Why keep non-fungible tokens for long-term issues

Non-fungible tokens, or NFTs, present a new and exciting investment opportunity. But it’s important to approach them with caution and do your research before investing.

Non-fungible tokens (NFTs) have become a hot topic in art and digital assets in recent years. NFTs are unique digital assets stored on a blockchain, making them immutable and impossible to duplicate. They are often used to represent digital art, music, videos and other types of creative content, and are bought and sold using cryptocurrencies such as Bitcoin or Ethereum.

One of the biggest draws of NFTs is their potential as a financial asset. Many see NFTs as a new type of investment, similar to buying stocks or real estate. Some NFTs have sold for millions of dollars and investors hope to profit by buying and selling NFTs at the right time.

However, investing in NFTs is not without risk. The market for NFTs is still relatively new, and a lot of volatility and speculation is involved. Prices can rise and fall quickly, and it can be challenging to predict which NFTs will hold their value over time.

Dive deep into NFTs

One way to reduce the risk of investing in NFTs is to research and invest only in projects and artists with a proven track record. Look for NFTs backed by reputable galleries or auction houses or created by established artists with a loyal following. One can also look at the underlying technology and blockchain on which the NFT is stored to assess its authenticity and long-term viability.

Another factor to consider when investing in NFTs is market liquidity. NFTs are less liquid than other assets such as stocks or bonds, so selling NFTs can be challenging if one needs to access funds quickly. The holder may need to hold the NFT for a long time before he or she can sell it at a profit, and there is always a risk that the market will crash before you have a chance to sell.

Despite these risks, many are still excited about the potential of NFTs as a new type of investment. NFTs can disrupt traditional markets and provide new opportunities for artists and creators to monetize their work. They also offer a new way for investors to diversify their portfolios and potentially make money.

For example, after the success of the first iteration, former US President Donald Trump announced on its social media platform Truth Social the launch of the second set of NFT trading cards. Each is priced at $99, issued at Polygon, with a total of 47,000 pieces.

Real opportunities

One area where NFTs are particularly promising is in games and virtual worlds. NFTs can represent in-game items or virtual property, and players can buy, sell, and trade those items on a blockchain. This can create new economies within virtual worlds, where players can earn real money by participating in the game.

NFTs also have the potential to democratize the art world by allowing artists to sell their work directly to collectors without the need for intermediaries such as galleries or auction houses. This can help level the playing field for new artists who have traditionally struggled to get their work in front of a wider audience.

Overall, in the long run, NFTs can be beneficial for several reasons.

First, NFTs are unique digital assets verified on a blockchain, making them rare and valuable. Holding onto an NFT for a longer period of time can increase the asset’s value as demand grows, just like traditional art or collectibles. This can result in a potential profit for the owner if they choose to sell the NFT later.

Second, NFTs can have sentimental or emotional value to the owner, such as owning a piece of art or a memorable moment in a video game. By holding the NFT, the owner can continue to enjoy and appreciate the asset. Third, some NFTs may also provide ongoing benefits or rewards to the owner, such as access to exclusive content or events. By holding NFT, the owner can continue to reap these benefits.

Long-term effect as a financial investment

NFTs’ popularity and interest as potential financial assets has increased. Many people invest in NFTs not only for unique digital assets, but also for their potential long-term profits.

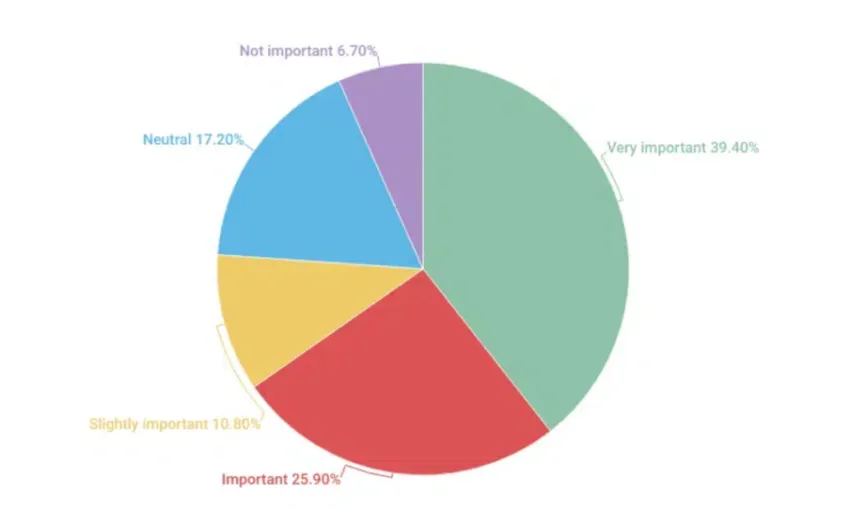

In a report shared with BeInCrypto, BitcoinCasinos.com noted that 39% of NFT buyers are motivated by the long-term profit factor.

The analysis also found that three out of four NFT holders consider how much benefit a collection provides before making a purchase. Additionally, 68.80% of buyers said they buy an NFT because they want to join the community, indicating that people use their investments to support projects and ideas they believe in.

Finally, personal enthusiasm for a collection’s business model and artwork was cited as a reason to buy.

Speaking to BeInCrypto, BitcoinCasino’s betting expert Edith Reads opined:

“It appears that NFT buyers are quite savvy when it comes to their investments, paying close attention to not only the utility of a given collection, but also its potential resale value. As such, many NFT holders have been able to take advantage of this emerging market and make money over time.”

Possible concerns

Despite the promising narratives, the NFT market capitalization recently took a massive hit. Various factors have acted as an obstacle to further innovation and adoption. One of the factors is security risks.

NFTs are often stored on blockchain networks that are prone to hacks and cyber attacks. If a hacker gains access to a user’s private key, they can steal or transfer the NFT to another account. Too late, NFT whale Franklin deleted his Twitter account. Previously, he said that due to personal gambling and a hack, he lost more than 2600 ETH.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.