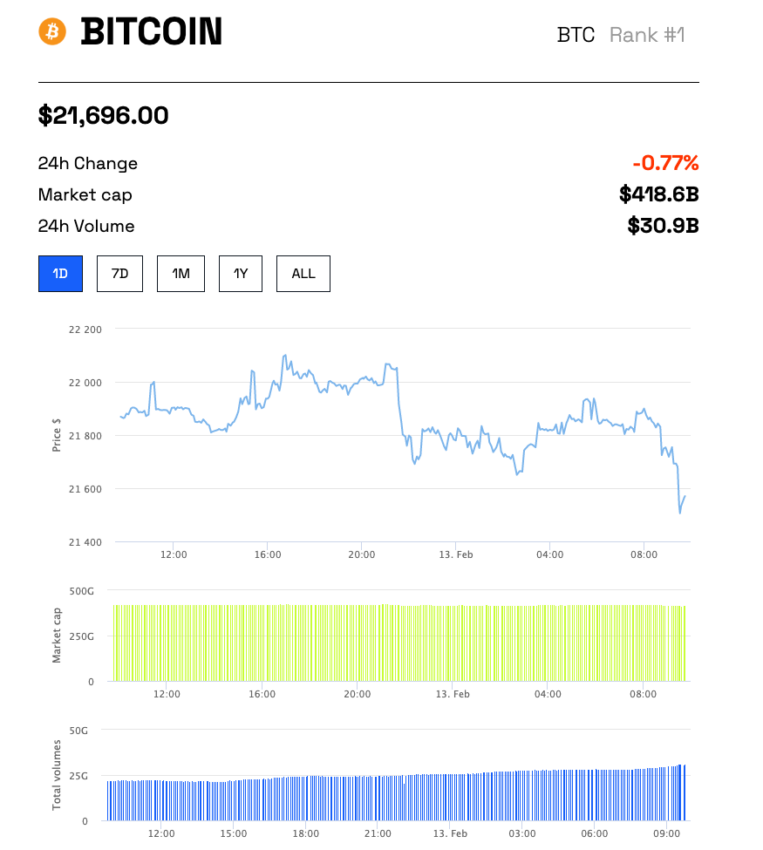

The next BTC halving is expected to happen on April 14, 2024. At the time of writing, Bitcoin is hovering in the 24-hour range of $21,650 – $22,100. However, in the past year, BTC’s price has dropped by around 50% amid the ongoing crypto winter. While gains remain muted the day before, the past week has lost over 5%.

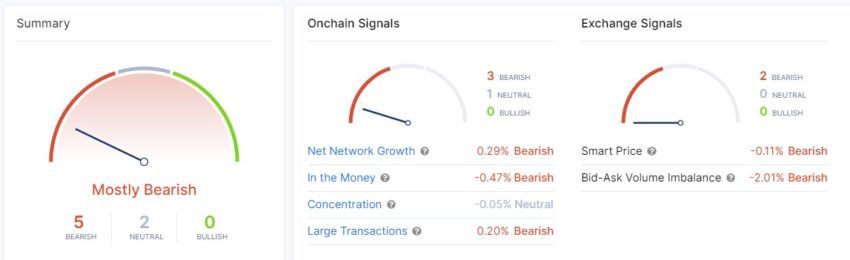

In this price range, 63% of BTC holders are in the money, per analysis by InToTheBlock. Only 3% of holders break even in this price range, while 34% have lost money. In particular, the analysis confirms that 11% of all BTC is accumulated with whales.

That said, Back lays out the idea that Bitcoin-structured products, mortgages backed by real estate but interest guaranteed by BTC, along with other products, foster growth.

Meanwhile, recent developments in technical indicators could herald the beginning of a long-term bull market for Bitcoin, according to BeInCrypto research.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.