Asia maintains its smart money reputation for trading Bitcoin

As with forex trading, crypto markets also trade 24/7 and follow the same conventional three-session trading system, which runs:

- Asia: 00:00-12:00 UTC

- Europe: 07:00-19:00 UTC

- United States: 13:00-01:00 UTC

Analysis on the chain revealed the extent to which Asia continues to play the role of “smart money”, where Asian investors have an ability to buy in times of fear or sell at the top.

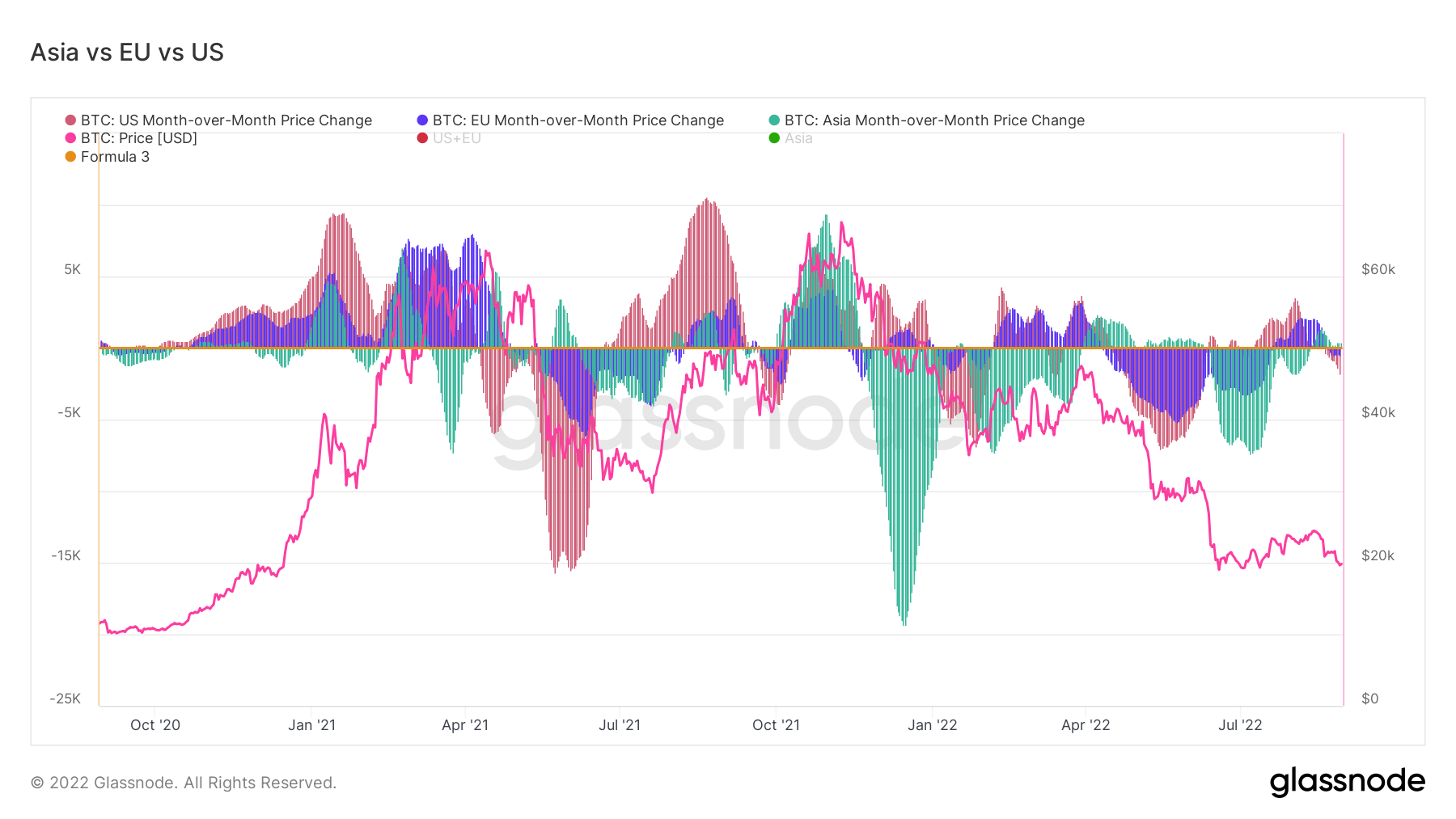

Bitcoin month-over-month price change

The chart below shows the Bitcoin month-over-month price change (MoMPC), over 30 days, for the regional price for all three locales.

A two-step process determines the regional award. First, price movements are assigned to a region based on Asian, European and American working hours. Geolocation of Bitcoin supply is likely performed at the unit level. The timestamps of all transactions created by a device are correlated with the working hours of different geographic regions to determine the probability that each device is located in Asia, Europe, or the United States

A unit’s balance will only contribute to the supply in the respective region if its location can be established with a high degree of certainty. Supply of stock exchange wallets is excluded.

