Bitcoin (BTC) Price “Set for Big Moves” But Here’s the Catch

The Bitcoin (BTC) price path has been anything but dull, but with volatility at an all-time low, price action could be prime for some big moves – either strongly bearish or bullish.

With Bitcoin’s price moving in a tight range between the $18,800 and $20,250 levels, the range-bound momentum has traders and investors waiting for some big moves. However, the top cryptocurrency seems to have some other plans in store for HODLers.

Big move on the horizon

Cryptoanalyst Michaël van de Poppe highlighted in a recent tweet that the Bitcoin Volatility Index has fallen below 25, which historically is “a guaranteed recipe for massive volatility.” He further predicted a “very big move on the horizon for Bitcoin.”

Especially when the volatility index falls to such low levels, price action makes a sudden extreme move, the same has been observed in the following cases before:

- Crash to $3000 in 2018, a 50% price drop – big bearish move

- Break Over $4,000 to $14,000 in 2019, a 240% Price Increase – Massive Rise

- Break Over $10,000 in 2020 – Start the 2020 Rally

At press time, Bitcoin’s price continued its struggle with the $19,000 mark, trading at $19,393 – down 0.58% on the day. Declining trading volume, low interest in BTC from traders and more bearish macro conditions meant that there were no major bullish catalysts for BTC’s short-term price action.

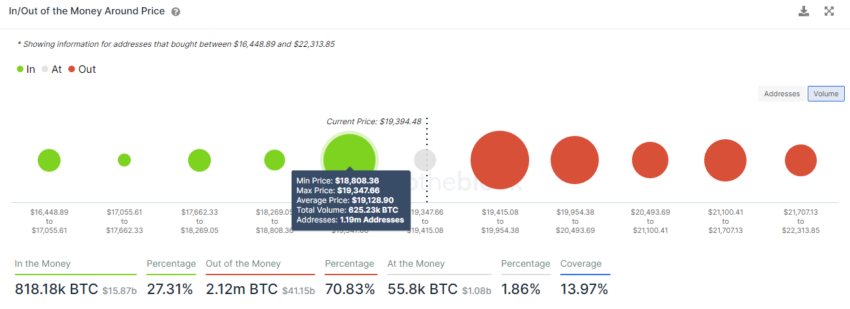

However, a look at the In/Out of the Money Around Price indicator highlighted that the key support level for the Bitcoin price was at the $19,000 price level, where 1.19 million addresses bought over 625,000 BTC.

A drop below the crucial $19,000 level amid such low volatility could trigger a bearish spell for the top crypto.

BTC long-term owners with losses

Data from Glassnode highlighted that the on-chain cost basis for short-term Bitcoin holders had crossed below that for long-term holders. This meant that Bitcoin buyers over the last five months have a superior cost basis to those who have held through all the volatility of the 2020-22 cycle.

With long-term HODLers at a loss, market confidence in the original HODLers was at risk.

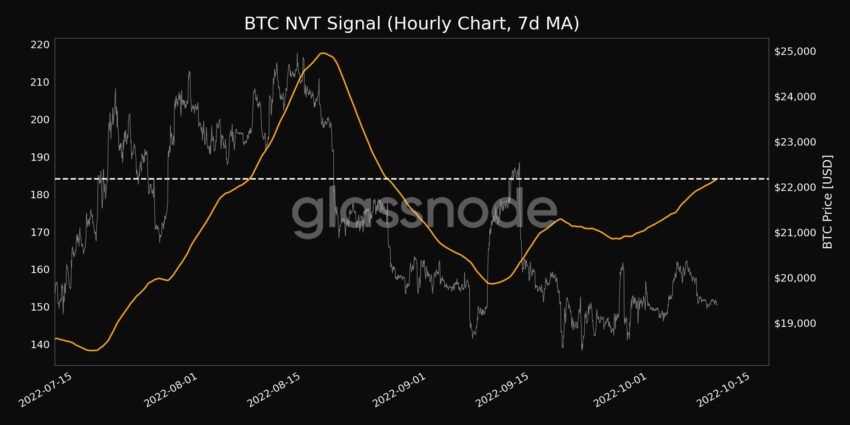

In addition, the Bitcoin Network Value to Transactions (NVT) Signal (7d MA) had reached a one-month high of 184,148. High values are generally an indication of market value growth that exceeds the transfer volume on the chain.

Apparently, the BTC price was at a crucial crossroads where the path forward could be guided by its short-term price action, as the $19,000 mark serves as a decisive point.

If the BTC price falls below the $19,000 mark, the next major support could be at the $16,400 price level. However, in the event of a bullish breakout, the next resistance would be at the $22,750 mark.

Disclaimer: Weather[in]Crypto strives to provide accurate and up-to-date information, but will not be responsible for missing facts or inaccurate information. You comply and understand that you should use all such information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.