Why crypto prices are roaring back today in a show of strength

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

As investors liquidate their digital assets, the cryptocurrency market remains in the grip of the bears. However, in the last twenty-four hours, the crypto industry’s Total Value Locked (TVL) has increased by 0.96 percent, bringing it closer to $1 trillion.

Impressively, the current bullish wave is not led by industry giants, such as Bitcoin and Ethereum, but other alternative currencies (altcoins). What’s driving crypto’s resurgence and is now a good time to buy and hold in anticipation of a bull run?

Ukraine War Escalation Supports Safe Harbor Diversification

Following recent statements by President Vladimir Putin, the seven-month-old Ukraine war is taking on a new dimension. According to the Russian ruler, he will mobilize his military reserves after several setbacks in the campaign to take over Ukrainian territory.

https://m.youtube.com/watch?v=Db6qhydxdys

Putin also states that a series of referendums will be held in the four strategic Ukrainian regions it controls. The referendum, which started today and is expected to last until Tuesday 27 September, will lead to the annexation of Luhansk, Donetsk, Kherson and Zaporizhzhia to Russia. Any recovery attempt and intervention by Ukrainian military forces and Western authorities will be seen as a threat to Russian territory.

Ukrainian President Oleksandrovich Zelenskiy and Western bodies have called the supposed referendum a sham and a desperate attempt to hide their mistakes on the battlefield.

The financial market reacts to this news; The S&P 500 closed in the negative with a decrease of 3.67% in the last 24 hours. Investors are currently examining the best vehicles to store their wealth and hedge against the possible financial implications of Russia’s continued aggression in Ukraine. With commodities like gold bearing the brunt of an interest rate hike by the US Federal Reserve and the ongoing economic fallout from the war, cryptocurrencies are likely to be a stopgap for investors in the short term.

Institutional smart money is moving into crypto

Despite their current bearish outlook, cryptocurrencies such as Bitcoin remain attractive asset hedges for institutional investors. One such deep-pocketed investor is American software company MicroStrategy, which recently bought an additional 301 Bitcoins for a reported $6 million. This currently puts its total Bitcoin holdings at 130,000 bands, and the company says it is still looking to raise more funds to increase its Bitcoin position.

According to a Securities and Exchange Commission (SEC) archivingMicroStrategy wants to secure $500 million from Cowen & Co. after the sale of class A shares.

MicroStrategy’s aggressive Bitcoin buying spree is expected to catalyze what many will see as an institutional surge of investment in the coming weeks.

Recession will hurt “real” economy more than crypto

The Fed recently announced a new benchmark interest rate. In accordance Fed Chair Jerome Powell, the interest rate increase has been shifted by three quarters of one percent. And Fed officials feel rate hikes will continue well into 2023 as the U.S. economy tries to recover from the post-pandemic economic trauma.

Higher interest rates on loans can be ideal for savings, but bad for investments as the loans are too high. This could lead to a global recession. With a drop in spending and borrowing, the economic departures would grind to a halt.

While cryptocurrencies are not entirely free from the likely implications of this, the crypto industry’s chances of survival are much more appealing. In unstable economic climates, assets such as Bitcoin can be an attractive alternative, given its deflationary tendencies. Bitcoin and others could fill the gap almost immediately if the dollar becomes unstable as the global reserve currency.

Crypto is the next frontier

Many sectors and industries are experiencing disruption as the world becomes completely digital. One of the most disruptive factors of the past decade has been blockchain technology, a digital online accounting system. This system has a transparent, accountable, immutable and decentralized framework. The blockchain is the bedrock on which all decentralized networks and cryptocurrencies operate.

With faster value transfer and lower fee systems, cryptocurrencies are becoming more attractive to businesses and enterprises day by day. As a result, experts are warming to the idea that cryptocurrencies will see more mainstream use cases in the coming decade.

A valuable digital resource is TAMA, one of the best meme coins right now. Tamadoge, a combat-oriented blockchain protocol, allows users to raise digital pets as non-fungible tokens and interact with each other in the TamaVerse space. The project’s strong potential is reflected in the recently concluded pre-sale window, which raised $19 million. This is much more than Ethereum’s $16 million ICO in 2015.

A valuable digital resource is TAMA, one of the best meme coins right now. Tamadoge, a combat-oriented blockchain protocol, allows users to raise digital pets as non-fungible tokens and interact with each other in the TamaVerse space. The project’s strong potential is reflected in the recently concluded pre-sale window, which raised $19 million. This is much more than Ethereum’s $16 million ICO in 2015.

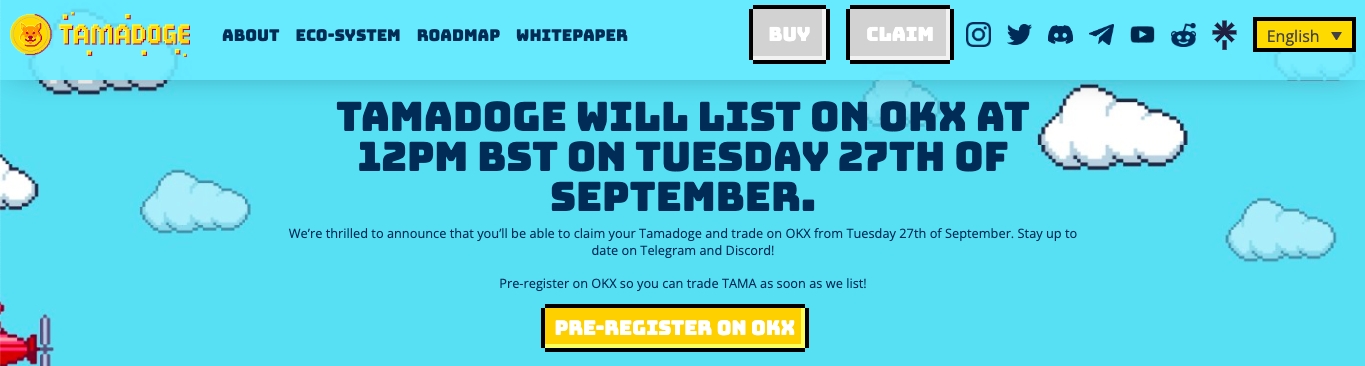

TAMA launches on OKX on September 27, enabling investors to start trading.