A key function in fighting crime

A Financial Times article accusing crypto of fueling crime ignores how crypto prevents crime through the blockchain’s transparency, decentralization, and efforts by crypto companies to fight money laundering and terrorist financing.

Crypto critic Jemima Kelly argues that crypto’s claim of ethical neutrality is a false narrative because crypto was designed to be censorship resistant.

Crypto prevents crime and empowers citizens

However, human rights activist Alex Gladstein argues that Bitcoin’s censorship resistance helps citizens fight authoritarian regimes, which suppress political opponents through economic control.

“Authoritarian regimes and high inflation often go hand in hand. You get capital controls and governments trying to stop their citizens using other currencies,” he told Red Bull.

Last year, Canadian police froze the bank accounts of truck drivers protesting against COVID-19 vaccine mandates. The truck drivers collected 20 Bitcoin in donations, which Canadian police only partially confiscated.

In 2020, protesters against police brutality in Lagos collected Bitcoin donations after the government froze their bank accounts.

Companies like Notabene have developed technology to help crypto wallet companies comply with Europe’s new MiCA crypto legislation. The Transfer of Funds section requires crypto companies to record the identity of both parties involved in a crypto transfer.

Furthermore, sophisticated tools such as those developed by AnChain.ai help law enforcement agencies detect money laundering violations.

Blockchain Transparency Unobtained by Crypto Crimes

Kelly uses a recent claim by Binance’s former chief compliance officer to bolster the argument that people are using crypto solely for crime.

While a lawsuit against Binance makes damning claims, it’s important to remember that even though such firms onboard users of crypto, crypto is inherently decentralized.

The exchanges match, among other things, buy and sell orders for crypto. A decentralized open ledger ultimately verifies these transactions. Criminal activity exploits corporate or security holes in the use of off-chain financial products built on the ledger’s open technology.

Stephen Diehl, the author of Popping the Crypto Bubble, told the FT that the exchanges have created a “dark transnational payment network.”

While crypto is not free of illegal activity, criminals are about 800 times more likely to use fiat to launder money, a recent Messari report says.

“Global Laundromat” scam saw $20 billion laundered through banks and shell companies worldwide. The Panama Papers leak revealed the use of shell companies to hide wealth and avoid paying taxes.

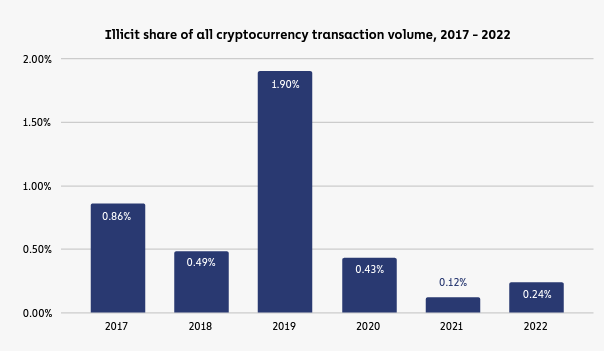

Citing a 2023 Chainalysis report, Kelly claimed that the bear market did not prevent cryptocrime from rising to over $20 billion compared to $18 billion the previous year.

While this is true, Chainalysis points out that the proportion of illegal transactions has declined overall.

Cybersecurity firms are developing increasingly sophisticated forensic tools to track the behavior of cryptocriminals. Cyver.ai develops behavioral analytics tools to detect suspicious on-chain transaction activity.

AnChain.ai has developed a security framework that uses machine learning to analyze errors in smart contracts. These are the building blocks of chained financial primitives such as lending. It also uses a multichain analysis platform.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.