Alameda Gap Persists as Crippled Liquidity Holds Back the Crypto Market

February is over, but ‘Alameda Gap’ is not.

As the second month of this year approaches, prices in the crypto market have recovered somewhat from last year’s crash. Still, the so-called “Alameda gap” resists filling, as liquidity is far from pre-infamous levels FTX collapse.

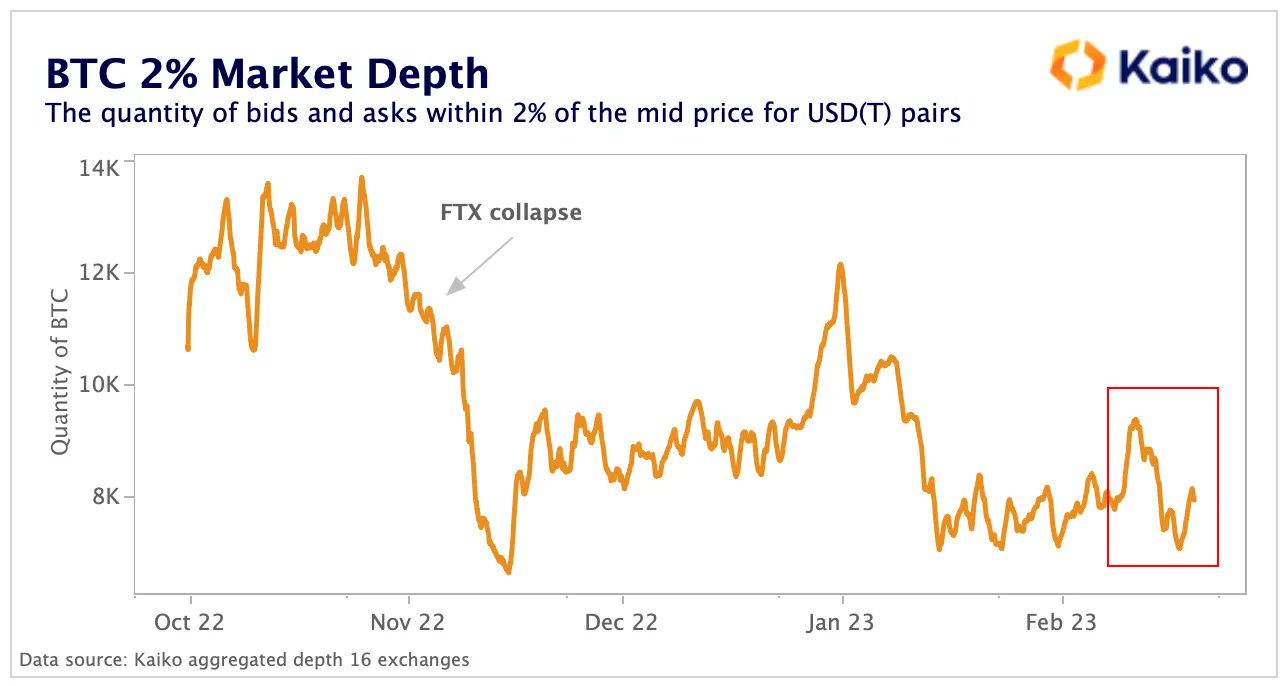

Researcher Kaiko tweeted that this month too, the gap persists, with bitcoin (BTC) “market depth still well below November levels.” It stated that,

“The amount of BTC-USD(T) bids and asks within 2% of the average price aggregated across 16 exchanges hovered around 8k BTC in February – 40% less than in October.”

As a reminder, the FTX exchange, together with the parent company Alameda Research and a number of subsidiaries, filed for bankruptcy back in November of last year — and those companies, along with founder Sam Bankman-Fried, have been dealing with the regulatory and legal fallout ever since (at the expense of users).

Kaiko noted the existence of the ‘Alameda gap’ that same month, arguing that liquidity drops typically occur during periods of volatility when market makers rush to manage risk.

“Crypto liquidity is dominated by just a handful of trading firms, incl Wintermute, Amber Group, B2C2, Genesis, Cumberland and (the now defunct) Alameda. With the loss of one of the largest market players, we can expect a significant drop in liquidity, which we will call the “Alameda Gap”, it said at the time.

Riyad Carey, research analyst at the company, was quoted by Bloomberg on Friday as saying that

“It’s not just Alameda, although they were one of the biggest. Other market players took a crack and are more cautious. […] It really depends on the token, but I’d say there’s still a 20-40% gap from previous liquidity levels. When there is less liquidity, we tend to see prices being more volatile in both directions, which has been the case for the last couple of months.”

Strahinja Savic, head of data and analysis at FRNT Financialwas quoted as saying Three Arrows Capital (3AC), Celsius network,” and many other crypto funds, both famous and not,” are responsible for this gap. Therefore, the drop in trading volume at the end of 2022 can probably be linked to the “elimination” of these companies.

