A very simple explanation of how Bitcoin works

Bitcoin – a popular cryptocurrency created in the late 2000s by developer/s Satoshi Nakamoto – can be complex when it comes to operations. One can say Bitcoin is a digital currency that uses cryptography to record transactions. One could also say that the underlying blockchain technology adds uniqueness to Bitcoin. It can also be said that Bitcoin is about the absence of intermediaries such as banks, with full control over the operations in the hands of the people. The situation right now is such that even stakeholders in the cryptocurrency world lack consensus on Bitcoin.

Before assuming anything about Bitcoin, including that it is a speculative investment asset, it is important to understand how Bitcoin works. Is Bitcoin a company where employees work in an arrangement similar to the operation of a bank? Are Bitcoin operations controlled from any headquarters? How are records maintained of the movement of BTC tokens from one party to another? Here is a simple explanation.

How Bitcoin Works

Firstly, Bitcoin is also a blockchain network apart from being a cryptocurrency. Bitcoin’s mainnet is a distributed ledger, meaning that record-keeping is not centralized, but distributed among a large number of participants. Nakamoto envisioned Bitcoin as “electronic cash” or virtual money. Money makes sense only when the records are properly maintained and there is no double spending. The holder should be able to use the money once, and the subsequent right of use should be passed on to the recipient.

Bitcoin works in a way that all transactions are recorded in the ledger of globally distributed peers. This process verifies the authenticity of transactions and prevents double spending. Elements like hashing and proof-of-work can be complicated, even for someone with a technical background. These simply contribute to the journaling process, with rewards for journalers, also known as nodes. It’s simple – when two parties trade, it triggers a record-updating exercise, which is performed by independent nodes that are rewarded for work done.

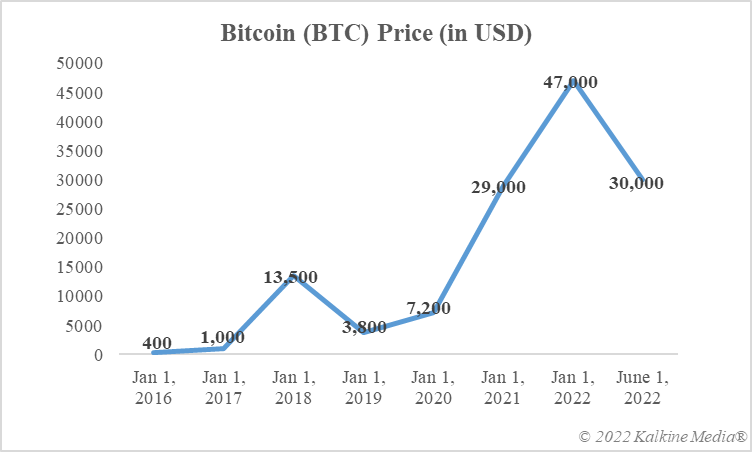

Stated data of CoinMarketCap.com

Both cryptocurrency and blockchain

Many cryptocurrency enthusiasts mainly focus on Bitcoin as a cryptocurrency. However, there is a clear and distinct blockchain mainnet that exists. It is similar to the blockchains of Ethereum or Solana or Cardano. In particular, Bitcoin’s blockchain can support a so-called secondary framework, also called Layer 2 in the blockchain world. The Lightning Network is one such Layer 2 protocol that sits on top of Bitcoin’s main network. When a token is mined on the mainnet, it becomes Bitcoin (BTC) cryptocurrency.

The bottom line

Bitcoin can be simple to understand — considering it’s a decentralized virtual currency — and also complex when you consider how record keeping on the mainnet is managed. Intermediaries such as central banks and commercial banks have no role to play in it, and authority is distributed among participants known as nodes. Is Bitcoin a speculative investment asset? This is another debatable topic.

Risk Disclosure: Trading cryptocurrencies involves high risks, including the risk of losing part or all of your investment amount, and may not be suitable for all investors. The prices of cryptocurrencies are extremely volatile and may be affected by external factors such as economic, regulatory or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) are subject to change. Before deciding to trade in financial instruments or cryptocurrencies, you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience and risk appetite, and seek professional advice where necessary. Kalkine Media does not and cannot represent or warrant that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept responsibility for any loss or damage resulting from your trading or your reliance on the information shared on this website.