Binance Led 2017 ‘Dumb Money’ Bitcoin Investment; FTX leads 2022 cycle

Bitcoin (BTC) withdrawal patterns on centralized exchanges have changed significantly over the past five years.

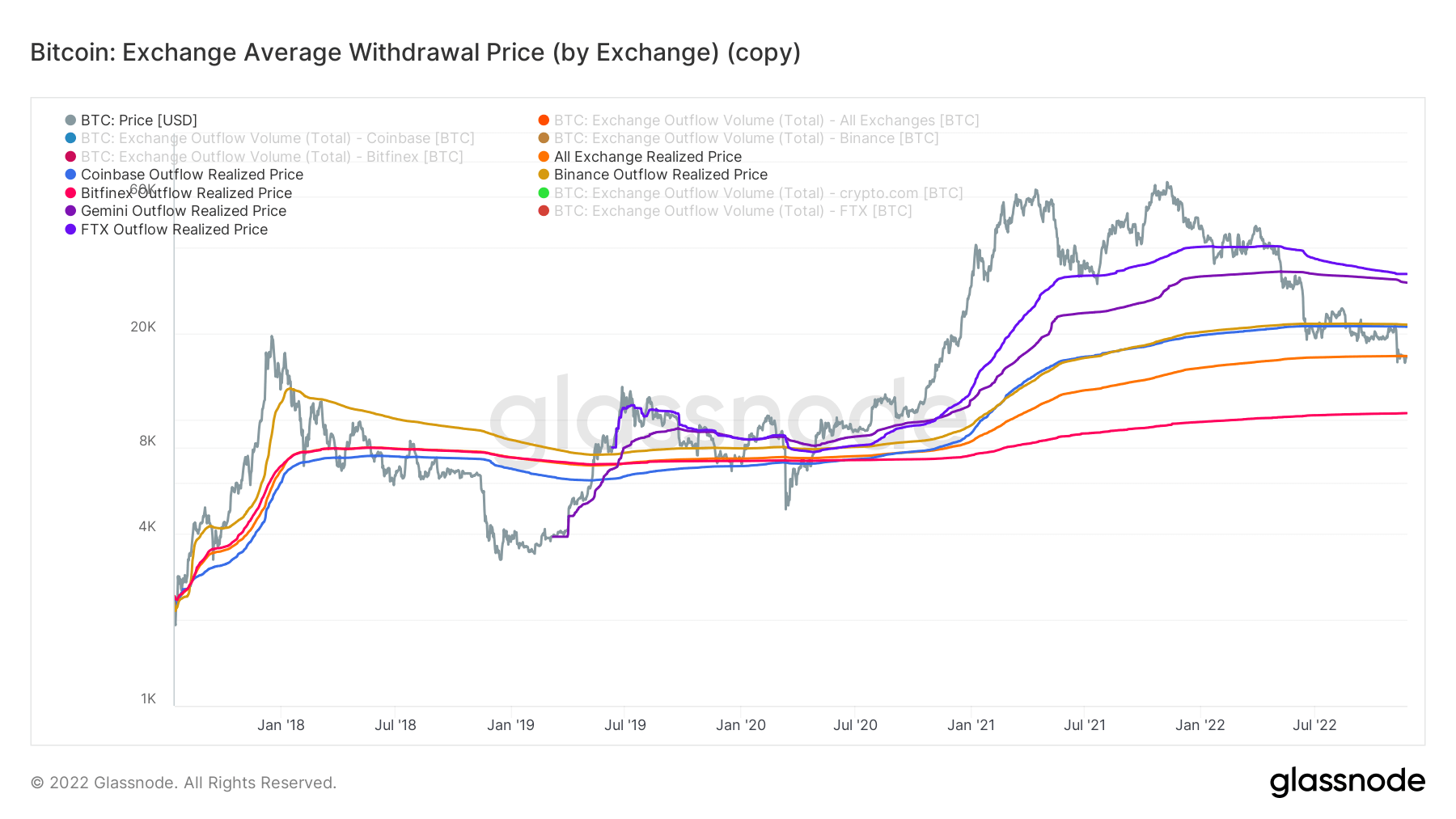

CryptoSlate analysis of Glassnode data on BTC’s average withdrawal price on top exchanges such as Coinbase, Gemini, Binance, FTX and Bitfinex reveals an interesting pattern.

The chart above showed that in the early days of crypto adoption, especially in 2017 when Binance was established, the exchange saw most of the stupid money flow into crypto.

According to Investopedia, dumb money refers to retail investors who buy primarily because of market hype and the fear of missing out. Generally, this group of investors tend to buy when the price is high or near the top.

Because they buy near the top, they end up selling or pulling out when the value of the asset declines. This was evident in the early days of Binance, when most withdrawals on the platform occurred after Bitcoin peaked.

This suggests that most users did not withdraw with maximum profit even though they had no losses. Thus, the realized outflow price ends up exceeding today’s.

However, the emergence of newer exchanges such as FTX and Gemini saw the movement of “dumb money investors” away from Binance. Since these exchanges launched in 2019, their average withdrawal price has been very high.

For reference, the average withdrawal price of Gemini and FTX hit record highs during the Terra LUNA market implosion. FTX’s recent collapse also caused retail traders to massively withdraw their assets from the bankrupt exchange.

In comparison, the average withdrawal price on Bitfinex has remained low and stable since 2017. This suggests that the exchange has a more sophisticated user base, i.e. smart money.

Investopedia describes smart money investors as institutional and knowledgeable investors who have a better understanding of the market and use this to make informed decisions. This class of investors has the tools and the foreigners to make better investment decisions.

Meanwhile, only Bitfinex has a realized Bitcoin outflow price below the average for all exchanges.