Widely Followed Suite of Bitcoin On-chain Metrics Flash Bullish as BTC Price Holds Above $28,000 Post-Fed – Where Next?

A widely followed array of on-chain and technical metrics are sending bullish signs for the Bitcoin price, with BTC/USD holding near nine-month highs just above $28,000 as markets digest Wednesday’s US Federal Reserve policy meeting.

Bitcoin initially sold off on Wednesday in a “sell the fact” reaction to the US Federal Reserve raising interest rates by 25bps as expected, dampening the prospect of further rate hikes amid banking sector woes.

But the world’s largest cryptocurrency was able to regain its balance and climb back above $28,000 on Thursday, as narratives that Bitcoin was a safe haven against fragility in the US (and global) banking system and around the Fed’s dove pivot lured bulls to buy dip.

All the while, a suite of chain and technical indicators that together have a strong track record of predicting when Bitcoin will return to a bull market from a period of bearishness continue to flash long-term bullish signals.

In fact, seven out of eight metrics tracked in crypto data analytics firm Glassnode’s “Recovering from a Bitcoin Bear” dashboard currently meet the condition that Bitcoin is in the early stages of a new bull market.

The dashboard tracks eight indicators to determine if Bitcoin is trading above key price patterns, if network exploitation momentum is increasing or not, if market profitability is returning and if the balance of USD-denominated Bitcoin wealth favors the long-term HODLers.

When all eight are flashing green, this has historically been a strong bullish sign for the Bitcoin market.

Signal 1 and 2: Bitcoin is above 200DMA and realized price

Bitcoin is trading comfortably above the 200DMA and realized price, the first two of the eight signals tracked by Glassnode. A break above these key levels is seen by many as an indicator that short-term price momentum is shifting in a positive direction.

Similarly, when the Bitcoin price mounts a strong defense of these levels, as it did when it retested them earlier this month, it is also seen as an important technical confirmation that the bull market is still in play.

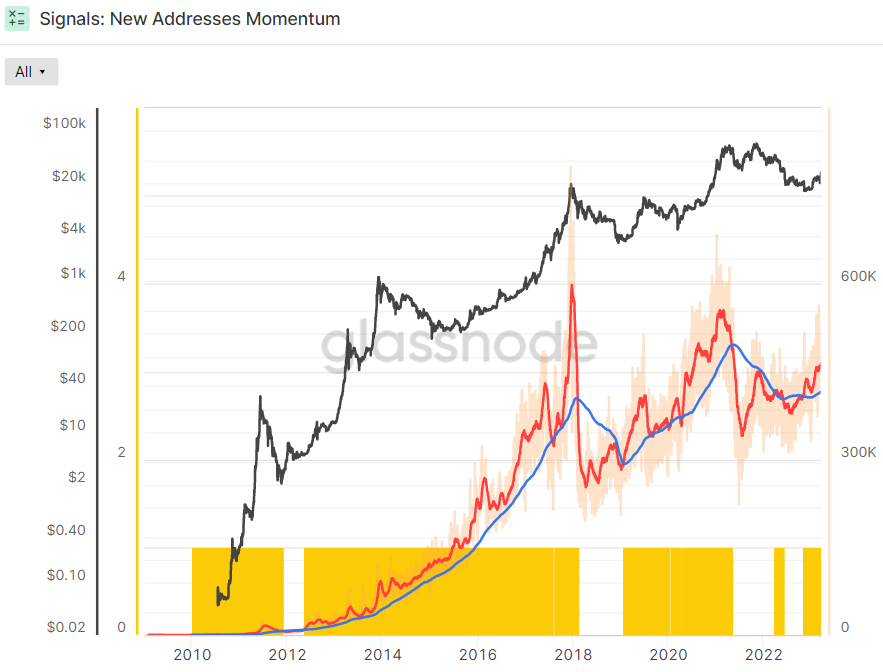

Signal 3: New address momentum

The 30-day SMA for the creation of new Bitcoin addresses moved above its 365-day SMA a few months ago, a sign that the rate at which new Bitcoin wallets are being created is accelerating. This has historically happened at the start of bull markets.

