ANALYSIS: Lawyers see growth in crypto work despite slowdown

The crypto industry is suffering its biggest setback yet, with token values down significantly and decentralized finance (DeFi) companies imploding. Still, lawyers expect legal work in the crypto space to increase in the coming years, according to a recent Bloomberg Law survey.

The results of Bloomberg Law’s second State of Practice survey also suggest that crypto-legal work is beginning to move into the mainstream.

What crypto lawyers told us about their practice

The survey was carried out between 29 June and 22 July, with responses from 382 lawyers who had an average of 18.6 years of experience in legal practice.

Of those surveyed, 27 respondents (7.1%) currently practice in the cryptocurrency space. Looking forward, 46 lawyers (12.1%) said they were considering expanding into cryptocurrency, and 30 lawyers (7.9%) indicated they were considering expanding their practice to include the metaverse. As might be expected for an evolving industry, crypto makes up a small portion of lawyers’ current practices with an average percentage of 9.2%.

What areas of the digital assets/decentralized economy and internet space are likely to grow for lawyers? Of those attorneys expecting crypto work in the next two years, the most common area was cryptocurrency (44%), followed by blockchain (38%), decentralized finance (30%) and Web 3.0 (20%).

Survey shows the crypto industry is maturing

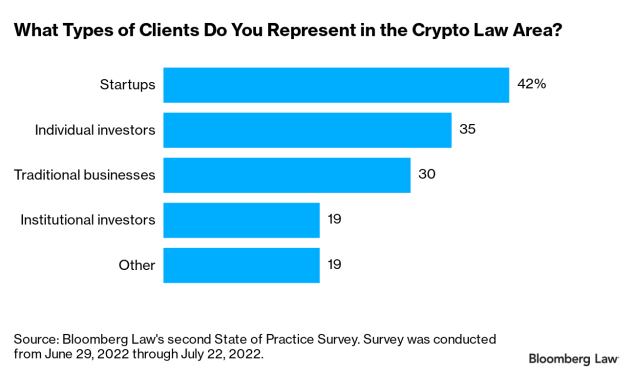

Although crypto is still an emerging industry with regulation lagging behind innovation, the types of clients lawyers represent—and the cryptolegal advice they provide—point to a growing sector. Startups make up only a majority of investigative lawyers’ clients, balanced by traditional businesses, individual and institutional investors, and others.

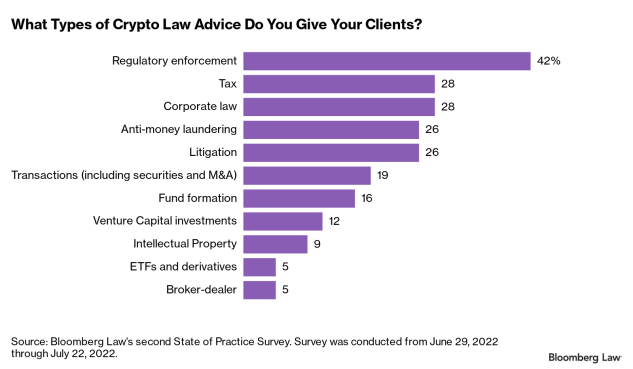

The types of crypto-legal issues addressed by the respondents reinforce the conclusion that the industry has reached a new stage in its development. Early days in emerging industries are usually focused on growing the business, with legal quandaries often delayed until a future date.

However, that is not what our investigation found. Regulatory enforcement led the way in the legal advice provided category, with other areas of legal compliance, such as tax compliance and anti-money laundering, also near the top.

Overall, the mix of clients and advice provided paints a picture of an industry that is beginning to seriously address its regulatory obligations.

—With the assistance of Princess Onyiri.

Bloomberg Law subscribers can find information about US federal and state regulatory actions against cryptocurrencies and other digital assets at our Fintech Compliance resource, including the new one Tracker for financial technology development.

If you are reading this on the Bloomberg terminal, please BLAW OUT