With 59% institutional ownership, FinTech Evolution Acquisition Group (NYSE:FTEV) is a favorite among the big guns

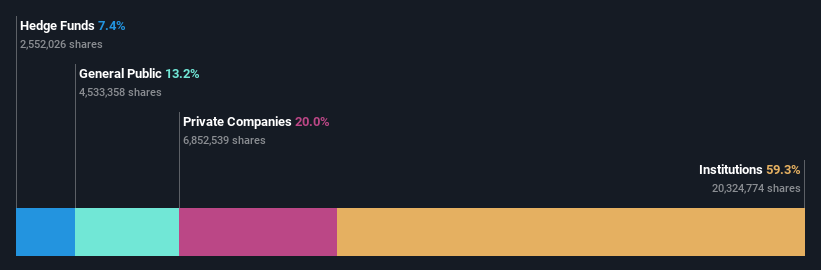

Every investor in FinTech Evolution Acquisition Group (NYSE:FTEV) should be aware of the most powerful shareholder groups. We can see that institutions own the lion’s share of the company with a 59% stake. This means that the group will gain the most if the stock rises (or lose the most if there is a decline).

Since institutionals have access to vast amounts of capital, their market movements tend to be heavily scrutinized by retail or individual investors. As a result, a significant amount of institutional money invested in a firm is generally seen as a positive attribute.

Let’s take a closer look to see what the different shareholder types can tell us about FinTech Evolution Acquisition Group.

See our latest analysis for FinTech Evolution Acquisition Group

What does institutional ownership tell us about FinTech Evolution Acquisition Group?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock when it is included in a major index. We expect that most companies have some institutions in the register, especially if they are growing.

As you can see, institutional investors have quite a stake in FinTech Evolution Acquisition Group. This suggests some credibility among professional investors. But we can’t rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there is always a risk that they are in a “crowded trade”. When such a trade goes wrong, multiple parties can compete to sell shares quickly. This risk is higher in a company without a history of growth. You can view FinTech Evolution Acquisition Group’s historical revenue and earnings below, but remember there’s always more to the story.

Investors should note that institutions actually own more than half of the company, so they can collectively wield significant power. It appears that 7.4% of FinTech Evolution Acquisition Group shares are controlled by hedge funds. It catches my attention because hedge funds sometimes try to influence management, or bring about changes that will create short-term value for shareholders. Fintech Evolution Sponsor LLC is currently the largest shareholder, with 20% of the shares outstanding. Glazer Capital, LLC is the second largest shareholder owning 7.4% of the common stock, and Aristeia Capital, LLC owns about 4.7% of the company’s stock.

We dug a little further and found that 9 of the top shareholders account for about 52% of the register, which suggests that along with larger shareholders there are a few smaller shareholders, thus balancing each other’s interests somewhat.

While studying institutional ownership of a company can add value to your research, it’s also good practice to examine analyst recommendations to gain a deeper understanding of a stock’s expected performance. As far as we can tell, there is no analyst coverage of the company, so it probably flies under the radar.

Insider ownership in FinTech Evolution Acquisition Group

The definition of an insider may vary somewhat between different countries, but board members always count. The company’s management runs the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals that management thinks like the true owners of the company. However, high insider ownership can also give enormous power to a small group within the company. This can be negative in some cases.

Our data cannot confirm that board members own shares personally. Not all jurisdictions have the same rules around disclosure of insider ownership, and it is possible that we have missed something here. So you can click here and learn more about CEO.

General public ownership

The general public, which are usually individual investors, have a 13% stake in the FinTech Evolution Acquisition Group. Although this size of ownership may not be enough to influence a political decision in their favor, they can still have a collective impact on the company’s policies.

Private company ownership

We can see that Private Companies own 20% of the shares that have been issued. It’s hard to draw any conclusions from this fact alone, so it’s worth looking at who owns these private companies. Sometimes insiders or other related parties have interests in shares in a public company through a separate private company.

Next step:

Although it is well worth considering the various groups that own a company, there are other factors that are even more important. For example, consider risks. All companies have them, and we have seen 2 warning signs for FinTech Evolution Acquisition Group you should know about.

Of course this may not be the best stock to buy. So take a look at this free free list of interesting companies.

NB: Figures in this article have been calculated using data from the last twelve months, which refers to the 12-month period ending on the last date of the month in which the accounts are dated. This may not be consistent with the annual report for the entire year.

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Join a paid user research session

You will receive one $30 Amazon Gift Card for 1 hour of your time while helping us build better investment tools for individual investors like yourself. sign up here