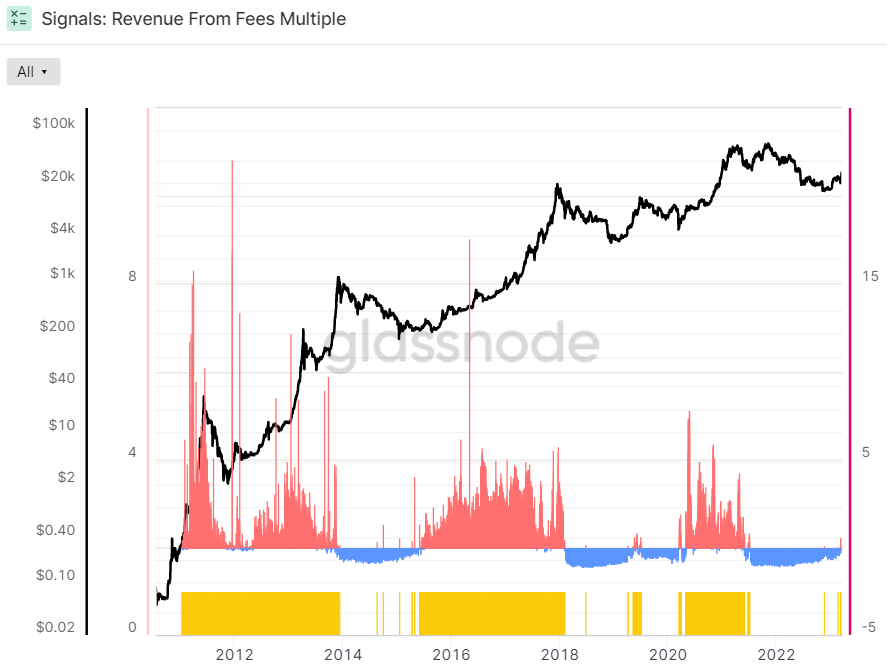

Signal 4: Income from multiple fees

Meanwhile, the two-year Z-score of earnings from fee multiples turned decisively positive a few days ago. Z-score is the number of standard deviations above or below the mean of a data sample. In this case, Glassnode’s Z-score is the number of standard deviations above or below the average Bitcoin fee income for the last 2 years.