“These firms would have controlled spreads, kept them in check and supported market depth,” but their fall resulted in “an increase in certain inefficiencies in the crypto market,” Savic said.

“It is also a result of Genesis bankruptcy, incurring losses for other market makers related to both Genesis and FTX,” claimed Vetle Lunde, senior analyst at K33 Research (formerly Arcane Research).

Traders are not back yet

Overall, according to Noelle Acheson, author of the “Crypto Is Macro Now” newsletter, thin liquidity suggests that larger traders are not back in the market.

Acheson was quoted by Bloomberg as saying that,

“I expect the continued rise in volatility since the beginning of the year to gradually lure some of the big players back into the market, as the December-early January lows would have made the market not interesting enough to be worth their time.”

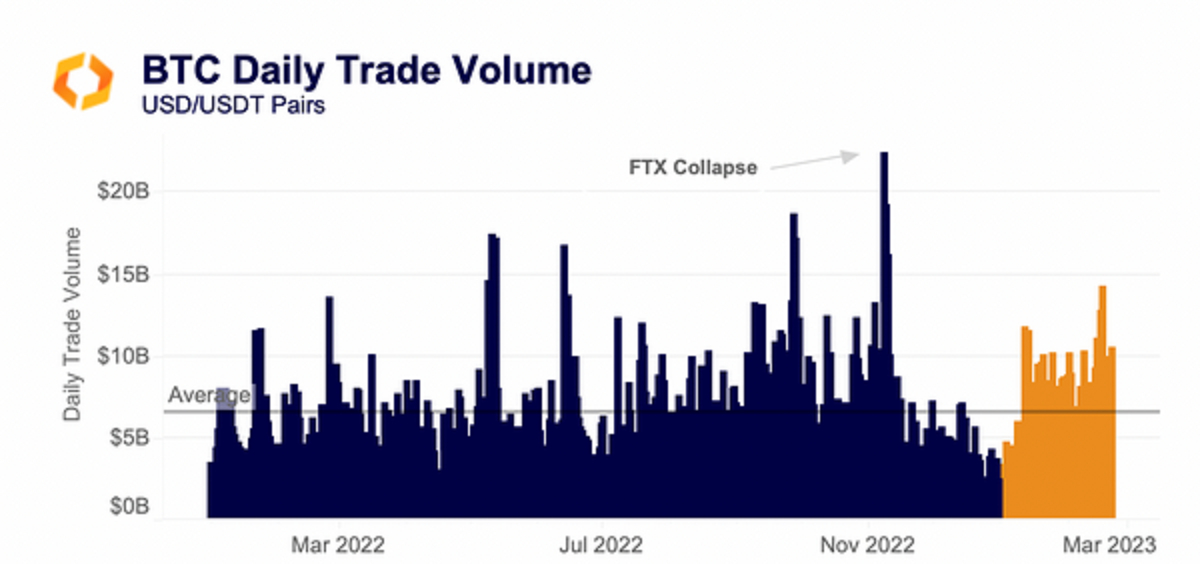

Meanwhile, in its weekly market overview, Kaiko stated that daily trading volume has been consistently higher this year. It fell to annual lows at the end of 2022, partly due to poor retail sentiment following FTX’s collapse.

That said, sentiment appears to have picked up “significantly” so far in 2023, with daily BTC volume crossing $14 billion during February, it said.

The researcher added that

“Total volume is also higher than the end of 2022, apparently anchored to the daily volume figure of $10 billion, as opposed to about half of what was closed last year.”

Kaiko also noted that BTC and ETH market depth reached its lowest point since May 2022. “Liquidity in native units continued to fall last week, reaching its lowest level since the Terra collapse,” it said.

It added that BTC 2% market depth aggregated across 15 centralized exchanges fell to 6,800 BTC, down almost three times since its peaks in October. The market depth for ETH fell to around 57,000 ETH, compared to 139,000 ETH in October.

As for prices, back in November BTC fell to the $15,700 level, but has since climbed up to today’s $23,283. At 10:00 UTC Tuesday morning, it was down 0.5% in a day and 6% in the past week.

At the same time, ETC was trading at $1,621, down 1% in the last 24 hours and 4.7% in the last 7 days. This is a significant increase since November 2022 when it had plunged to $1,095.

____

Learn more:

– FTX founder Sam Bankman-Fried faces multiple criminal charges – the latest twist in a high-profile case

– Report requirements Binance mixed user funds similar to FTX

– FTX Japan Crypto Exchange to resume withdrawals today – here’s what’s happening

– $200M Galois Crypto Hedge Fund Shuts Down as Half of Assets Stuck on FTX Exchange – Here’s What Happened