Will Bitcoin Short-Term Holder Breakeven Point Act as Resistance Again?

On-chain data shows that Bitcoin short-term holder SOPR is approaching the “breakeven” value, a point that has served as resistance for the cryptocurrency in the past.

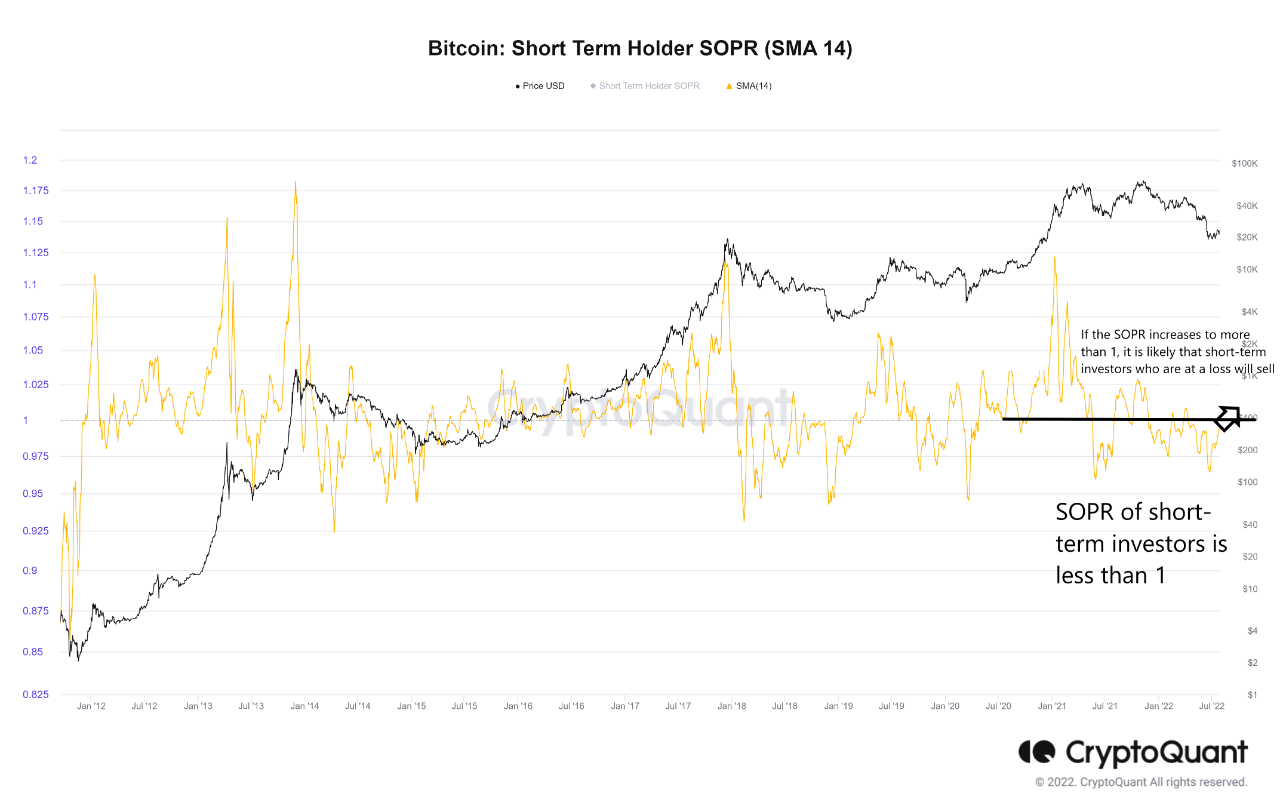

Bitcoin short-term holder SOPR rises and approaches a value of “1”

As pointed out by an analyst in a CryptoQuant post, selling pressure from short-term holders could see an increase if their SOPR continues to rise.

“Spent Output Profit Ratio” (or SOPR for short) is an indicator that tells us whether the Bitcoin market as a whole is currently selling at a profit or a loss.

The metric works by going through the chain of each coin being sold to see what price it sold for before this. If the previous value of a coin was less than the current price, that coin was making a profit right now.

While the last sale price is lower than the last one will mean that the sale of the coin leads to a realization of loss.

When SOPR’s value is greater than one, it means that the overall market is currently selling at a profit. On the other hand, values below the threshold suggest that the average investor is moving BTC at a loss.

Now, “short-term holders” (STHs) include all Bitcoin investors who sell their coins after holding them for less than 155 days. The chart below shows the trend in SOPR specifically for this cohort.

The value of the metric seems to have observed some rise in recent days | Source: CryptoQuant

As you can see in the graph above, the Bitcoin STH SOPR dipped below “1” a few months back, suggesting that these holders were selling at a loss.

In the past few months, the indicator has tried to escape this zone twice, but both times it failed and the price went down at the same time.

The reason behind this trend is that the “SOPR = 1” line represents the “breakeven” point for the market. As the calculation reaches this level, investors who had previously been at a loss believe that they have now got their money “back” and thus sell their coins here.

This leads to higher than usual selling pressure from the STHs at this mark, providing resistance to the price of Bitcoin.

Recently, the SOPR for this group of holders has increased and is now approaching the threshold again. If previous trend is anything to go by, when it tests its value, BTC may see a downtrend this time as well.

BTC price

At the time of writing, Bitcoin’s price is hovering around $23.7k, up 5% in the last seven days.

Looks like the price of the coin has been consolidating sideways during the last few days | Source: BTCUSD on TradingView

Featured image from Amjith S on Unsplash.com, charts from TradingView.com, CryptoQuant.com