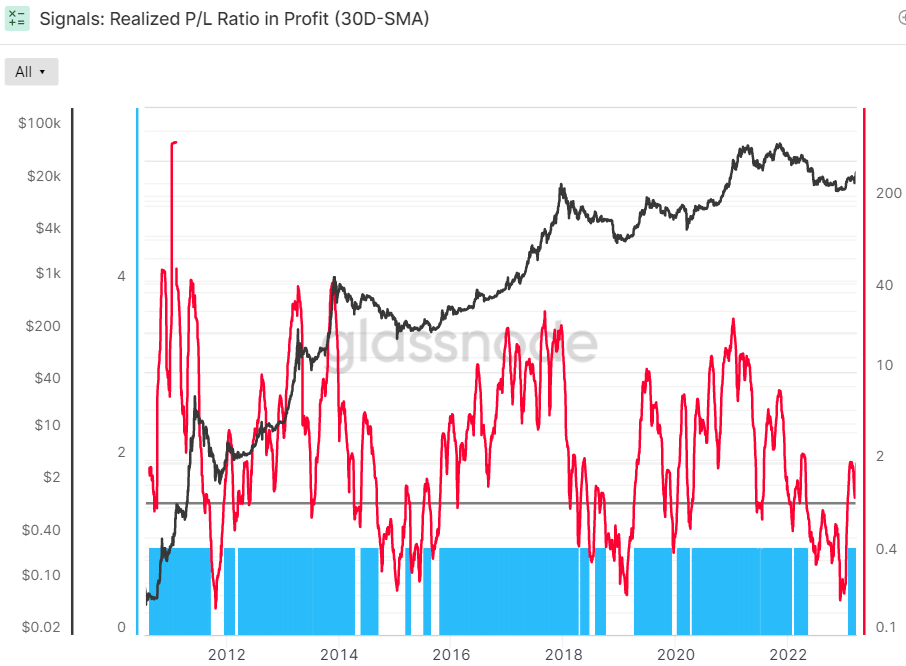

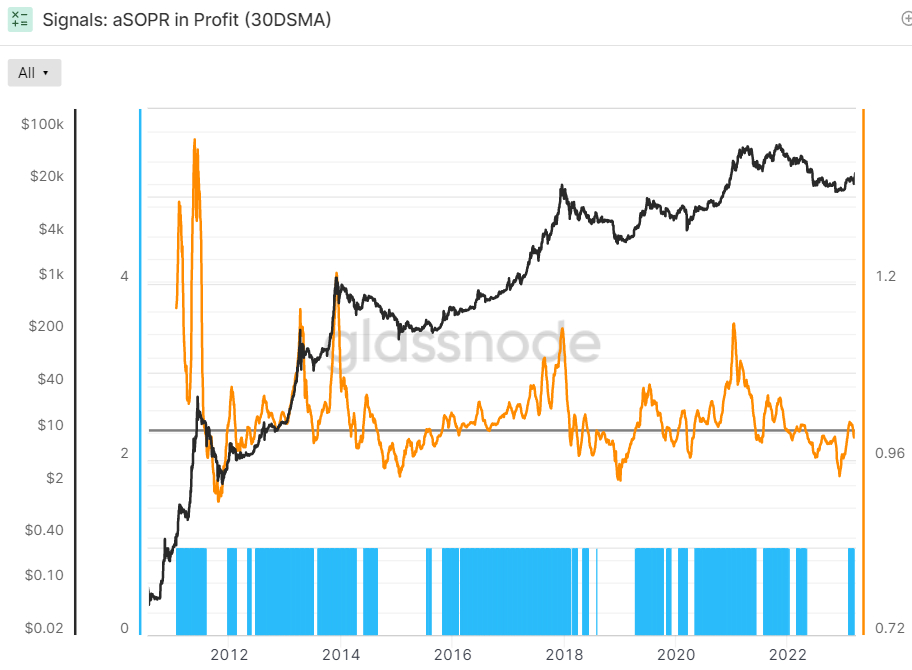

Signal 5 and 6: Realized P/L ratio and aSOPR in Profit

Moving on to the fifth and sixth indicators related to market profitability; The market’s recovery from previous monthly lows helped keep the 30-day simple moving average (SMA) of the Bitcoin Realized Profit-Loss Ratio (RPLR) indicator above one.

When the RPLR is above one, this means that the Bitcoin market realizes a greater proportion of its profits (denominated in USD) than its losses. According to Glassnode, this “generally means that sellers with unrealized losses are exhausted, and a healthier inflow of demand exists to absorb profit-taking”. Therefore, this indicator continues to send a bullish signal.

The 30-day SMA for Bitcoin’s Adjusted Spent Output Profit Ration (aSOPR) indicator, an indicator that reflects the degree of realized profit and loss for all coins moved on-chain, recently dipped below one (meaning it is no longer sending a bullish signal) . This essentially means that the market is no longer in profit on average over the last 30 days.

Amid the Bitcoin price rally from previous monthly lows to new nine-month highs above $28,000, this indicator should soon recover above one. This will mean that all eight of Glassnode’s indicators are flashing green. Looking back at the last eight years of Bitcoin history, aSOPR rising above 1 after a prolonged period below it has been a fantastic buy signal.