Regional prices are determined by calculating the cumulative sum of each region’s price changes over time.

Over the past two years, Asia has outperformed Europe and the US when it comes to selling at the top and buying during terrible market sentiment.

The market peak in November 2021, for example, saw a massive distribution from Asia. Similarly, Asia sold during the July and August relief rally, when BTC moved towards $25,000, while Europe and the US bought.

Currently, with Bitcoin falling below $20,000 over the weekend, the MoMPC shows that Asia is buying while the rest of the world is trapped in fear.

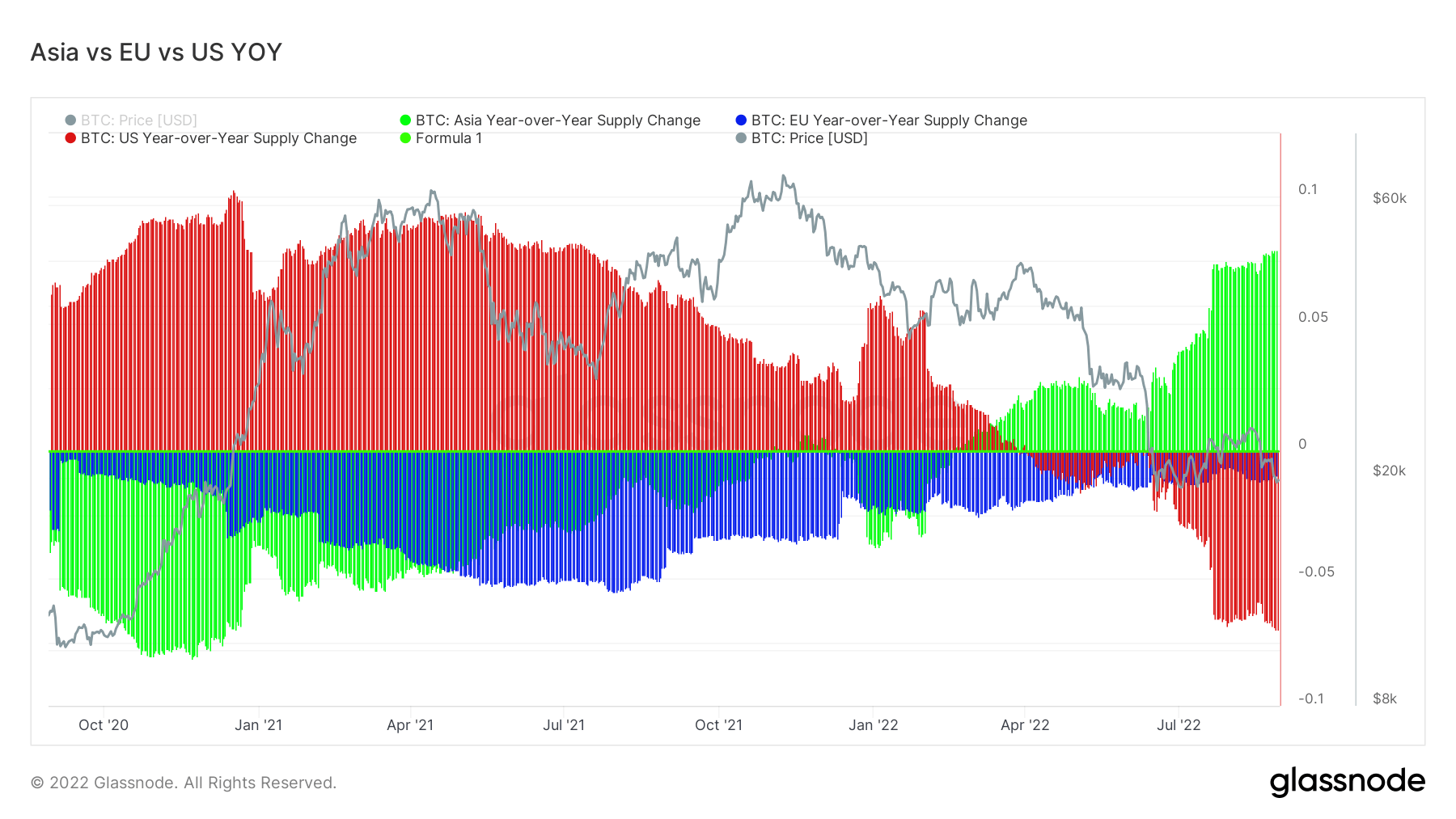

Year-on-year analysis

The chart below shows regional price changes from a year-over-year view. It shows that Asia has been extremely bullish on Bitcoin since the Terra LUNA/UST collapse, buying at the suppressed prices. Conversely, Europe and the US have sold.

Likewise, the US was a big buyer during the 2020 run to the end of 2021, while Asia was a net seller, further demonstrating Asia as the smart money region.