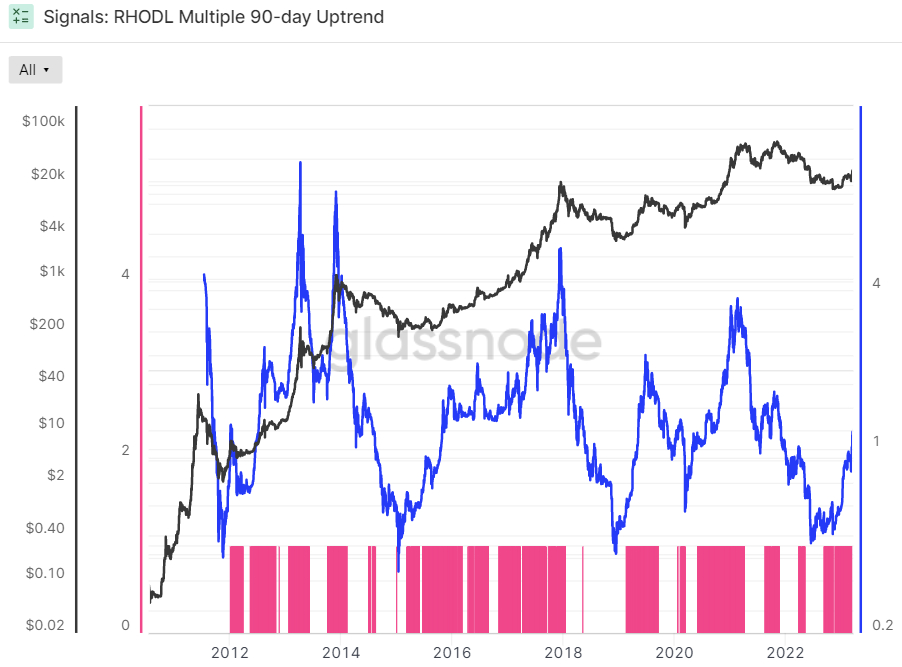

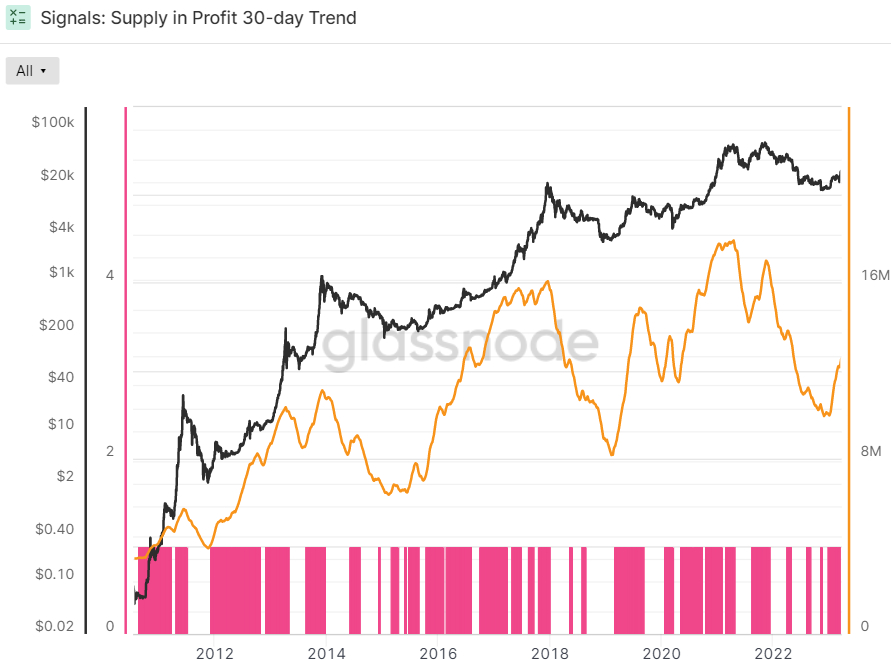

Signal 7 and 8: RHODL Multiple and Supply in Profit

Finally, there are the last two indicators that relate to whether the balance of USD wealth had swung back sufficiently in favor of the HODLs to signal weak hands selling exhaustion.

The Bitcoin Realized HODL Multiple has been in an uptrend for the past 90 days, a bullish sign according to Glassnode. The crypto analytics firm states that “when the RHODL Multiple transitions into an uptrend over a 90-day window, it indicates that USD-denominated assets are beginning to shift back toward new demand inflows”.

It “indicates that profits are being taken, the market is able to absorb them… (and) that long-term owners are starting to use coins,” says Glassnode.

Glassnode’s final indicator in the Bitcoin Bear recovery dashboard is whether or not the 90-day exponential moving average (EMA) of Bitcoin Supply in Profit has been in an uptrend over the past 30 days. Supply in Profit is the number of Bitcoins that last moved when USD prices were lower than they are right now, suggesting they were bought at a lower price and the wallet is holding a paper profit. This indicator also flashes green.

Where next for BTC?

Many analysts believe that Bitcoin’s next stop will be a test of the $30,000 level, but some have expressed doubts about BTC’s ability to muster a sustained break above this level in the absence of new bullish catalysts.

These catalysts could be further contagion and crisis concerns in the US banking sector, which could stimulate new demand for Bitcoin. Alternatively, if Fed communications give markets reason to extend their rate cut bets for the year ahead, it could boost Bitcoin amid easing economic conditions.

But even in the absence of these catalysts, continued positive trends in Bitcoin market fundamentals amid rising adoption and a growing narrative that 2022’s bear market is long overdue mean Bitcoin’s outlook for the rest of the year still looks very good.